In the year 2021, Africa's Fintech sector has recorded an exponential growth in the past 5 years, with startups raising about $5 billion. This year, Fintech startups in Africa continued along the same progression after raising $305.43 million in June only, making it the largest recipient of funds from investors compared to the rest of the world.

The African Startup ecosystem, over the past few years, has witnessed tremendous growth. Leveraging technology, many of these startups have bridged gaps and provided solutions that the continent desperately needs to grow its economy while also improving lives across a myriad of sectors. Much like other startups across the world, failure rates across these startups have equally been daunting. Beyond peculiar environmental, infrastructural, and regulatory challenges, funding – the oldest limitation in the books – still poses a major challenge for many startups on the continent. However, the past few years have witnessed an influx of foreign and local investments into the startup ecosystem.

A 2021 Africa Investment Report by Briter Bridges reveals that African startups have received an estimated $4.9 billion in funding in 2021 and it appears that 2022 may have an even better close. In just Q1 of 2022, African startups raised about $1.8 billion. In June of the same year, startups in Africa made 36 fully disclosed funding rounds to the tune of $426,280,000 million. African startups were also able to increase their funding by 134.25% in the first half of 2022 compared to the first half of 2021. In the year 2021, Africa's Fintech sector has recorded an exponential growth in the past 5 years, with startups raising about $5 billion. This year, Fintech startups in Africa continued along the same progression after raising $305.43 million in June only, making it the largest recipient of funds from investors compared to the rest of the world.

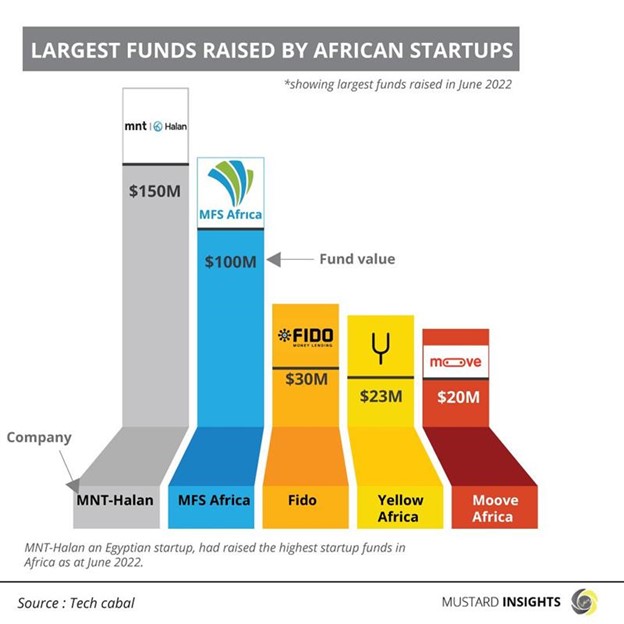

The following are some of the largest funds raised by African Startups as of June 2022:

MNT-HALAN AND MFS AFRICA LEAD THE PACK

MNT-Halan: MNT-Halan is an Egypt-based fintech company operating on the premise of digitizing traditional banking and cash-based markets through tech and data-driven solutions. Since it transitioned from a ride-hailing service for two and three-wheeler vehicles, MNT-Halan has since solidified itself as Egypt’s largest and fastest-growing lender to the unbanked. Its wholly-owned subsidiary, Tasaheel, securitized $150 million of its loan book in the first issuance of a US $600M program with Commercial International Bank (CIB), making it the company with the largest funds raised in Africa.

MNT-Halan CEO Mounir Nakhla had this to say about the funding, “We are especially pleased with the confidence that investors have placed in our company. CIB’s role was instrumental. This transaction marks our first securitization and ensures our continued growth as we expect our loan book to exceed the US $2 billion over the next couple of years. This will be driven by our digital strategy capitalizing on synergies and venturing into new verticals.”

MFS Africa: MFS Africa is the leading digital payments gateway supported by a multi-cultural, multi-talented, agile team from over 30 different nations that connects senders, recipients, and service providers across Africa’s fast-growing yet fragmented mobile payments ecosystem through the establishment of access to speed and efficiency, the global digital economy, new options, new markets, and customers, and more. The fintech company placed second, as the company with the most generated funding in Africa. It raised a total of $100 million through a series C extended round of funding.

MFS Africa says this extension will help “accelerate MFS Africa’s expansion plans across Africa, its integration into the global digital payment ecosystem, its expansion into Asia through its joint venture with LUN Partners to enable cross-border digital payments between Africa and China, and its ambitious growth plans for the BAXI network of merchants and agents in Nigeria and beyond.”

OTHER KEY PERFORMERS

Fido: Fido is a Ghanaian-based fintech app that empowers individuals and entrepreneurs to capture financial opportunities in Africa. The company recently received a “backdrop of a $30 million equity investment and some undisclosed debt funding that the startup has just raised in a Series A round led by Israel-based private equity fund Fortissimo Capital, with participation from Yard Ventures: a VC fund by Harvard alumni. This brings the total equity investment raised to date to $38 million” (Tech Crunch). Making it the third most funded company as of June.

Yellow Africa: Yellow Africa is a South African-based tech company operating on the premise of enabling a distributed network of sales agents to serve rural households with life-changing products and services through digital technology. Yellow concluded the “final of a series of debt transactions, totaling US$23 million, with Lion’s Head Global Partners joining Triple Jump, SunFunder, SIMA and Trine” (Kenyan Wallstreet).

Moove Africa: Moove Africa is a mobility fintech company that provides revenue-based vehicle financing to mobility entrepreneurs across Africa. The Nigerian-based company raised $20 million in funding from the UK government’s development finance institution (DFI) British International Investment (BII), formerly known as CDC Group, making it the fifth most funded company in Africa.

Thoughts?

We won't share your email address. All fields are required.