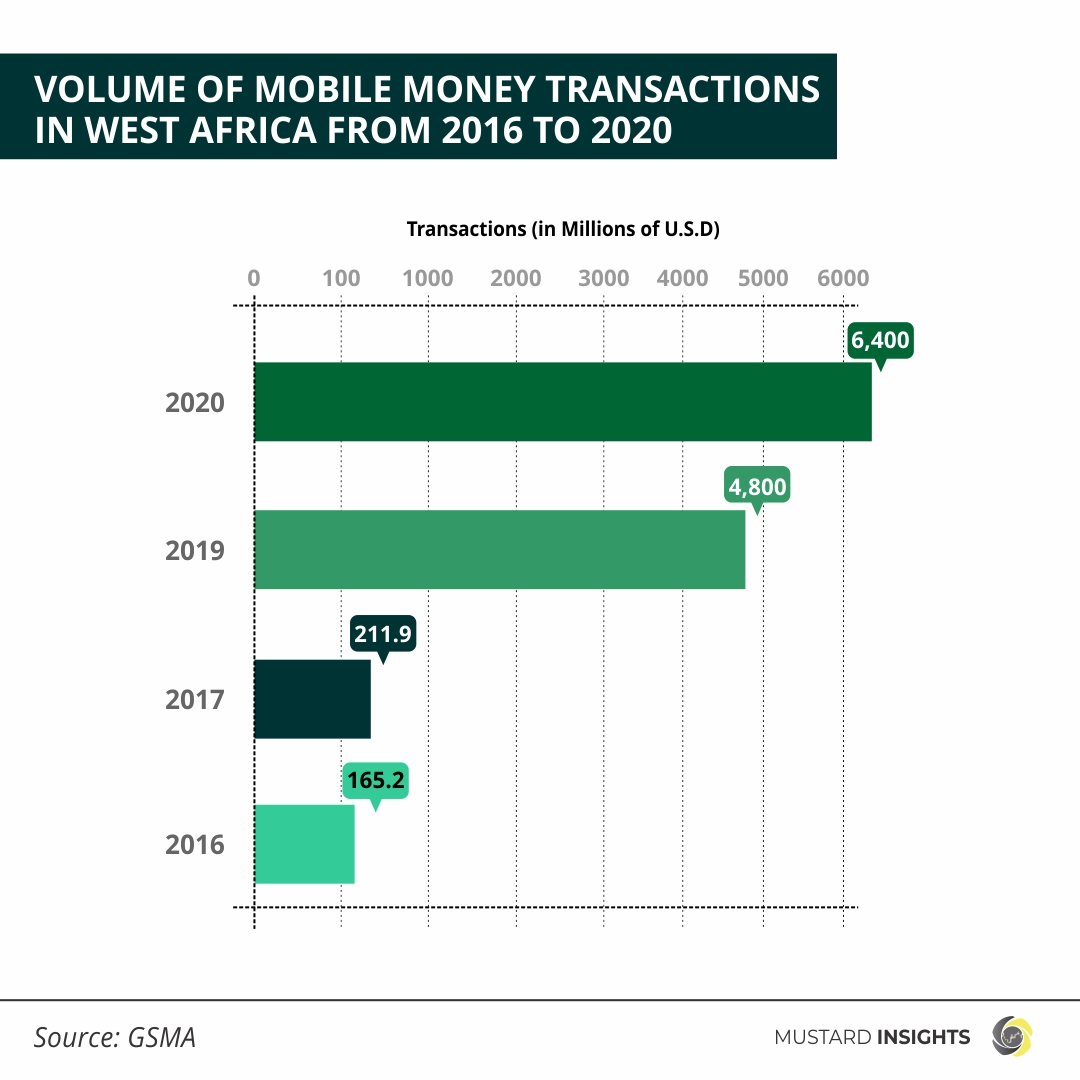

Volume of Mobile Money Transactions in West Africa from 2016 to 2020

The COVID-19 pandemic has, in hindsight, masterminded the rise in adoption of mobile money for transactions and as a driver for financial inclusion. During this period, the widespread restrictions enforced, especially in Africa introduced mobile banking as an effective alternative to traditional banking. Also, it exposed the limitations of the traditional banking system in a fast-changing world.

What is Mobile Banking?

Mobile banking is a financial service that involves the use of mobile devices to perform financial transaction. This service is usually provided by financial institutions such as banks or by fintech companies. Individuals and clients will be able to carry out various transactions as provided by the institution.

‘Over the last decade, Sub-Saharan Africa has been at the forefront of the mobile money industry’, according to the GSMA’s State of the Industry Report on Mobile Money 2021, and has been actively spreading to reach more countries in the continent. In 2020, Sub-Saharan Africa has overseen the majority of growth in registered mobile money users and accounts for 43% of all new accounts. This has allowed Africa account for more than half of the global numbers of registered mobile money users.

Globally, as at 2020, there were 1.2 billion registered mobile money users of which 604 million were registered in Sub-Saharan Africa or Middle East and Northern Africa. This has positioned the African continent as being home to more mobile money users than any other region in the world with 175 million active users.

Sub-Saharan Africa exchanged a combined sum of 449 billion USD in 2020 through the use of mobile money providers.

Why Use Mobile Money

Mobile money has become highly prevalent and serves as a means of financial inclusion of the unbanked individuals across Africa. Also, it allows users pay for electrical bills, day-to-day shopping through the use of their mobile phones. This eliminates the inconveniences of journeying to a physical bank or having to queue in banks for long periods.

West Africa retains its #1 position of having the highest transaction volume and value in Africa. The region has 198 million registered accounts active users which is the highest in any sub- region, has a transaction value of 178 billion USD which is a 46% increase from 2019’s transaction value of 121 billion USD. Comparatively, 2020’s transaction volume of 6.4 billion is a 29% increases from 2019’s transaction value of 121 billion USD.

In 2016, the transaction volume recorded in West Africa stood at 165.2 millions and in 2017, it increased to 211.9 million.

Thoughts?

We won't share your email address. All fields are required.