African startups raised 2.25 billion in funding in Q1 2022, marking the highest funding within the period in seven years. According to data analysed by Mustard Insights Research, the $2.25 billion raised in Q1 2022 is 2.5x the total amount startups raised during the same window in 2021, 5x the amount raised in 2020 and 8x the amount raised in 2019.

African startups raised 2.25 billion in funding in Q1 2022, marking the highest funding within the period in seven years.

According to data analysed by Mustard Insights Research, the $2.25 billion raised in Q1 2022 is 2.5x the total amount startups raised during the same window in 2021, 5x the amount raised in 2020 and 8x the amount raised in 2019.

A cursory Review of The Trends

African startups have raised 2.25 billion USD through funding activities and from investors in the first quarter of 2022, according to data published by GSMA (Global System for Mobile Communications) and the Big Deal (database and insights on startups funding in Africa).

The seed funding of 2.25 billion USD raised in Q1 2022 is almost half of 2021’s total funding, where African startups raised over 4 billion USD across 355 funding deals. Africa’s four regions have produced many new firsts so far in 2022. It has been the year of 100 million USD single-round raises featuring prominently with 10 startups, including unicorns Wave, OPay, Flutterwave, and Chipper Cash. That’s a significant increase from 2020, where no African startup raised 100 million USD in a single round, and a 400% total increase from the only 2 startups that raised such amounts pre-Q1 of 2021.

Currently, the number of unicorns in Africa has increased by 166%, from three unicorns to eight. Andela, Chipper Cash, Wave, OPay and Flutterwave joined Jumia, Fawry, and Interswitch on the global stage.

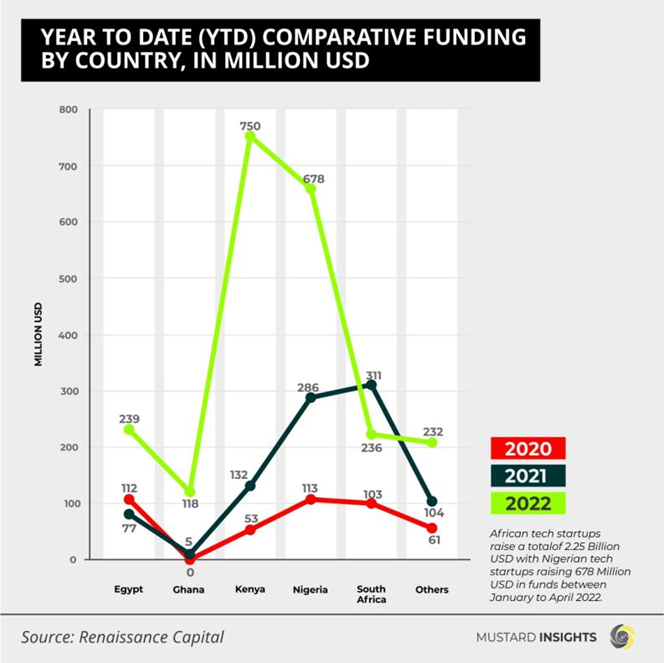

For funding across geographic locations, the “big four” remain big, raising 85% of total Venture Capital funding. Nigeria took the lead in terms of deal count and size, raising over 540 million USD in 28 deals. A sizeable chunk of which was Flutterwave’s 250 million series D raise.

Funding activity of startups like Wasokowatch - formerly known as Sokowatch - (125 million USD), M-KOPA (75 million USD) and COPIA Global (50 million USD) pumped the numbers for Kenya, raising 387 million USD in 17 deals.

South Africa closed 197 million USD in 12 deals with 50% of the deals being growth investments ranging from Series A to C. Egypt closed 160 million USD in 25 deals. Of Egypt’s 25 deals, over 50% were less than 7 million USD, which suggests a lot of checks issued to seed stage startups.

Biggest Sectors - FinTech continues to thrive

Financial Technology-driven solutions continue to be at the heart of most investor fundings in Africa. This is obvious with Fintech raising 30% of the total funding raised in Q1 2022. Following the Fintech start-ups closely are E-commerce and Logistics raising $200M and $142M, respectively.

Africa’s tech ecosystem raised over 1.5 billion USD in funding, of which startups in the financial services space (Fintech) securing 752.62 million USD in funding in Q1 2022 — 47.1% of the total 1.589 billion USD.

