Remittance inflows to Africa soared by about 14 percent to $49 billion, more than erasing the falloff of 8 percent recorded in the pandemic year of 2020—and representing the strongest gain since 2018.

Remittance inflow has been one of the tools that has been used by members of the diaspora to support their home country’s growth and development for years now. This act has been perceived to reduce poverty drastically, most especially in developing countries like those in Africa.

The International Monetary Fund defines remittance inflow as the process, “where migrants send home part of their earnings in the form of either cash or goods to support their families, these transfers are known as workers’ or migrant remittances.” They have been growing rapidly in the past years, and now represent the largest source of foreign direct investment for many developing economies.

Remittances may enable individuals buy basic consumption goods, pay for their housing requirements, children’s education, and health care. They can also provide capital for small businesses and entrepreneurial activities. They help pay for imports and external debt service; in some countries, banks have raised overseas financing using future remittances as collateral.

Remittances inflow inches closer to the pre-covid level in LMICs

In 2021, the latest World Bank data highlight that remittances flow to low- and middle-income countries (LMICs) registered a robust gain of 8.6 percent to reach $605 billion. Remittances are a major source of external finance to LMICs, compared to foreign direct investment (FDI), official development assistance (ODA), and portfolio investments

World Bank surveys on household showed that international remittance receipts helped lower poverty by nearly 11 percentage points in Uganda, 6 percentage points in Bangladesh, and 5 percentage points in Ghana. Between a fifth and half of the 11 percent reduction in poverty in Nepal between 1995 and 2004 - a time of political conflict - has been attributed to remittances.

Therefore, every year, on the 16th of June, the International Day of Family Remittances (IDFR) is observed to raise further awareness on the abnegation and sacrifice of migrant workers, who support their families and communities of origin through the money they send back home, particularly in these times of crisis. This year (2022), the IDFR lauds the human spirit and resilience of over 200 million migrants who defied predictions of the pandemic and continued to send money home to their countries of origin.

Africa: The largest recipients of remittances inflow

Despite the decline in trade, as a result of Covid-19, and the recent Russia-Ukraine siege which is increasing deficits and debt, boosting inflation, and cutting into real incomes and growth, remittance inflows to Africa soared by about 14 percent to $49 billion in 2021, more than erasing the falloff of 8 percent recorded in the pandemic year of 2020—and representing the strongest gain since 2018.

