A country’s exchange rate is usually determined by factors like the domestic currencies value, and the foreign currencies value. These rates capture a lot of economic variables and can be affected in different ways like the country’s inflation rate, political stability, debts, export and imports, among other factors.

A country’s exchange rate is usually determined by factors like the domestic currencies value, and the foreign currencies value. These rates capture a lot of economic variables and can be affected in different ways like the country’s inflation rate, political stability, debts, export and imports, among other factors.

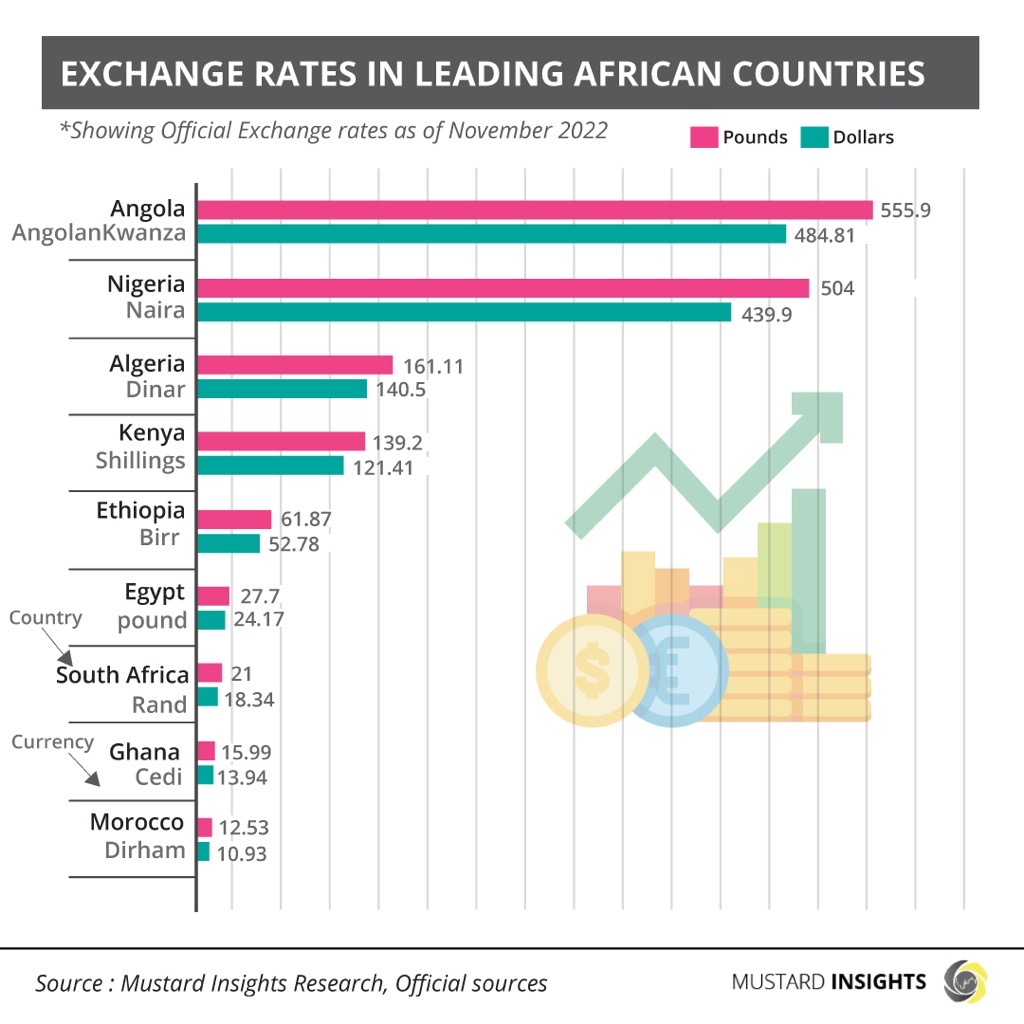

The Ghana Cedi is facing one of these problems as the currency has now among the worst performing in the world. In October the Ghanian government began talks with the International Monetary Fund (IMF) that may involve debt restructuring, which led to a 45.1 per cent loss of the cedi’s value to the dollar. Prior to this Cedi was trading at 10.5 cedis to a dollar, which made it one of the strongest in Africa. This development has seen it fall short and is now trading at 13.9 cedis to a dollar.

Nigeria is also going through a foreign exchange crisis as a result of the unavailability of foreign currency in its banking system. Although the bank rate stands at 439.9 naira to a dollar, the parallel market is the rate which most Nigerians resort to using, as foreign currency is more accessible through the black market. The present parallel rate stands at 855 naira per dollar1. This figure is a significant increase from the end of October, when the rate was 795 naira to a dollar. The implication of this is inflation in the country is going to rise as imported goods that are already at steep prices will increase again. Most traders and various entrepreneurs in the country depend on the dollar rates for their businesses to thrive as a lot of finished products in the country are exported. These businesspeople have stated thay they often incur huge losses when exchanging their local currency for dollars. They face declining sales fewer goods can be purchased from outside the country and the general public continue to see reductions in disposable income.

Angola is a rare success story. The country's currency has been performing at a decent level all 2022, since it ended its five years recession in 2021 and has seen the currency strengthen by over 20%. This development has placed the currency as the world's best performing currency and is fostered by the increased demand of the country's oil matched by its oil production, as well as other factors. Angola is presently Africa’s largest oil producer and generates nearly 90% of all its revenue through fossil fuel sales.

Thoughts?

We won't share your email address. All fields are required.