BNPL (Buy Now, Pay Later) is also fast becoming a choice sector after raising 102 million USD in Q1 2022. In 2020, the Gross Merchandise Value (GMV) was approximately 204 million USD and is likely to reach 1.74 billion USD by 2028.

Also, Q1 2022 saw the rise of AI/AR startups in Africa with Tunisia’s InstaDeep securing 100 million USD in Venture Capital (VC) funding, alongside South Africa’s Carscan raising 1.3 million USD.

The total announced deals closed by African tech startups for the quarter stood at 1.589 billion USD with 111 funding deals, 45 seed rounds, 27 pre-seed rounds and 14 Series A rounds.

With Africa taking the lead in tech-driven solutions for global consumption, the continent is well on its way to closing around $8 billion in funding by the end of 2022 should this trajectory continue. Such a feat can spur the growth of amazing innovative ideas on the continent and attract more Foreign Direct Investment (FDI).

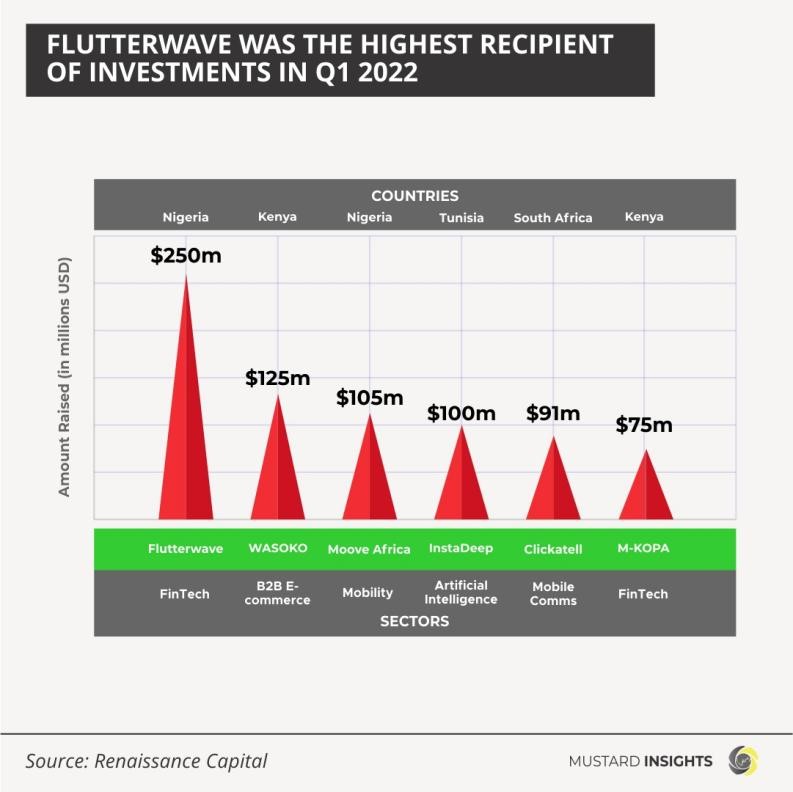

The Biggest Winners - Flutterwave, Wasoko, Moove and InstaDeep lead the pack

Flutterwave, Wasoko, Moove and InstaDeep occupy top spots as the only tech startups to secure 100 million USD or more in their respective round of funding.

Flutterwave, a Fintech startup and one of Nigeria’s two tech startups to feature in the “exclusive top four” flexed its muscle as it secured 250 million USD and strengthened its unicorn status after it crossed the 3 billion USD valuation. Kenya’s B2B E-commerce, a distant second, raised half of Flutterwave’s Q1 funding at 125 million USD for the first quarter of 2022.

Moove, one of Nigeria’s fast-growing mobility tech startup, showed why it is an attractive proposition to investors as it raised 105 million USD in Q1 2022. Tunisia’s InstaDeep, an Artificial Intelligence (AI) startup, raised 100 million USD to be part of the “100 million USD or more” seed fund recipient within the same period.

Flutterwave’s 250 million USD Series D funding is the biggest round of the quarter, with two of the top six raises coming from financial services providers. Kenya’s M-KOPA is the second Fintech company to feature in the top six.

Thoughts?

We won't share your email address. All fields are required.