Africa is facing an increasingly precarious debt situation, with more than half of its nations considered highly vulnerable, high-risk, or already in debt distress, according to Afreximbank’s debt sustainability framework. The situation is compounded by a significant rise in external debt, pushing the continent into uncharted financial territory.

As of the end of 2023, Africa’s external debt reached a staggering $1.152 trillion, according to the African Development Bank (AFDB) Group. This sharp increase in debt has raised concerns about the sustainability of the continent’s finances. Afreximbank further warns that the continent is facing a three-decade high in loan defaults, highlighting the growing financial distress many African nations are experiencing.

Key financial indicators show that the situation is worsening. In 2024, critical liquidity ratios—such as the debt service-to-revenue and debt service-to-exports ratios—have surpassed recommended thresholds, indicating that many countries are struggling to meet their debt obligations. This marks a troubling trend that could hinder Africa’s economic growth and stability for years to come.

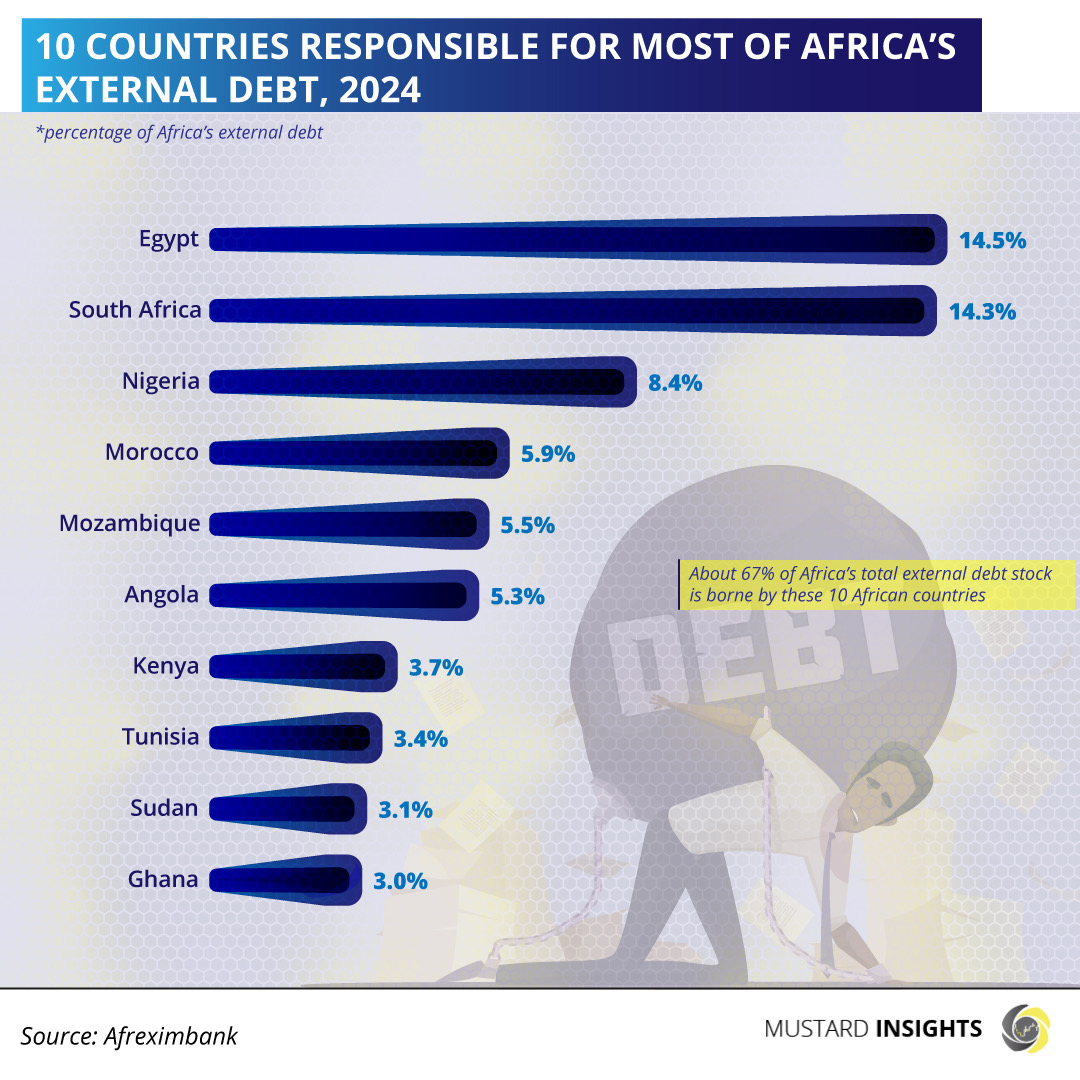

An interesting aspect of Africa’s debt crisis is that the continent's external debt is highly concentrated among a few countries. As of 2023, around 67% of Africa’s total external debt stock is held by just 10 countries:

- Egypt: 14.5%

- South Africa: 14.3%

- Nigeria: 8.4%

- Morocco: 5.9%

- Mozambique: 5.5%

- Angola: 5.3%

- Kenya: 3.7%

- Tunisia: 3.4%

- Sudan: 3.1%

- Ghana: 3.0%

This concentration highlights the vulnerability of these nations, particularly as they face mounting debt servicing pressures and the risk of further defaults.

Africa’s rising debt burden poses a significant threat to its economic development and stability. With more than half of its countries at risk, and key financial ratios already breaching recommended thresholds, urgent action is needed to address the debt crisis. This includes exploring debt restructuring options, enhancing fiscal policies, and diversifying economies to reduce reliance on external borrowing.

It is also critical for international financial institutions, African governments, and private stakeholders to work together to create sustainable solutions that can help mitigate the continent's debt vulnerabilities and support long-term growth.

Thoughts?

We won't share your email address. All fields are required.