Global oil prices continue to remain above 100 USD per barrel, the highest it has been since 2014. The ongoing Russia-Ukraine conflict has contributed to the hike in international crude oil prices. With sanctions placed on Russia, world’s second largest oil exporter, this may push oil prices much further up.

Many African countries have taken this update on board and should the Russia-Ukraine continue as the year progresses, global oil prices may increase further. Attention has shifted to determining the volume of crude oil reserves oil-producing countries have to meet the increasing demand for oil and its consumption while potentially increasing daily production of the commodity.

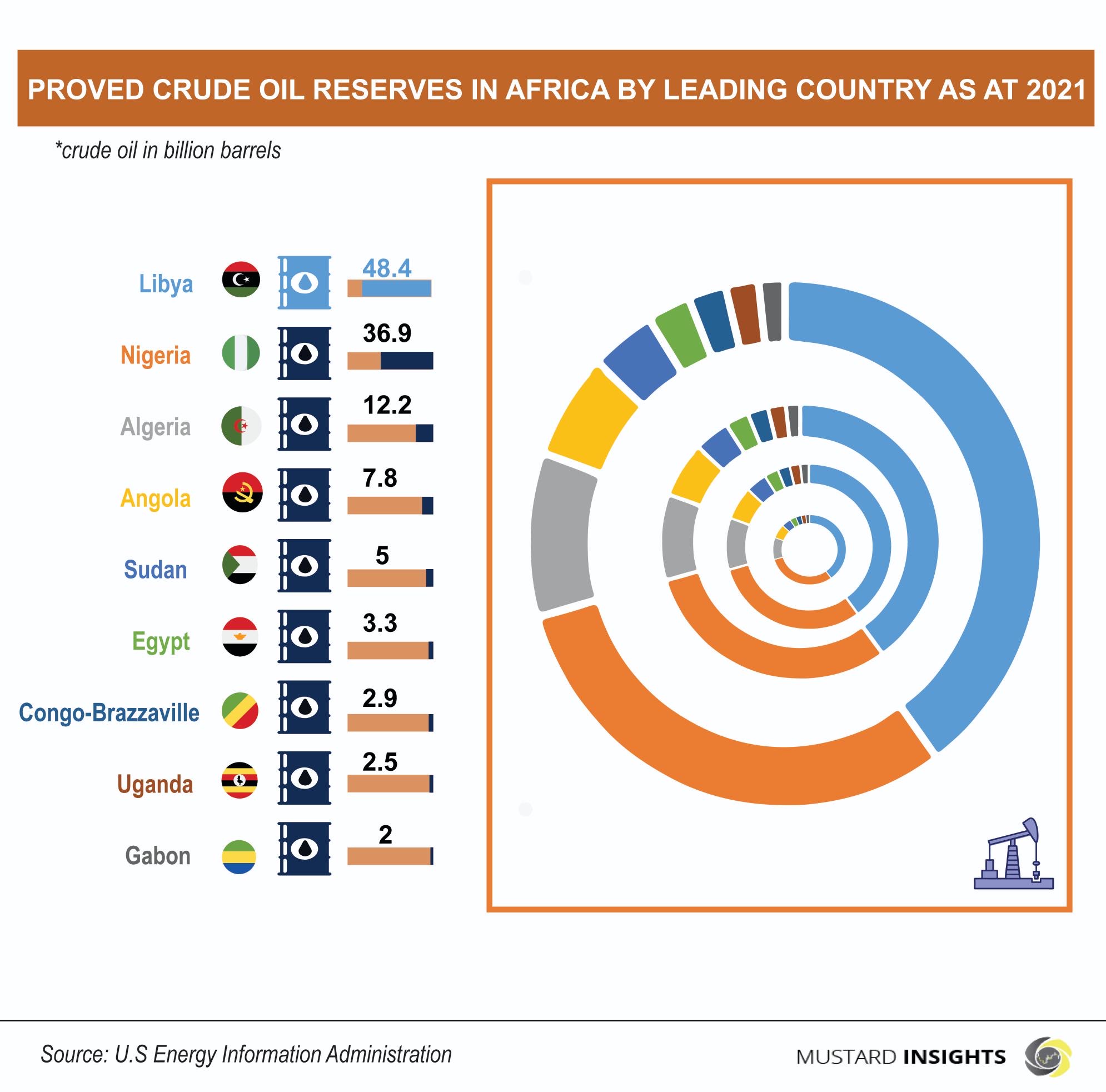

Proven crude oil reserves in Africa

According to the U.S. Energy Information Administration, the volume of oil reserves in Africa as at 2021 was 125.3 billion barrels. Libya has the highest volume of proven oil reserves in Africa at 48.4 billion barrels, followed by Nigeria, Africa’s largest producer of oil, with a proven oil reserves volume of 36.9 billion barrels. Algeria has the third highest proven oil reserves volume of 12.2 billion barrels beneath its surface.

Other countries in Africa with proven oil reserves include Angola with 7.8 billion barrels, Sudan with 5 billion barrels, Egypt with 3.3 billion barrels of oil. Congo-Brazzaville has proven oil reserves of 2.9 billion barrels of oil, Uganda has proven oil reserves of 2.5 billion barrels of oil, Gabon has proven oil reserves of 2 billion barrels of oil.

Chad, Equatorial Guinea and Ghana have proven oil reserves of 1.5 billion barrels, 1.1 billion barrels and 0.7 billion barrels of oil beneath their surfaces. Tunisia has 0.4 billion barrels of oil with Cameroon, Congo-Kinshasha and Niger having 0.2 billion barrels of oil reserves each. Cote d’ivoire has the lowest volume of oil reserves at 0.1 billion barrels.

The combined volume of oil reserves available beneath the surfaces of Libya, Nigeria and Algeria account for over 77% of total volume of oil reserves on the continent.

With global oil consumption on the rise, the demand for oil prices may fuel an additional surge in oil prices. According to the U.S. Energy Information Administration (EIA), global consumption of petroleum and liquid fuels reached about 98.3 million barrels per day in March 2022.

This shows an increase of 2.4 million barrels per day during the same period of March 2021. The outlook on global consumption of petroleum and liquid fuels will average 99.8 million barrels per day, throughout 2022, hence maintaining the average increase of 2.4 million barrels per day throughout the year.

The EIA forecasts global consumption of petroleum and liquid fuels will rise by 1.9 million barrel per day in 2023 to an average of 101.7 million barrels per day.

Takeaway

For African countries heavily dependent on oil exportation for revenue generation, fluctuations in oil prices play a vital role in economic performance and foreign exchange earnings. Hence, an increase in oil prices signifies an increase in foreign exchange earnings, which most African countries will seek to take advantage.

With African countries alert to the high global oil prices, this provides additional incentive to produce more oil to maximize profits, increase national reserves and budgetary spending.

Thoughts?

We won't share your email address. All fields are required.