According to the International Monetary Fund, 37 percent of women in sub-Saharan Africa have access to financial services compared to 48 percent of men. According to a 2019 McKinsey study on gender parity, if African countries made strong attempts to economic gender equality, Africa could add as much as $316 billion to its gross domestic product (GDP) by 2025.

In Africa, women's access to financial services is comparatively lower in relation to men. The situation persists despite efforts to bridge the gap between women's and men's access. According to the International Monetary Fund, 37 percent of women in sub-Saharan Africa have access to financial services compared to 48 percent of men. According to a 2019 McKinsey study on gender parity, if African countries made strong attempts to economic gender equality, Africa could add as much as $316 billion to its gross domestic product (GDP) by 2025.

Financial inclusion issues majorly arise in rural to low-income areas without adequate development. Seeing as the women in these areas are likely to have lower income and education than men, they are more likely to be excluded compared to women in urban areas, who may have similar levels of income and education with men. Income and education are key socio-cultural drivers that affect how people are measured in society. Some traditional patriarchal conditions have created a scenario where men are more likely to be educated and earn more than women limiting their capacity to contribute. In a nation with a majority of it’s population living in rural areas, it is inevitable that women will lag behind men when it comes to education, income, or financial inclusion.

Financial inclusion matters because it allows women to attain a level of independence monetarily. This untethers them from having to rely on a man for financial issues and builds an avenue for women to save and invest. More holistically, financial innculsion opens a pathway to wealth and financial independence for women.

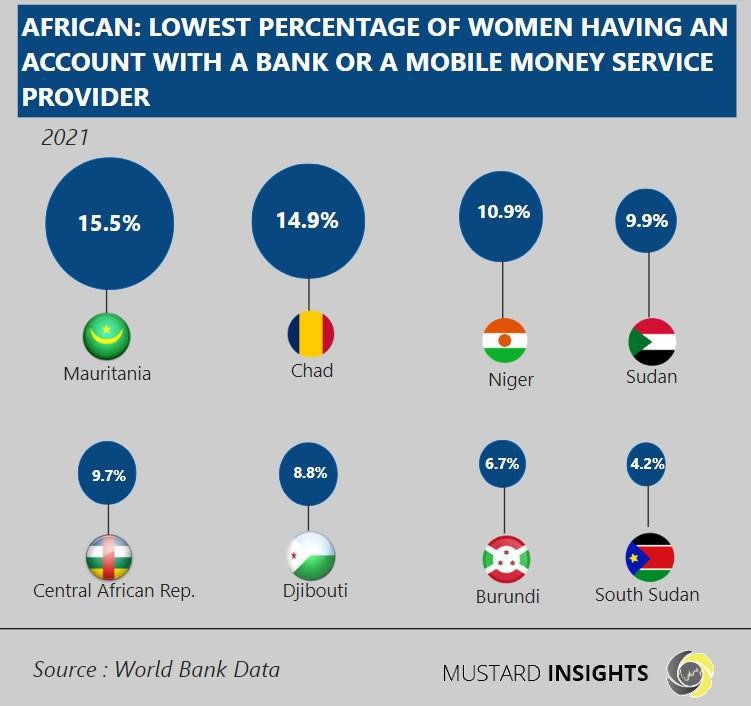

This article briefly looks at the countries with the lowest percentage of women with bank accounts or access to mobile money service providers.

Breakdown & Key Metrics

In Mauritania, 15% percent of the women have access to financial services, which is quite low compared to the rest of Africa. One of the reasons for this is that only 27.4% of the women in the country are economically active, which means that many women do not contribute and, therefore, rely on other means for financial stability.

In Chad, only 14.9% of the women in the country own bank accounts. The country's history of conflicts and structural problems has widened the income gap between genders in communities, as most women have been left destitute, resulting in minimal trade for survival. Additionally, financial services in most rural parts of Chad are non-existent, and most women have to result to archaic methods of preserving money.

Niger Republic owes its lack of financial inclusion to some of its inherited laws. In Niger, married women still have to seek their husband's permission before opening bank accounts, creating a barrier for women to be financially inclusive. This might be why only 10.9% of its women own bank accounts or access mobile money services.

Other countries with subpar financial inclusion on the list are:

Sudan – 9.9%

Central African Republic – 9.7%

Djibouti – 8.8%

Burundi – 6.7%

South Sudan – 4.2%

Takeaway

To boost financial inclusion amongst women in Africa, we must first address some underlying issues attached to gender equality. Education needs to be accessible to all everybody regardless of gender. Financial literacy should be improved in low-income or rural to low-income areas and should be available to all. Governments should also consider abolishing archaic traditional laws to enable absolute inclusion in areas where necessary.

Thoughts?

We won't share your email address. All fields are required.