Finance, technology, take center-stage in Nigeria's economy, but at to what cost?

The tech industry has taken off in Nigeria in recent years, becoming one of the nation’s fastest-growing sectors. This rapid development has been aided by considerable funding from outside the country, led by the Facebook founder, Mark Zuckerberg’s USD24million investment in Andela back in 2016. That move by Zuckerberg opened the floodgates, legitimizing an already-growing industry. Since then, numerous Nigerian tech companies have acquired funding from abroad. According to the financial and legal content platform, Mondaq, in 2021 alone Nigerian tech companies raised NGN903,680,000 in funding, accounting for 42% of all funding raised by African tech companies. Financial technology, or fintech, companies raised 59% of that sum. So, there's no secret there: the Nigerian tech sector is awash with cash.

With the rapid growth of the tech sector has come the need for labor — programmers, developers, product managers — a substantial labor market basically created in a decade. However, Nigeria is a country of 206 million people, a lot of whom are between 18 and 35. That demand for labor was always going to be met. Nigerian youths had pre-empted the tech bubble: they were ready before the opportunities were. This labor surplus has contributed to the country becoming a tech hotbed akin to India. It’s not just the tech companies in Nigeria that are hiring; a lot of Nigerians now work remotely for foreign tech companies. It’s a boom, and there is a myriad of problems with this.

Services have always accounted for the bulk of Nigeria’s GDP. In 2021, the services sector contributed almost double the combined value of the agriculture, mining, and construction sectors…put together. This is no doubt fueled by the rise of the tech sector. But at what cost? The Nigerian tech bubble has created considerable sectoral inequality, especially among young people, who are all attracted to money. In a country with alarming levels of poverty, young people cannot be blamed for picking the best possible route for economic advancement.

Hence, a massive migration to tech, regardless of previous career decisions. Nigeria famously manufactures very little and would produce even less as that sector loses more talent to tech. Its younger, more educated population wants to live in urban areas. Financialization is a way to describe the rapid rise of the finance sector and financial capitalism which has grown since the rise of neoliberalism and deregulation of the financial sector in the late 1970s and early 1980s.

It is relatively easier to accrue profit in financial markets than it is in physical markets. An investor with USD$1million looking to find profit within three to five years is more likely to look towards the stock market than building a power plant. Hence, this profitability, with the aid of fewer regulation, has seen the finance industry gradually come to dominate economic activity.

The merger of tech and finance creates another industry. Some can see the fintech industry as the democratization of the financial sector. Anyone can download Robinhood and become an investor in the stock market, or get into cryptocurrency through Coinbase. Not just investment though; everyday financial transactions can be conducted through payment platforms like Paystack and Interswitch. The result of this is that through this technology, more people interact with the financial sector. In a way, we are now all traders, investors, in ownership of some sort of portfolio.

