Since the collapse of FTX and the crypto winter of May to August, more voices begin to call for regulation of the industry.

It won’t be an overstatement to say that the month of November has been a tumultuous period for cryptocurrencies. At the start of the month, a single Bitcoin was worth USD 20,481.88, and by the 5th of November, the value had risen to US$21,278.88.

On the 6th of November, crypto news outlet, Coindesk, broke news that a hedge fund called Almeda held almost a third of its assets in the form of a token called FTT. This might sound unfussworthy, but Almeda is the hedge fund of the cryptocurrency exchange, FTX. Additionally, FTT is a token created by FTX. Almeda held almost 30% of its assets in a token created by its parent company.

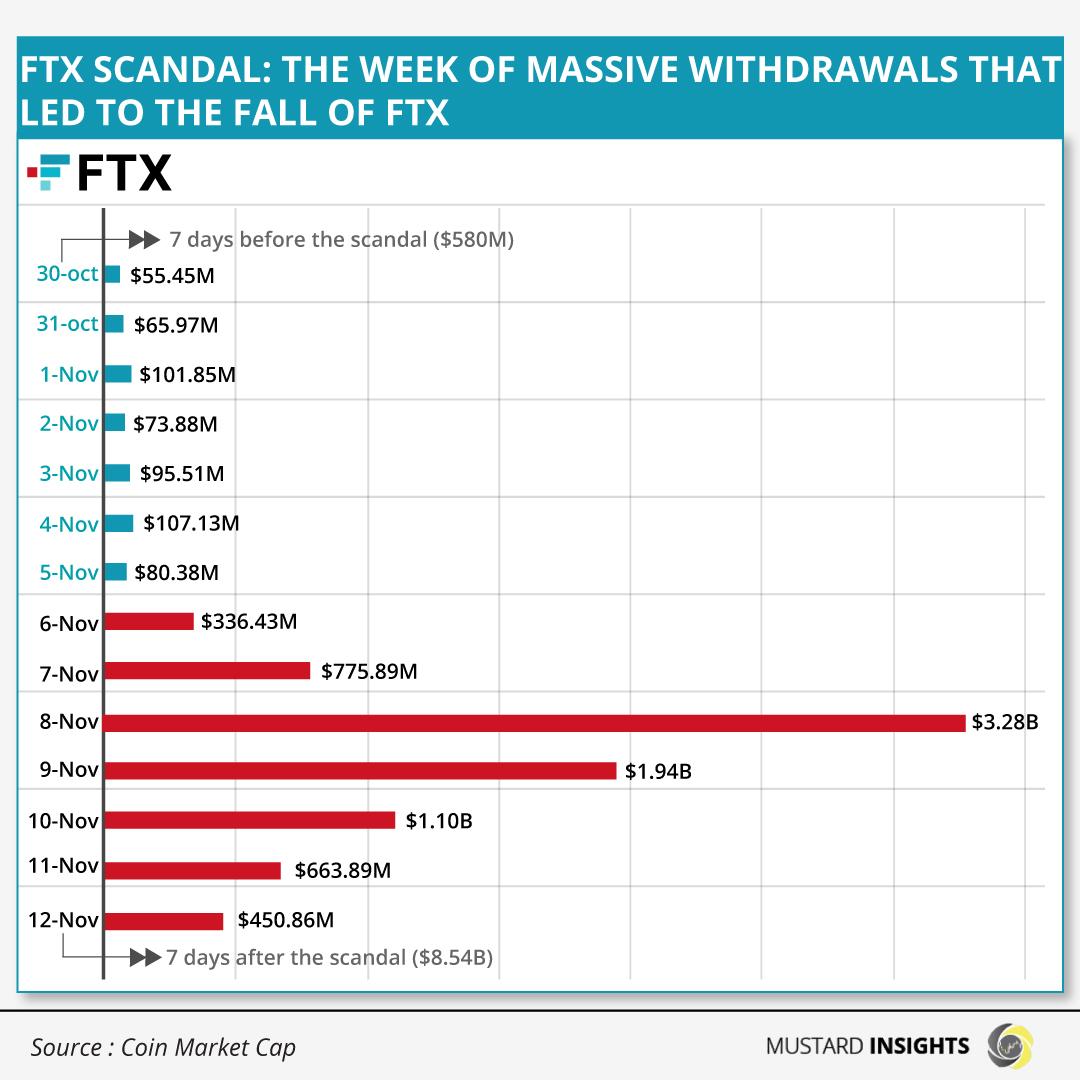

Documents released to Coindesk further revealed that Almeda had made risky investments with traded FTT assets, prompting the rival cryptocurrency exchange, Binance, to liquidate its holdings in Almeda, It is important to note that the cryptocurrency market acts like the stock market in that it is mostly speculative. When Binance sold its holdings, other customers saw the smoke. They didn’t need to see the fire: there was a scramble to withdraw funds. It would later come out that there was indeed a fire; Almeda had held customers’ money, traded carelessly, and lost nearly US$8 billion of FTX customer funds.

What followed was a spate of withdrawals that led to the collapse of FTX. In the seven days following Coindesk’s publication, over US$8.55 billion was withdrawn from FTX, as customers rushed to withdraw their holdings in the exchange.

Also resulting from its speculative nature, the collapse of FTX will have ripple effects around the entire market. Withdrawals were not limited to FTX alone; withdrawals were so rife that some exchanges such as BlockFi and Genesis were forced to halt withdrawals.

The collapse of FTX has led to renewed calls for regulation of the cryptocurrency market. In an interview with Coindesk, a former employee of the U.S. Securities and Exchange Commission (SEC) stated that most U.S. lawmakers are not equipped with the know-how to figure out crypto regulation.

Even if American lawmakers figured out a way to regulate the market, exchange owners could just move their operations overseas to escape government oversight. After all, FTX is based in the Bahamas and Terra, another major exchange is based in Singapore. Additionally, the CEO of the exchange, Coinbase, stated to Coindesk that as much as 95% of crypto trading occurred overseas.

The main victims in all of these will remain the customers. Almeda and FTX frittered away over US$8 billion of customers’ funds. Some may never get their money back. The cryptocurrency industry has lost over US$2 trillion in value since it peaked in November 2021, falling from being worth over US$3 trillion to less than a trillion today. Some crypto industry practices may pass for arbitrage in more regulated markets, and the mistakes of a few cause many grief.

The great promise of cryptocurrencies is a decentralised, deregulated market of independent money. However, the absence of rules create an even greater environment for high volatility and the creation of bubbles with a mirage of endless profitability.

The issue with bubbles, however, is that they eventually burst with many never recovering from its dire consequences.

Thoughts?

We won't share your email address. All fields are required.