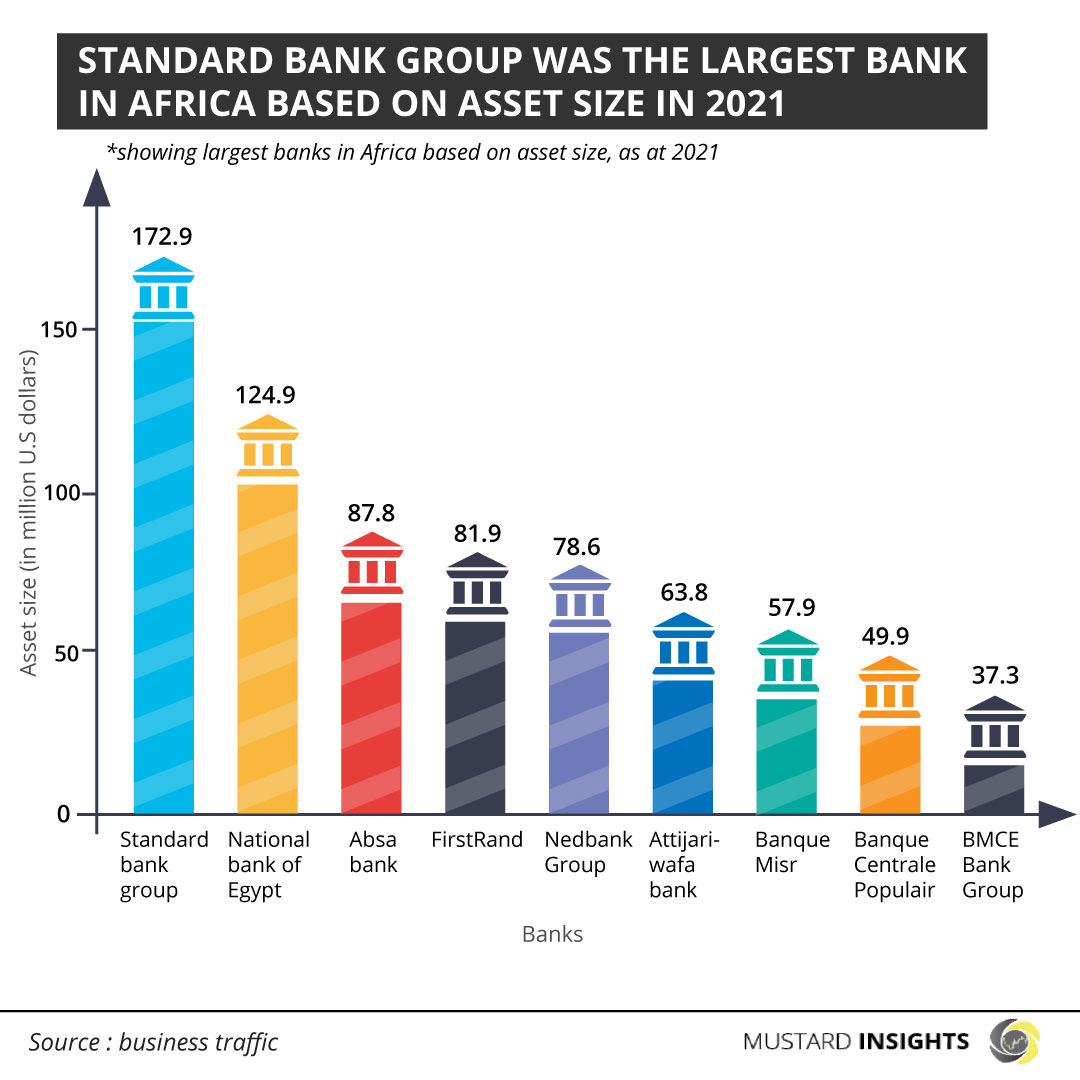

South Africa’s Standard Bank Group stamped its position as Africa’s largest bank in 2021; a position it has held for over 20 years. Four other South African banks feature as South Africa dominates the list, followed by Morocco with three banks.

