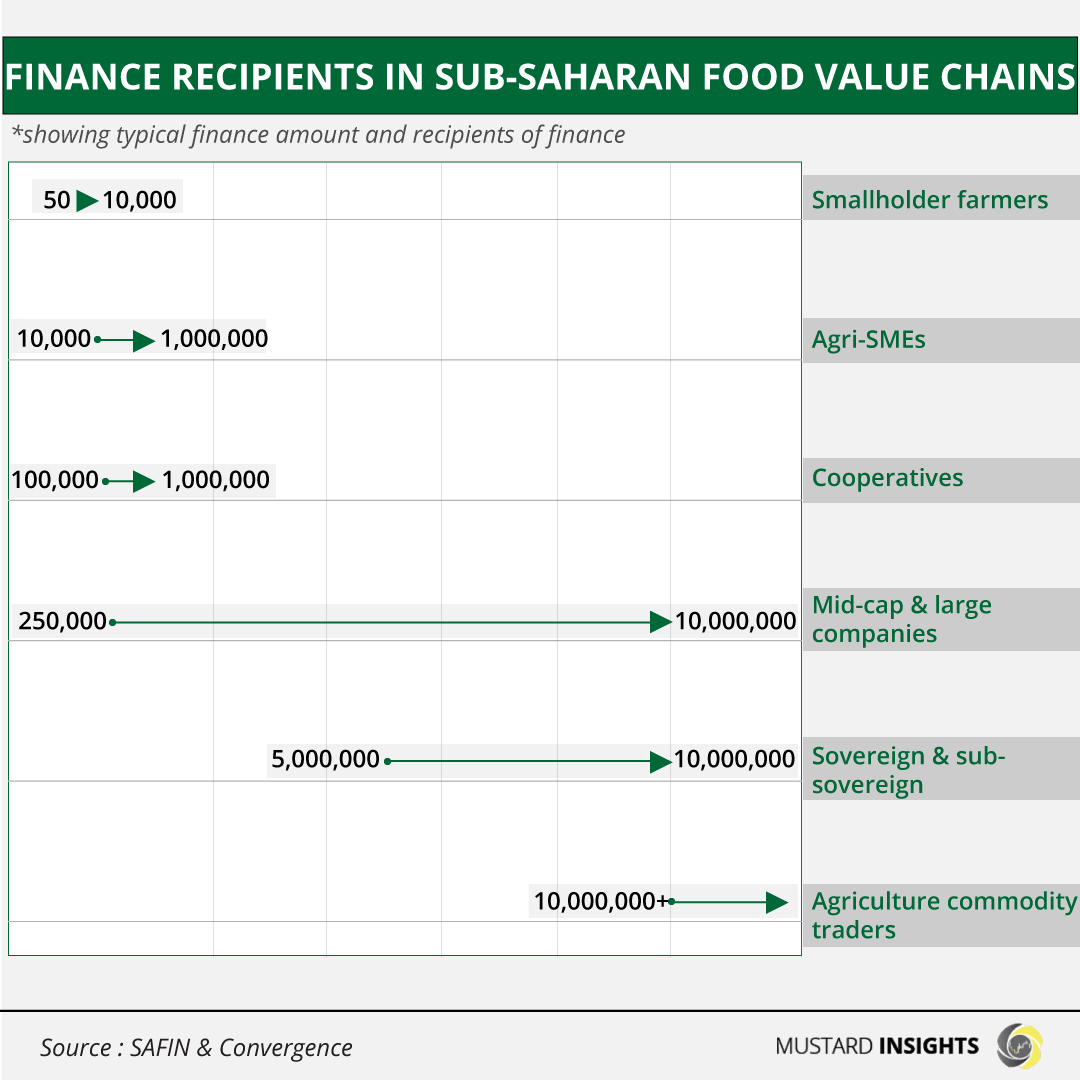

Breaking down the different demand-side stakeholders in Sub-Saharan Africa's food systems and how they are allocated financing.

In a previous article, we discussed the need for a transformation of Africa’s food systems and how funding is required from both the public and private sector to push this. It’s also important to understand to whom this funding is supposed to be allocated, and how it will be used. We must clarify the key players on the demand side of food systems financing, the roles they play, and from whom they will receive funding.

