Mustard Insights has set out to provide data and data infrastructure to aid the growth of specific areas of the African economy. We believe that the need for data that offers valuable information to decision makers within the continent and beyond to aid new export areas and investments to various aspects of the non-oil sector, has become more imperative.

It is no doubt that the African continent is teeming with opportunities. From its huge and exponentially growing population – a source of labour and consumption, vast mineral resources, and largely untapped markets, there is no gainsaying the fact that it plays a vital role in the global economy. However, its overreliance on oil has possibly done more harm than good. Many African economies are reliant on exporting this same singular commodity, making them susceptible to price changes, amongst others.

Nigeria and Angola, Africa’s largest oil producing nations, have over 70% of their export revenue from oil, ignoring other high value resources. Hence, they are ultimately performing sub-optimally economically. In Nigeria, oil has been regarded as a resource curse; not only does the country remain one of the poorest globally, the National Bureau of Statistics reveals that oil sector contributed only 5.66% to the country’s real GDP in Q3 2022. Additionally, given the continued transition from fossil fuels, oil and gas producing nations are faced with the reality of exploring other points of export.

In a bid to aid that transition, Mustard Insights has set out to provide data and data infrastructure to aid the growth of specific areas of the African economy. We believe that the need for data that offers valuable information to decision makers within the continent and beyond to aid new export areas and investments to various aspects of the non-oil sector, has become more imperative.

Consequently, our immediate sectors of focus include: Agriculture, Solid Minerals, Green Energy, Real Estate/Construction, and Entertainment.

Overview of the sectors and the rationale for our foray into them:

(1) Agriculture

Africa presents an important solution to curbing the rising food demand on the continent and beyond. With over eight billion people across the world to feed, there is no gainsaying the fact that Agriculture remains a viable industry for exportation on the continent. While insecurity has threatened food security in many parts of the continent, Africa’s untapped agricultural potential is enormous with over 60% of the world’s remaining unused arable land, below average yields no thanks to input and infrastructural deficits, and more.

The United Nation’s joint report, The State of Food Security and Nutrition in the World, shows that people affected by global hunger rose to 828 million in the year 2021. This shows an increase of 150 million since the outbreak of the COVID-19 pandemic. Africa accounts for 249 million of the global total. Data by African Development Bank (AfDB) however, has it that Africa alone has the potential to feed nine billion people in the world by 2050. They also believe that “Africa’s agricultural output could increase from $280 billion per year to $1 trillion by 2030.” It is our desire to be a part of the solution for the rising global food need by providing requisite data to unveil its many teeming opportunities as the African Agricultural sector provides.

(2) Solid Minerals

Gold, diamonds, platinum, copper, cobalt, graphite, iron ore, titanium, zinc – and a wide range of others. Africa holds a wealth of resources, of many shapes and sizes underneath its earth. In the south and central regions, precious metals and minerals are some of its biggest exports. In terms of gold, Ghana thrives as the continent’s largest producer, followed by South Africa, Sudan, and Mali. For diamonds, Democratic Republic of the Congo ranks high, followed by Botswana and South Africa. Yet so many more untapped mineral resources exist. According to the United Nations, Africa holds about 30% of the world’s mineral reserves. With the inherent value from their trade bolstered by a booming jewellery industry, its use for the creation of smart phones, electric vehicles, and more, Africa is sitting on a goldmine – literally.

(3) Green Energy

Africa might be producing around 2-3% of global carbon emissions, but it is no doubt a prime source of oil. Simply put, when Africa produces oil, the rest of the world uses it. Conversations have progressed globally at different scales towards the transition to clean or at least, cleaner sources of energy and Africa too has a role to play. The continent holds massive capacity for hydro, solar, wind, geothermal, and other forms of renewables. Beyond being a focal point of production, more investors are pulling out of fossil fuels. Demand for fossil fuels is expected to peak and then ultimately fall. A good case for this is Europe which is looking to attain net zero by 2050.

In addition, renewable energy sources are being considered to solve the continent’s age-long quest for full electrification and energy inclusion. At the moment, renewable sources account for nearly 18% of the electricity output; this will expectedly significantly increase. With companies on the continent and international companies looking to find opportunities on the continent now being forced to consider putting in place carbon management strategies towards building a low carbon world, Mustard Insight seeks to provide data at the intersection of this transition.