South Africa’s Standard Bank Group stamped its position as Africa’s largest bank in 2021; a position it has held for over 20 years. Four other South African banks feature as South Africa dominates the list, followed by Morocco with three banks.

Africa has 763 commercial banks located across the 54 countries on the continent. Standard Bank Group has a total number of 721 branches with 239 branches in 18 African countries, including its headquarters in South Africa, and 473 branches spread across 21 countries outside Africa.

Breakdown and Key Metrics

According to data from Statista, analysis of the data showed that Africa’s largest banks by asset size were mostly South African and North African banks. A bank's asset size is determined based on their Tier 1 capital, which is a sum of their capital, reserves, retained earnings, and minority interests.

- South Africa’s Standard Bank Group (Stanbank) tops the chart with an asset size of 172.9 billion USD. This is the largest asset size of all the banks in Africa.

- The National Bank of Egypt has the second largest asses size valued at 124.9 billion USD. It is the oldest commercial bank in Egypt with 510 branches nationwide serving over 14 million customers and also operate internationally.

- Absa Bank is third on the list and the second South African bank to feature in Africa’s top three banks with the largest asset size. Absa bank has a total asset size of 87.8 billion USD.

Other banks in the top 10

Three additional South African banks, three Moroccan banks and another Egyptian bank complete the top 10 African banks based on asset size.

The South African banks are First Rand bank (4th) with an asset size of 81.9 billion USD, Nedbank Group (5th) with an asset size of 78.6 billion USD and Investec bank (10th) with an asset size of 29.9 billion USD. These make five south African banks featuring in Africa’s top 10 banks by asset size.

Morocco’s banks on this list are Attijariwafa bank (6th) with a total asset size of 63.8 billion USD, Banque Centrale Populaire (8th) with an asset size of 49.9 billion USD and BMCE Bank Group with an asset size of 37.3 billion USD.

Egypt’s second representative in the top 10 is Banque Misr, with a total asset size of 57.9 billion USD.

Other insight

- Representation of banks by region in an expanded view of the top 100 banks in Africa based on asset size shows that North Africa has the highest number of banks on the list. North Africa has 45 banks (up from 42 the previous year), followed by Southern Africa with 22 banks (down from 25 the previous year), West and Central Africa with 18 banks and East Africa with 15 banks.

- South Africa has 28% of the total banking Tier 1 capital, ahead of Egypt’s 20%, Morocco’s 13.5% and Nigeria’s 10.6%. However, by region North Africa is ahead, with 45% of the total capital (up from 44% last year), compared to 34% in Southern Africa (down from nearly 36%). There are still 12 Nigerian banks in the top 100.

- Standard Group Bank’s Tier 1 capital grew by 24% to 13.8 billion USD and recorded a profit of 991 million USD. Although National Bank of Egypt recorded a 26% growth in capital pushing it to 6.7 billion USD (profit of 809 million USD), it still has a long way to go to challenge the king of Africa’s banking savannah.

- South Africa’s Absa Bank and Nedbank both recorded a capital growth of 6% to close at 6.3 billion USD (profit of 141 million USD) and 5.5 billion USD (profit of 268 million USD), respectively. FirstRand bank saw its Tier 1 capital go down 9% to 5 billion USD, yet recorded a profit of 831 million USD Return on Equity (ROE).

- Moroccan banks, Attijariwafa bank with a Tier 1 capital of 6 billion USD, Banque Centrale Populaire with a Tier 1 capital of 4.7 billion USD and BME Bank Group with a Tier 1 capital of 3 billion USD recorded profits of 416 million USD,144 million USD and 153 million USD, respectively.

- Egypt’s Banque Misr Tier 1 capital of 3.4 billion USD remains unchanged and yielded a profit of 515 million USD.

Thoughts?

We won't share your email address. All fields are required.