The demand side and financing recipients

While there are various recipients of financing, three main groups should be the most targeted. These are smallholder farms, agri-based small- and medium-enterprises (SMEs), and mid-cap to large companies. These groups play a different role in the overall food system value chain, with the occasional overlap. However, all are essential and a sustainable food system can’t function with one minus the other.

Smallholder farmers

According to a 2019 report from McKinsey, corroborated by the American nonprofit, The Borgen Project, over 60% of Sub-Saharan Africa’s population is either made up of, or relies on subsistence agriculture or smallholder farming. It is by a distance the most prevalent form of agriculture in the region. The African Development Bank (AfDB) estimates that smallholder farmers will need as much as US$33 billion a year. This finance is required for land acquisition, working capital, and capital expenditure (CAPEX).

This funding is to be provided from financial institutions such as microfinance banks and informal sources along the corporate value chain such as credit cooperatives and other SMEs. Obstacles to funding might be high levels of informality – smallholder farmers may not possess good records and bookkeeping as most are semi-literate or worse. There is also the issue of penetration, as inland farmers in remote areas may be inaccessible.

Agri-SMEs

This might be the most crucial part of the food system value chain. According to a 2019 report from the Alliance for a Green Revolution in Africa (AGRA), 70-90% of all the food consumed in Africa is produced, processed, transported, and retailed by local SMEs. This is the source of a lot of job creation and innovation in the food system. Crucially, SMEs often tend to have established relationships with smallholder farmers.

Agri-SMEs are defined as enterprises needing between US$25,000 to US$5 million in finance. ISF Advisors estimate that as many as 190,000 agri-SMEs in Sub-Saharan Africa will require up to US$90 billion in financing, and so far, only US$15 billion is met. Seeing as this sector is crucial not just for the food systems but for the economy at large, it is imperative that finance is available and accessible. This financing should come from microfinance institutions, local banks, corporate value chains, capital importation, and national development banks. The funding is mostly directed at financing working capital and capital expenditure.

Mid-cap to large companies

Mid-cap companies – companies with market capitalization or market value of between US$2 billion and US$10 billion – and larger companies are valuable in food systems because they often have the capacity to carry out research and technological innovation, carry out foreign trade, and adopt international quality standards. They lower production costs via economies of scale and often finance smaller businesses like the agri-SMEs.

Financing for these companies is supposed to come from mostly national banks, development finance institutions (DFIs), corporate value chains, capital markets, and debt/equity funds, the latter possible as these companies are more likely to be public limited companies (PLCs) and listed on national stock exchanges.

Other financing recipients

Local credit cooperatives are often a major source of funding for its members, who are more likely to be agri-SMEs and smallholder farmers. Funding from cooperatives will often go into land acquisition, working capital, and capital expenditure. Typical finance providers are local banks, specialized DFIs, national development banks, and corporate value chains.

Agricultural commodity traders may fall under SMEs, be a branch of a mid-cap to large company, or exist independently. They often serve to transport and trade agricultural produce, and require financing for working capital mainly directed at storage facilities like silos and warehouses, and transport infrastructure. Funding is typically provided by national banks, international DFIs, cross-border banks, capital markets, and debt/private funds.

Sovereign and sub-sovereign recipients are public sector institutions such as Ministries of Agriculture. They are often involved in the construction of large-scale food system infrastructure such as irrigation projects, and national and sub-national financing of everyone from SMEs to smallholder farmers and occasionally, even mid-cap companies. They derive funding from multilateral sources such as the World Bank and international DFIs, bilateral sources such as cross-border commercial banks, and capital markets.

Takeaway

Every institution discussed is a major player in the food system value chain from the average smallholder farmer to giant corporations and government ministries. Thankfully, the framework exists for the routes to financing. All that is left is the monitoring and implementation of these pathways, accompanied with strict accountability. We will discuss in depth, through the Mustard Insight newsletter, the supply side of food systems financing.

Will FTX's Collapse Lead to Crypto Regulation?

Thoughts?

We won't share your email address. All fields are required.