- Published: 23rd Feb, 2022

Shift In Digitisation And Online Banking Penetration: Nigerian Banks And The Future

Technology has proven to be the most innovative disruption since electricity and it is set to change the game in the financial services space whether the traditional banks are with it or not. In Nigeria today, digital-banking-only companies are giving traditional banks a run for their monies, and this has been further bolstered by the operating licence given to telcos like MTN, by the CBN.

More so, the convenience of mobile baking operations as simple as SMSs as well as the proximity offered by an agency banking network are certainly more likely to close the financial inclusion gap in Africa. They have also generally increased customer expectations around speed and efficiency of service delivery. Simply put, traditional methods just might not cut it again especially as shown by how quickly humanity evolved since the COVID-19 pandemic restrictions.

Just a few weeks ago, Standard Chartered Plc reportedly concluded plans to shut down 50% of its Nigerian branches. While we’ve seen a number of banks in other African nations toe this line over the past couple of years, Nigeria’s position as the most populated, makes it one to double down on.

Backstory: The Limitation Of Nigeria’s Banking System And The Disruption Fintech Offers

Following the establishment of the CBN, the Nigerian banking system has undergone numerous changes and results have no doubt been outstanding. Recent market capitalisation of the top five banks, ‘FUGAZ’, came to a whooping N2.69 trillion. However, 22 commercial banks with more than 5,000 bank branches and over 900 micro-finance banks are still not enough to cater to a country of over 200 million people. Thus, birthing a financial inclusion gap as a majority are still unable to access formal banking services as a result of their proximity to the banks. The ratio of banks to people reveal why.

Simply put, even if banks double their buildings, they wouldn’t be able to reach the vast population and will instead keep incurring costs. By closing branches and instead, deploying mobile money, digital, and agency banking services, they get to save cost and reach the unbanked population while still offering a large spectrum of financial services.

There’s also the cost element. Agent banking is about 25% - 40% cheaper than branch transactions. There’s also time. Findex data revealed that the total time to open an account at a mobile agent outlet, including waiting time and face-to-face meeting time is 10 mins shorter, on average, than in a branch which takes about an hour. In essence, waiting time is reduced and transactions costs are lower resulting in an increase in volume and frequency of transactions.

The Future of Financial Services?

Many sectors and industries make up the Nigerian economy, but banks play a crucial role in its financial sustenance. With traditional banks already stretched, there is ardent need for them to restructure and come up with new strategies for long-term growth and sustainability.

The International Monetary Fund (IMF), a global lender in the finance market, disclosed in its Financial Access Survey Trends and Developments 2021 that as of 2020, Nigerian banks had closed 234 branches and 649 Automated Teller machines (ATM). In that space of time, there have been a considerable expansion in the usage of digital financial services since the pandemic. Data from the Nigeria Inter-Bank Settlement

System (NIBSS) revealed that between Q1-Q3 2021, Mobile Interscheme transfers transaction value and volume grew by 167.3% y-o-y and 113.8% y-o-y to N5.1tn and 188.7m, respectively. In addition to this, we have witnessed sustained increase in funding going into the Fintech landscape. It’s gold.

Digitalization has certainly changed how humans interact with the world and we can now see these changes also taking place in financial services. Hence, in order to be able to cater to the newer, tech-savvy, TikTok generation, brick and mortar services in physical locations is simply not how you move with the changing times. In other words, there’s also a growing culture shift in the world of business.

Shutting down bank branches is proof that more of the traditional banks in Africa acknowledge the limitations of their existing structures. However, that’s not enough to help solidify their continued ownership of the financial services market in the face of steep competition – the uber-fast, tech solutions being offered to their customers.

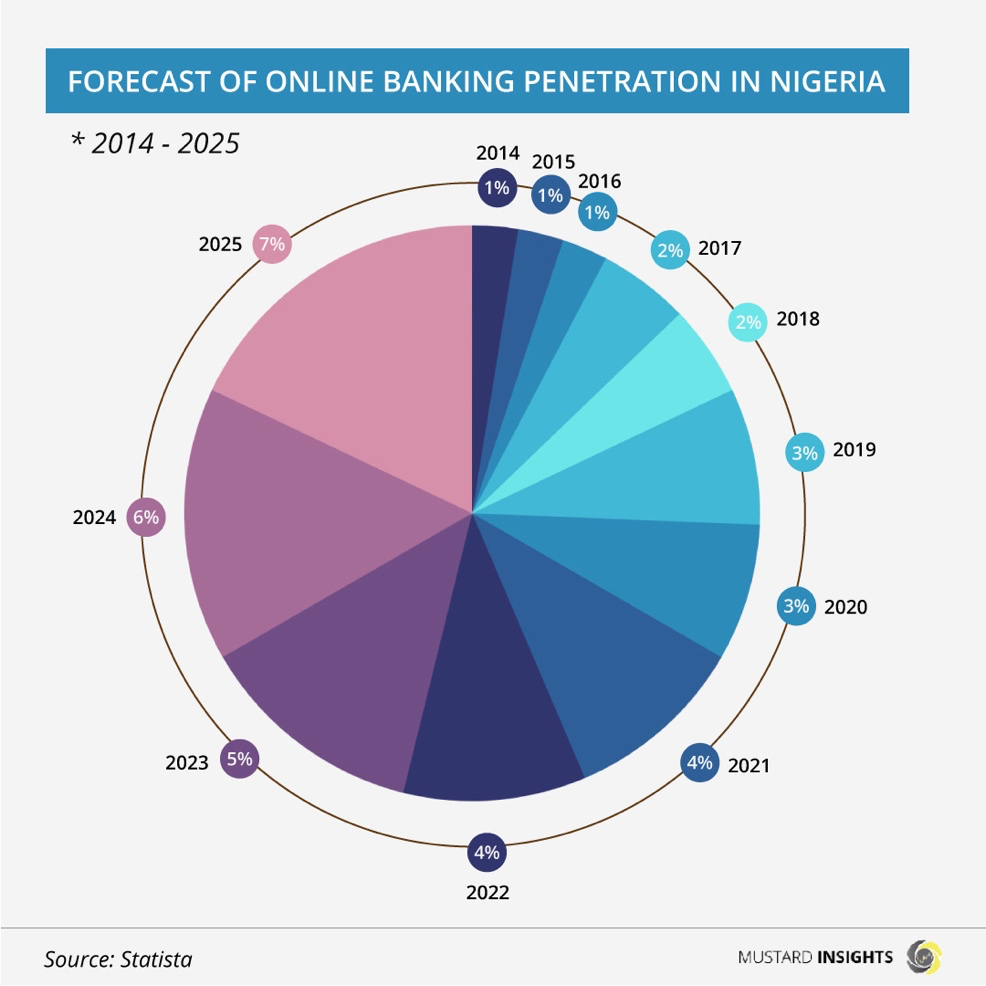

It is clear that traditional banks are already looking to improve the level of financial inclusion by exploring the opportunities of digital banking which is expected to increase their market share and profit margins by making services easily accessible and cheaper for customers (including the unbanked population). The question is, how ready are they? Is 100% digital/remote the future of financial services? If so, what happens to the labour economy? Considering our infrastructural limitations, how much innovation can Nigerians bank their cash on?

What’s your take?

Comments can be sent to @mustard_insights across all social media platforms.