As the world transitions to the use of clean energy, several mineral resources that are essential for powering the green energy revolution have surged in demand. According to the International Renewable Energy Agency, there is a need for energy storage capacity to significantly increase to meet the growing renewable energy infrastructure. Top on the list is Lithium and it has emerged as a critical resource to aid this transformation.

Fondly referred to as the "white gold" of the 21st century, Lithium is to the global energy transition what Nvidia chips are to artificial intelligence. Just as advanced semiconductors fuel the rise of AI, lithium is the critical mineral driving the world’s shift to cleaner energy. Lithium-ion batteries are the leading choice for energy storage solutions because of their high efficiency and energy density, which has driven up demand for lithium even further.

According to Statista, the global lithium market is poised for significant expansion, with demand projected to exceed 1.4 million metric tons of lithium carbonate equivalent (LCE) by 2025 – a stellar growth of 53% compared to 2023. Approximately 80% of global lithium production is used in battery manufacturing, primarily for electric vehicles, renewable energy storage, and consumer electronics. However, lithium also serves other industries with around 7% being used in ceramics and glass and around 4% goes into lubricating greases, according to INN News.

Lithium demand has especially skyrocketed in response to the rapid expansion of usage of electric vehicles (EV). Leading automakers like Tesla are pouring investments into lithium-ion battery production. This surge has sparked a global scramble for supply security, as companies race to lock in long-term partnerships with lithium producers to ensure stable access to this vital resource.

Who has it globally and in Africa?

