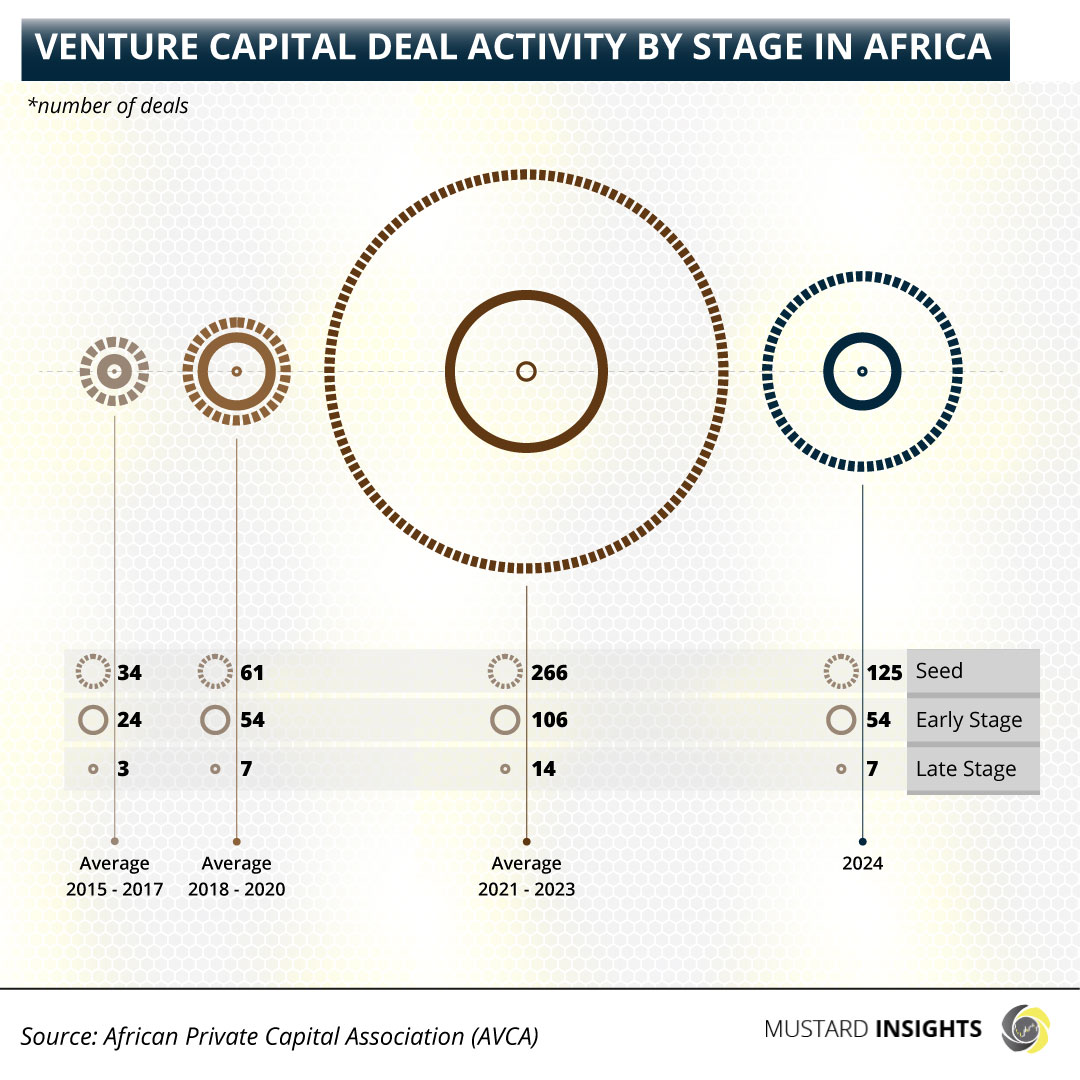

According to a Venture Capital in Africa Report by AVCA, there was a general decline in dealmaking activity for African start-ups across all investment stages in the year 2024, representing a shift from the growth trajectory of the preceding three years.

Deal activity from the seed through to the late stage in 2024 settled at just half of averages achieved between 2021 and 2023. Despite this universal decline in deal counts, median deal values at the seed and late stage rose in 2024. In 2024, the seed stage saw 125 deals, marking a 37% year-on-year decline, with total funding reaching US$236 million, down 16% from the previous year.

While the drop in deal volume was more significant than in deal value, the median deal size increased from US$1.2 million in 2023 to US$1.5 million, indicating ongoing resilience in ticket sizes despite the lower deal flow. Historically, the seed stage accounted for over 40% of Africa's total deal volume, but in 2024, it represented only 29%. Egypt emerged as the leading market for seed rounds, accounting for 19% of activity, closely followed by Nigeria at 17%, underscoring the continued strong momentum of North and West Africa in attracting early-stage capital.

The early stage was the most significantly affected by the decline in venture capital flows to Africa in 2024, with 54 deals (a 33% year-on-year decrease) totaling US$798 million (a 28% drop). In addition, the median deal size fell from US$10 million in 2023 to US$7.5 million in 2024, further emphasizing the growing challenges faced by startups at this stage. Already grappling with the issue of the 'missing middle,' early-stage companies now face increased pressure to demonstrate measurable growth, profitability, and effective capital management in order to secure future funding rounds.

The late stage continued its decline over multiple years, finishing 2024 with just 7 deals (a 22% year-on-year decrease), totaling US$813 million (an 18% drop). Despite this contraction, the median deal size grew from US$75 million in 2023 to US$100 million, reflecting investors' ongoing willingness to allocate larger amounts to established companies.

Capital appears to be accessible at both the earliest and most advanced stages. On one hand, emerging startups benefit from an expanding pool of regional funds and venture builders with targeted mandates. On the other hand, established companies capitalize on their own proven track records to attain larger late-stage investments.

Thoughts?

We won't share your email address. All fields are required.