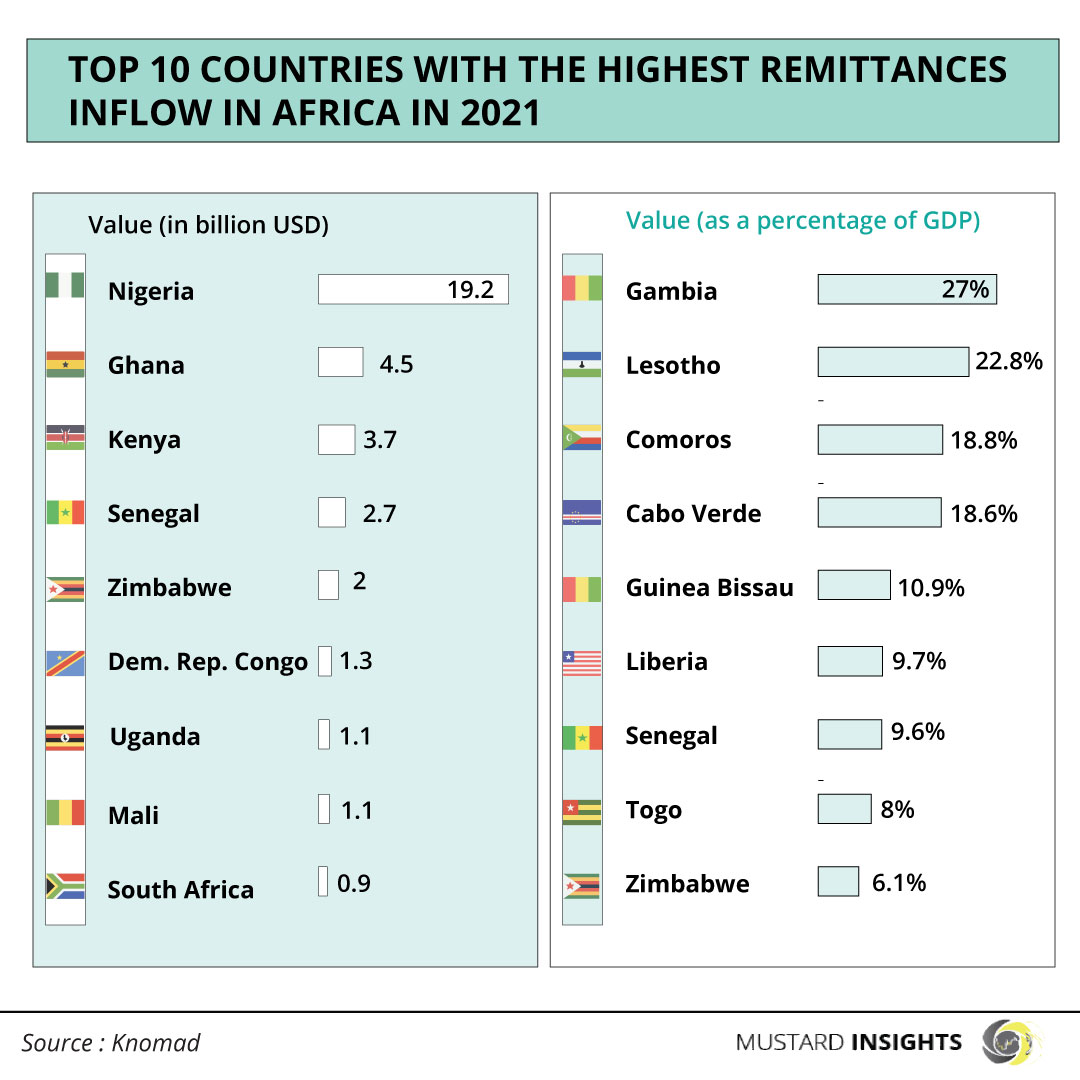

With that being said, here are the top remittance recipients in Sub-Saharan Africa:

- Nigeria: $19.2 billion

- Ghana: $4.5 billion

- Kenya: $3.7 billion

- Senegal: $2.7 billion

- Zimbabwe: $2.0 billion

- Democratic Republic of Congo: $1.3 billion

- Uganda: $1.1 billion

- Mali: $1.1 billion

- South Africa: $0.9 billion

- Togo: $0.7 billion

Nigeria with a population of over 200 million citizens is at the pinnacle of this benefit. In other to attract more remittances, Nigeria has had to restructure some of it financial services, having “plummeted by 27 percent in 2020 due to increased use of informal channels.” with numerous fintech companies making waves. In addition, the Naira-4-Dollar policy proffered by the Central Bank was intended to return payments to formal channels and appears to have achieved its objective—recorded flows advanced by a healthy 11.2 percent in 2021 to $19.2 billion. The surge in flows to Nigeria accounted for nearly one-third of the overall $6.3 billion increase in remittances to Africa. Solid economic activity in Europe and the United States during the first half of 2021, also contributed to Africa’s development as migrant workers were able to earn more income as opposed to the economic downfall faced in 2020.

Kenya, The Gambia, Tanzania, all recorded expansion in remittance receipts of 20 percent, 60 percent, and 30 percent growth respectively. While Mozambique witnessed two-thirds increase in flows, as migrants came together to support the people of Cabo Delgado during the times of peak insurgency. Remittance flows of Net oil-exporting countries like, Ghana, South Sudan, and the Democratic Republic of Congo, jumped to $26.3 billion, a boost of 16.15 percent.

Although, uncertainty and risks in the outlook for remittances to Africa (2022–23) are exceptionally high against the background of global conditions affected by the Russian invasion of Ukraine. Higher prices of oil, and the unavailability of wheat may affect households, especially poorer households..

Thoughts?

We won't share your email address. All fields are required.