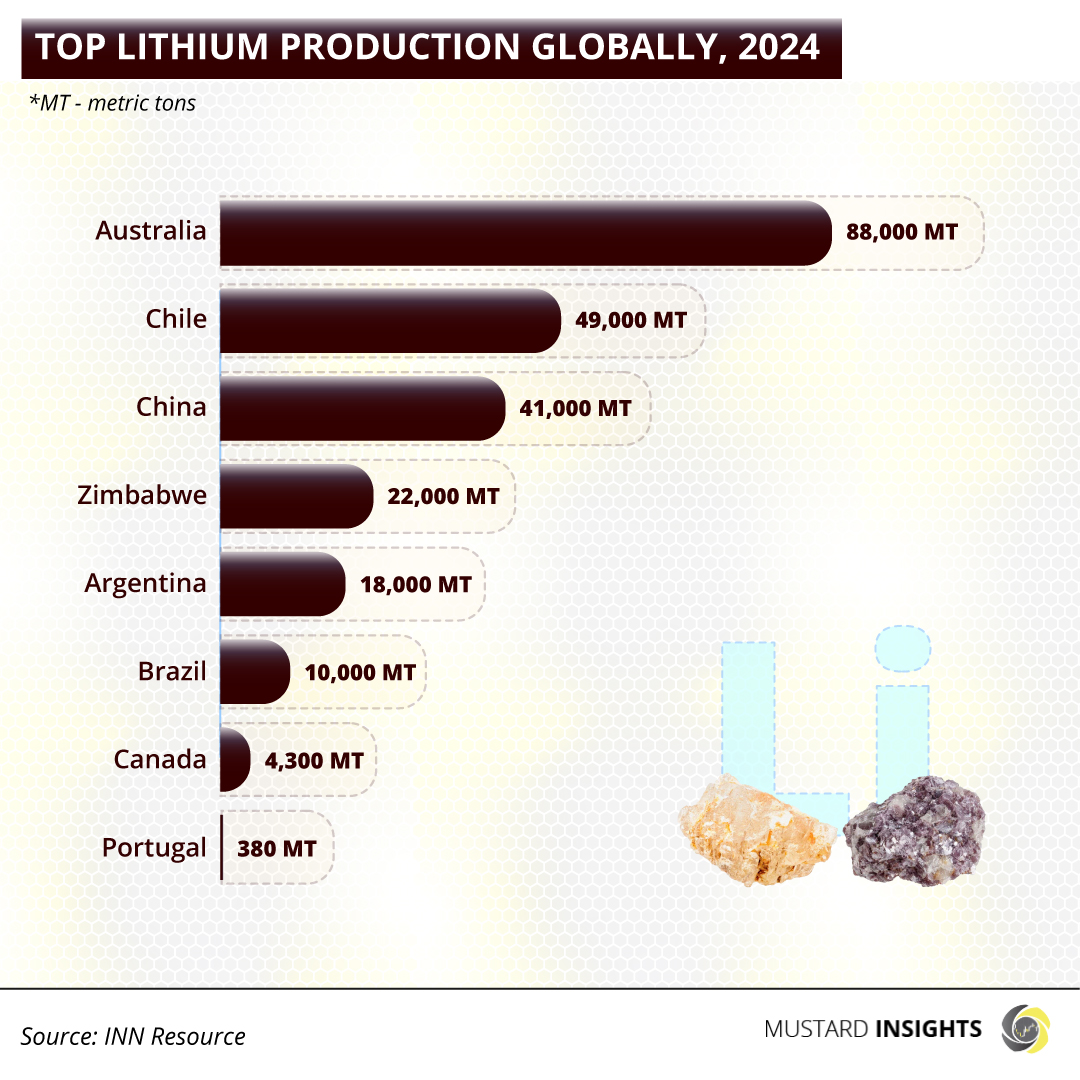

In 2024, Australia maintained its position as the world’s leading lithium producer, delivering 88,000 metric tons despite a slight year-on-year decline from 91,700 metric tons in 2023. The country is a critical player in the global lithium supply chain driven by its established mining infrastructure.

Chile and China followed as the second and third largest producers, with Chile reaching 49,000 metric tons and China hitting 41,000 metric tons in 2024. Chile has seen consistent growth in its lithium output, around than doubling production since 2020. Meanwhile, China expanded its production by nearly 15% Y-O-Y, a reflection of its aggressive push to secure supply for its domestic EV and battery manufacturing industries.

Among emerging players, Zimbabwe posted the most dramatic growth, producing 22,000 metric tons in 2024, up from just 800 MT two years earlier, making it a rising force in global supply. Zimbabwe is currently the only African nation ranked among the world’s top 10 lithium producers, but exploration efforts are underway across the continent as interest in the battery metal grows. The country holds the largest known lithium reserves in Africa and has, thus, attracted substantial Chinese investment.

Argentina and Brazil also saw significant increases, reaching 18,000 metric tons and 10,000 metric tons respectively, fueled by foreign investment and new project developments. Canada showed modest growth to 4,300 metric tons, while Portugal remained flat at 380 metric tons, marking a sharp contrast to its peak output in 2021.

