The 2022 Africa Wealth Report released by Henley & Partners revealed levels of private wealth in Africa beginning to once again grow after 2020’s dip. 2021 saw the number of high net-worth individuals (HNWIs) increase by 8.8% from 2020’s figure of 125,000 individuals. The report defines “private wealth” as the assets including property, cash, equities, and business interests minus liabilities held by an individual. It also defines HNWIs as individuals possessing private wealth of $1 million or more.

South Africa Forges Ahead

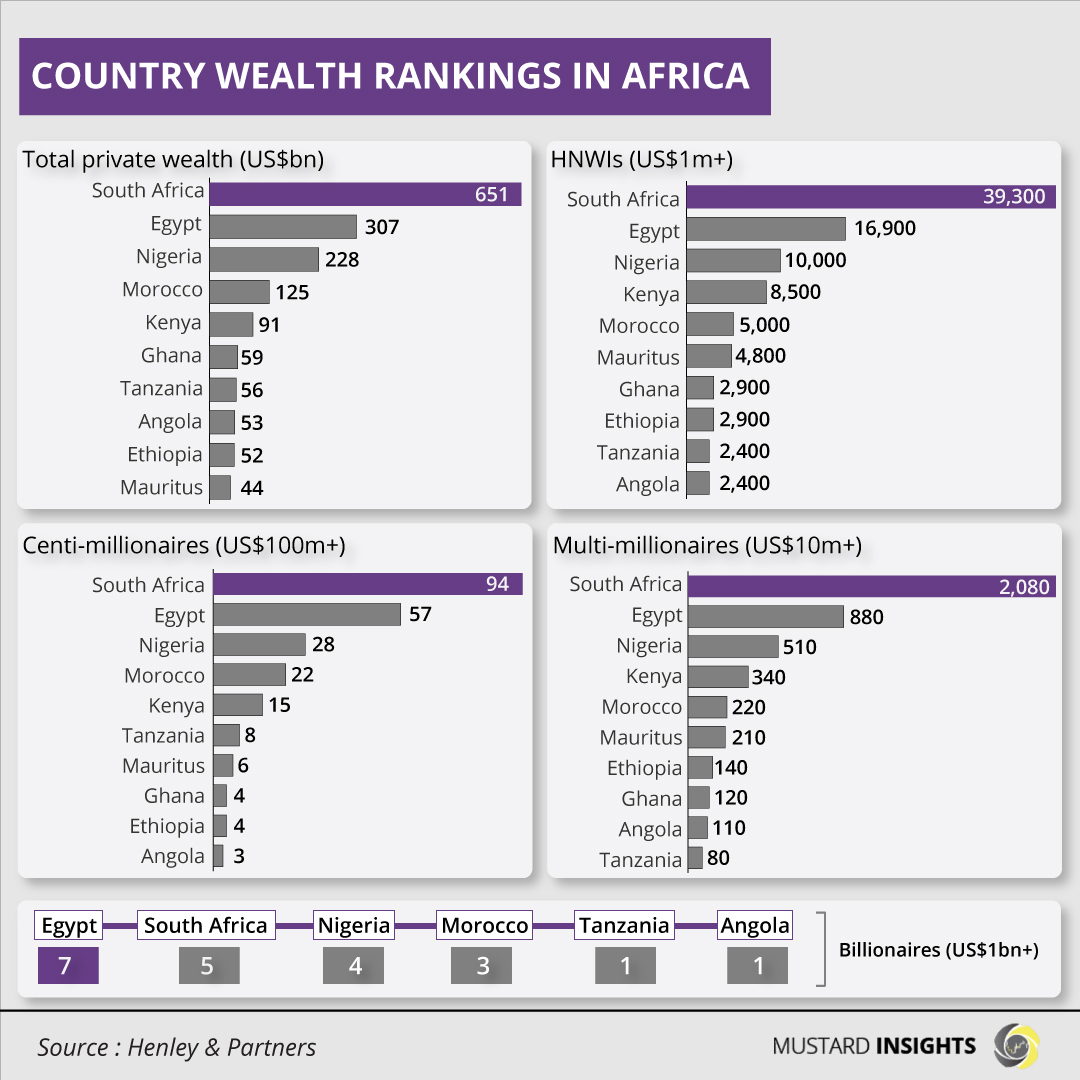

South Africa leads the continent in terms of private wealth by a significant margin, with the country boasting 39,300 HNWIs. That figure is more than that of the next three countries put together, with a total of $651 billion being the HNWIs cumulative wealth. A lot of the country’s private wealth is in the banking, finance, and wealth management sectors.

The Johannesburg Stock Exchange’s (JSE) All Share Index grew 120% between December 2011 and December 2011, using South African Rand-based valuation. A large section of the country’s HNWIs – 58% - have backgrounds in Law and Finance/Accounting. As such, it is only normal that 35% of South Africa’s HNWIs acquired their wealth through Financial and Professional Services, with 12% coming through Real Estate and 10% coming through Technology and Telecommunications.

The rest of the Big 5

Egypt, Nigeria, Morocco, and Kenya make up the rest of Africa’s Big Five wealth economies. Egypt has the most billionaires in the continent, with seven individuals. These five countries account for about 70% of all the private wealth on the continent, with aggregated wealth of $1.4 trillion, out of the continent’s $2.1 trillion total private wealth.

A common feature of all these countries is the existence of wealth hubs: cities with a large number of HNWIs residents. Four of Egypt’s seven billionaires live in Cairo, with three of Nigeria’s four $1 billion-plus HNWIs resident in Lagos, and two of Morocco’s three billionaires living in Casablanca. Of the Big Five, only South Africa possesses multiple cities of affluence, with four cities in the ten most HNWIs-concentrated cities on the continent. While Johannesburg has an outsized sample (16,000 of the country’s 39,300 HNWIs live there), Cape Town, Pretoria, and the Durban-Umhlanga twin cities also boast a large number of HNWIs.

In contrast, there is large wealth concentration in Egypt, Nigeria, Morocco and Kenya. 69% of all Nigeria’s HNWIs reside in the mega-city, Lagos. 63.5%, 50%, and 48.5% of Kenya’s, Morocco’s and Egypt’s wealthy reside in Nairobi, Casablanca, and Cairo respectively. As a result, it is not uncommon for trade and business to congregate in these cities, along with foreign investment and human capital. This may happen to the detriment of other cities, who will likely lose a sizeable percentage of the workforce and receive less capital investment.

Who’s Next?

Private wealth is expected to keep growing in Africa, with Henley & Partners forecasting a 38% growth rate by 2031. A lot of that growth is predicted to happen in non-Big Five countries, with Mauritius, Rwanda, and Uganda expected to lead the way with growth rates of over 60%. Those three countries, along with Ethiopia were the only African countries to experience 50%+ growth in private wealth in the past decade, with Mauritius’s total wealth growing 74%. The island country is presently ranked 1st in Africa’s Ease of doing business rankings and is 13th worldwide. This, along with a growing financial services sector and low taxation, may greatly aid the rapid wealth growth and investment in the country.

Thoughts?

We won't share your email address. All fields are required.