(4) Real Estate/Construction

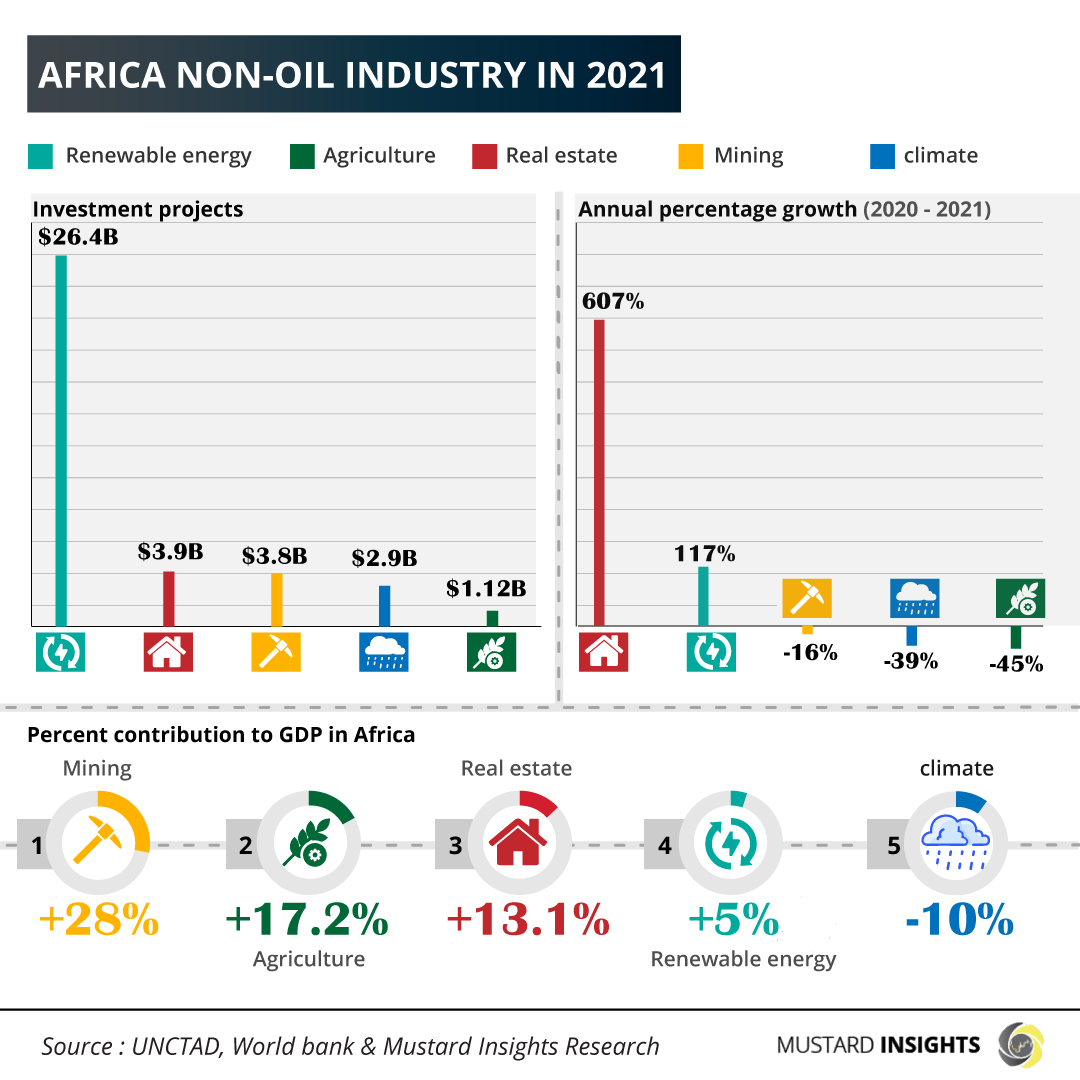

As the saying goes, the greatest challenges often hold the largest returns. Africa requires infrastructure – a lot of it. It also requires a lot of shelter to hold its enormous and growing population. Data by Modor Intelligence reveals that the African construction market is expected to record a compound annual growth rate (CAGR) of more than 7.5% during the forecast period (2022 -2027). Opportunities in the sector cut across Commercial, industrial, residential, infrastructural, as well as around energy and utilities. At the moment, Modor reveals that there are over 570 construction projects in Africa worth a whopping $450 billion. In 2021, the Real Estate sector contributed 13.1% to Africa’s GDP and this represents a growth of 607% from the previous year. Its potential is certainly not in doubt.

(5) Entertainment

Last on the list is the entertainment sector. While data around the expansion of this sector isn’t as structured as others on this list, subsectors like the music and movie industries have proven to be enticing investment areas to both local and international investors. Revenue in the Music Streaming segment alone is projected to reach U$187.60m in 2023. Research firm Dataxis projects Africa’s music streaming market to be $314.6m by 2026. Private equity investors have since jumped on the wave and started investing in talents, taking a chunk of streaming revenue and amongst others. For the film industry as well, UNESCO also reveals that the e economic potential of the film and audiovisual sectors remains largely untapped, accounting for US$5 billion in revenues in Africa and employing 5 million people. Yet, a wider scope of opportunity still exists for the entertainment industry as a whole.

Mustard Insight’s objective remains to build the largest repository/search engine of Africa’s data.

Africa has Some of the Highest Prices of Data Globally

Thoughts?

We won't share your email address. All fields are required.