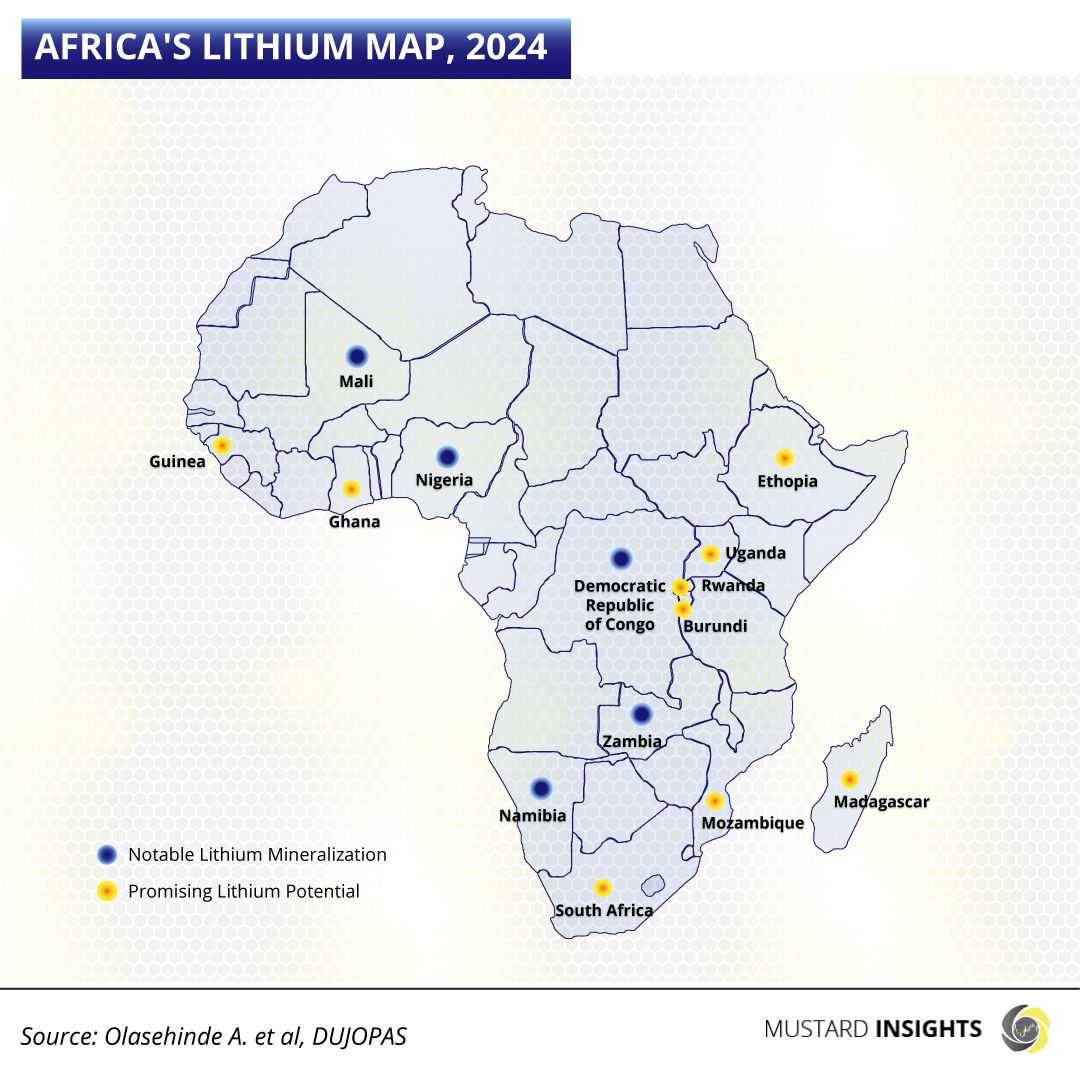

While Zimbabwe leads the way in Africa, other African countries are beginning to emerge on the lithium map. Collectively, Africa holds roughly 5% of global lithium resources, suggesting untapped potential that is drawing increasing attention from international mining companies and investors. Most of Africa’s lithium is exported to China, the world’s largest importer, refiner, and consumer of the mineral. China accounts for around 70% of global lithium compound consumption, driven by its massive domestic lithium battery manufacturing industry.

Nigeria’s Lithium Position

As this demand skyrockets globally, Nigeria’s untapped reserves positions it as a strategic player in an emerging supply chain. Nigeria is a relatively new player in the global market with commercially viable deposits only coming to light in 2018. Significant lithium reserves have been discovered across several states, including Kwara, Nasarawa, Kaduna, Osun, Kogi, and Ekiti. As exploration efforts intensify, Nigeria is on track to become a major partner in the burgeoning battery and clean energy markets, shaping its economic and geopolitical trajectory.

China’s dominance in lithium refining and battery manufacturing could strengthen its ties with Nigeria, fostering increased mining investments, infrastructure projects, and trade agreements. This shift offers Nigeria significant leverage in global negotiations, potentially making it a cornerstone of international energy policy. The African Continental Free Trade Area (AfCFTA) also offers a platform to enhance Nigeria’s position in regional lithium production. By refining and processing lithium domestically, Nigeria could add significant value to the mineral, stimulating industrial growth and job creation.

However, without careful management, Nigeria risks repeating the mistakes of the past, where unregulated mining and foreign exploitation left the country with limited benefits. To fully capitalize on its lithium resources, Nigeria must implement policies that prioritize national interests while attracting foreign investment.

Challenges in Nigeria’s Lithium Sector

Securing a mining license in Nigeria can be a complex and expensive process. According to an industry insider in an interview with Mustard Insights, “Obtaining a license to mine lithium took 7-8 months and cost more than expected and we spent 100% more than we were told would be required.”

This reflects familiar inefficiencies and corruption in the licensing process.

Price volatility is another challenge. The source commented, "Prices go up and down too quickly," making it difficult to make long-term projections. Despite these challenges, Nigeria holds notable lithium reserves, particularly in states like Nasarawa and Kwara, which could position the country as a key player in the global lithium market.

To unlock the sector's potential, Nigeria needs to address issues like corruption, illegal mining, and lack of investment, while improving governance and transparency in the licensing process. It will require careful policymaking, responsible resource management, and strategic partnerships to maximize the benefits of this newfound resource.

With the right investments in local value addition, sustainable mining practices, and strong global partnerships, Nigeria can become a global leader in the lithium supply chain, ensuring long-term economic growth, environmental sustainability, and geopolitical influence.

Thoughts?

We won't share your email address. All fields are required.