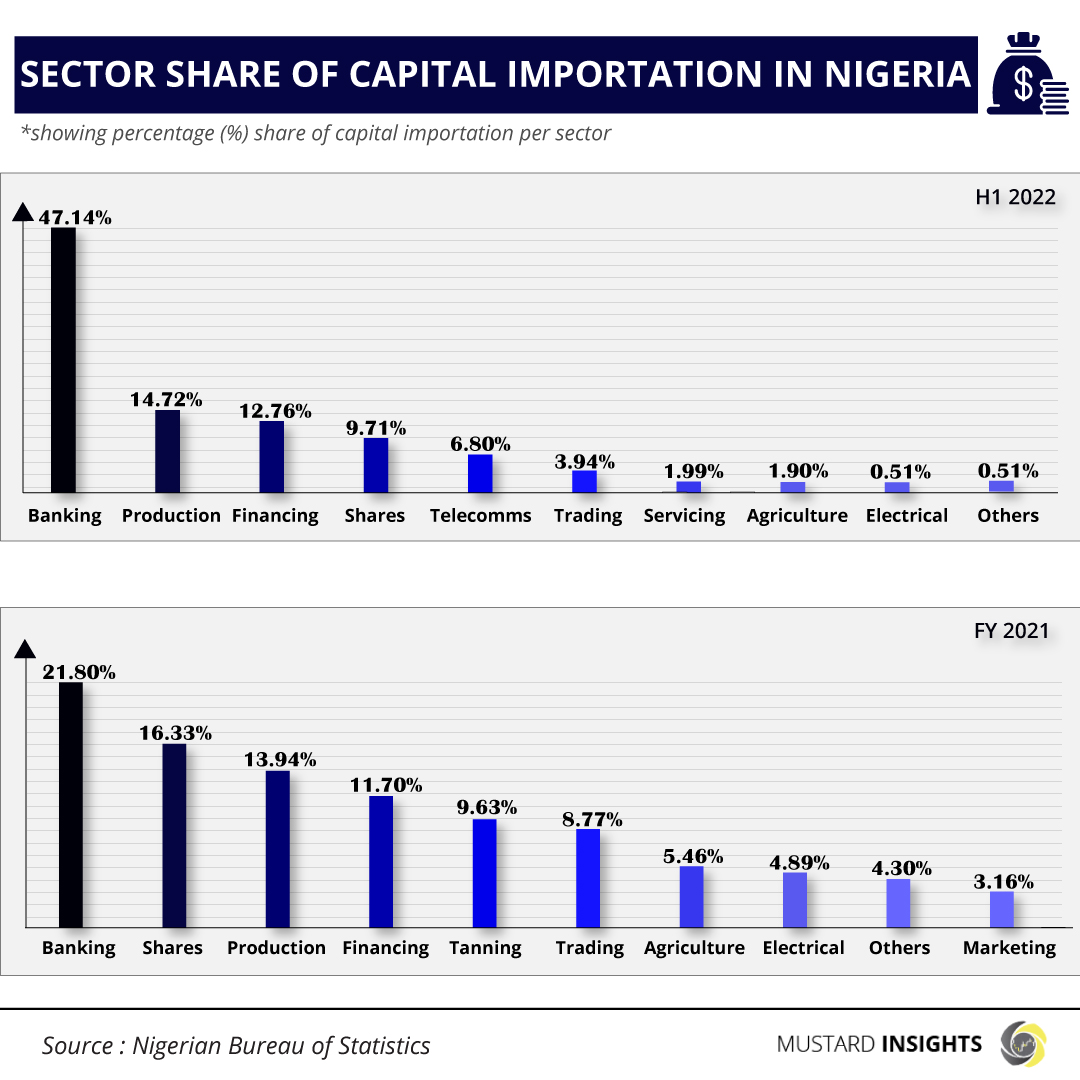

This financial industry domination also shows up in the foreign investment Nigeria receives. The stock market and other forms of equity financing, banking, and tech startups raising funding make up more of Nigeria’s total capital importation with each passing quarter. Statistics compiled by the Nigerian Bureau of Statistics show that foreign investment coming into Nigeria is disproportionately slanted towards the finance sector. Parsing sectoral data from the Bureau shows that finance or finance-adjacent sectors (Shares, Banking, Financing) accounted for 49.83% of all capital imported into Nigeria. By the end of the first half of 2022, that combined figure had risen to 69.61%. Banking as a sector takes up a 47.14% share, nearly three times that of Production, which accounts for 14.72%.

The fact that Production, Agriculture, and Construction draw in so much less in foreign investment than Shares, Banking, and Financing shows up in Nigeria’s manufacturing. Internal production of food and materials very rarely meet demand, and as such the country is a net importer. The massive sectoral inequality that has been created means that other sectors might be starved for talent and capital. This is turn produces an unbalanced economy, with the lacking sectors needing to be propped up by policy instruments such as subsidies and grants from the government.

This will also inevitably create income inequality. The few people who work in the tech and finance sectors will on average earn considerably more than teachers, farmers, or even doctors and engineers. While a society needs bankers and programmers as well as teachers and doctors, if the financial remuneration of one sector is vastly superior to the other, it warps the job market. Such an imbalance in compensation will create worker supply shortage in some sectors and a glut in others.

Nigeria is a country in dire need of physical infrastructure: transport, housing, medical, and energy. It needs investment in agriculture to feed its burgeoning population. However, money as a resource is finite. Capital being directed at one sector is capital of which another is deprived. Can the government funding make up for the lack of private sector investment in some sectors? So far, this has not proven to be the case. Sectors like Production, Agriculture, and Healthcare are underfunded, understaffed, and underequipped. It just so happens that these sectors are core to a nation’s progress, despite not being the route to major profits that equity financing can be.

According to the country’s National Bureau of Statistics (NBS), up to 4 out of 10 Nigerians live below the poverty line. Many lack access to basic infrastructure and just 17 percent of Nigerians have wage jobs that can lift people out of poverty. The country needs scientists, farmers, engineers, teachers, and medical personnel as much as it needs software engineers and financial analysts. It must find a way to incentivize its youth to take on these roles and properly fund these sectors to ensure their growth and sustainability. That way, the economy is diversified and resistant to shocks. Only then can the country’s growth be holistic and long-lasting.

Thoughts?

We won't share your email address. All fields are required.