- Published: 27th Nov, 2022

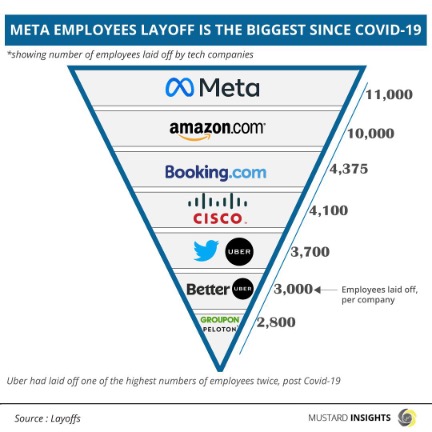

According to Layoffs.fyi, 836 tech companies had laid off 136,539 employees as at 21 November 2022, all within the calendar year. Since the onset of the Covid-19 pandemic, a date which the website posits as 11 May 2020, 1,373 tech companies have downsized to the tune of 232,530 workers. At the forefront of this retrenchment rabble is Meta, the parent company of Facebook and Instagram, which has laid off as much as 11,000 workers.

While this number is shocking, it is minuscule when put in scale and in terms of share of workforce. That 11,000 number is just 13% of the company's workforce. Companies such as Katerrra, Butler Hospitality, and Deliv have folded, losing 100% of their workforce. A cynic might say that peripheral tech companies come and go all the time, however, giants such as Twitter, Crypto.com, Zillow, and Groupon have laid off between 25-50% of workforce.

So, what is behind the tech industry’s layoff deluge?

Tech Funding Chronicles: A Background

In the wake of the 2008 Global Recession, the US Federal Reserve sought a way to fuel investment in the US economy. A slow economy was caused by both households and companies holding on to their money, spending and investing less. Hence, the government needing a way to kickstart the economy again. Their answer was found in monetary policy. More precisely, interest rates and printing money.

If interest rates are higher, commercial banks will charge higher on loans given to businesses and companies. When it cost businesses more to get credit, they are likely to invest less. This means less jobs, the economy has less demand, and this leads to slower or negative growth. This shows a link between rate of interest, inflation, and employment.

Lowering interest rates encourages corporate borrowing, and slashing the interest rates and creating a lot of new digital money at the same time means there was suddenly a lot of money seeking an investment avenue. The new money was used to purchase government bonds, and issuing houses like hedge funds were able to sell the bonds they held to great profit. Suddenly, they were sitting on a lot of new money and they needed an investment avenue.

A lot of this money found its way into the tech sector, or real estate. This large-scale purchase of tech stocks suddenly led to these companies suddenly becoming very valuable, even if they were not yet profitable. Silicon Valley-based firms were able to raise incredible sums through funding from hedge funds, venture capitalists, mutual funds, and other forms of money/wealth managers.

As a result, tech sector companies could draw on huge amounts of cash through funding without having to demonstrate any profitability. The institutions which gave these sums to the companies also made a lot of money, not through the profits of the companies they invested in, but through capital gains: basically, the difference between the value of the equity when it was purchased and when it was sold.

This model is dependent on the belief that at some point, these companies would begin to make operating profits. But two things might at some point dry up the well of investment: the investing bodies lose confidence in the company’s ability to make profit or, external economic shocks cause the investing companies to invest less.

At this point, it will not be improper to say that the present global recession was Covid-induced. Supply chains ground to a halt, production slowed and unemployment rates rose as some companies didn’t fare well with the shutdowns. Some companies still haven’t recovered to pre-pandemic levels of revenue growth. In terms of the tech sector, there was an initial overinvestment due to the sector being the main driver of stay-at-home technologies.

However, the investment in the tech sector has slowed down. In an interview with Nairametrics, Bello Muritala, founder of Sales Ultimo, proffered the opinion that a lot of tech companies had become overstaffed after raising funding from investors. This point of view is shared by Adewale Adeoye, the Chief Executive Officer of Chronix Technologies, who zeroed in on the hiring spree that the tech companies went on during the pandemic.

The reason why this phenomenon matters is that it might show that a lot of tech companies may have been operating outside of their means. If what happened in the U.S. tech sector is anything to go by, a lot of tech companies spend years making losses, with operating costs often far outpacing revenue. There’s a reason for this: tech companies at their advent often focus more on building market share instead of revenue generation.

How many people can we get using Piggyvest instead of an alternative savings platform? Can we get more users into Gokada instead of say, Opay? With this goal in mind, tech companies will be content to take operational losses as long as investors have confidence in the process or have the funds to invest.

The Way Forward

Maybe the recession has led investors to tighten their purse strings, or they are beginning to lose faith in the companies they invest in. It will be hard to determine that without empirical evidence, and non-public companies are not obligated to release their financial information. However, the answer would most likely bring us back to monetary policy and interest rates. High inflation has seen central banks around the world raise interest rates, which has inevitably led to stingier investment decisions from institutions like venture capital firms and hedge funds.

Fewer investment means that the tech companies have to act differently – suddenly they have to become profitable and institute sustainable practices. In addition, the cryptocurrency crash has hit the tech sector hard, as a lot of tech companies invest in the crypto market. Companies like Bitmama, who are a blockchain payment company, and Nestcoin, which holds its assets primarily in cryptocurrency, are presently taking huge losses.

The present state of the tech sector may prove to be a blessing in disguise, particularly for the companies. Adopting sustainable best practices may lead to more companies slowly pulling themselves into the black and turning profits. Until then, with the more and more companies returning to in-person work and the crypto market continuing to suffer, the tech industry might continue to face uncomfortable times. Tech companies should not be afraid to redesign their business models.