- Published: 2nd Apr, 2022

The Financial Technology (Fintech) landscape in Africa continues to witness positive growth in recent years, evidenced by the inflow of foreign investment or funds. In 2021, according to the BigDeal research, start-up's ecosystem in Africa recorded tremendous growth (2.5x YoY). Fintech continued to reign supreme, claiming US$2.3b in Africa out of US$4.3 billion attracted by startups for the period.

The 'Big Four' in the African start-up ecosystem are Nigeria, South Africa, Kenya and Egypt, with Fintech, Agritech, Healthtech and EdTech being the leading sectors. Giving the growth record of fintechs in Africa, it is easy to see why investors are in a frenzy to invest in the sector. Hence, this has placed Africa’s fintech firmly in the spotlight, coupled by the widespread adoption and export of the fintech solutions outside the shores of Africa.

Is Fintech funding enough to solve FDI paradox in Africa?

Most of the investment inflows into Africa have mostly been made possible by foreign investors’ keen interest in Africa’s vibrant financial technology sector. Interestingly, such foreign investments have led to the growth of fintech companies like Flutterwave and Opay, currently valued at over 1 billion USD.

Africa is the world’s largest adopter of mobile money transfer systems accounting for approximately 70% of global mobile money transactions and two-thirds of the world’s mobile money transaction volume by value. Digital payments and other integration of tech and financial services have led the way in fintech investments in Africa over the past decade.

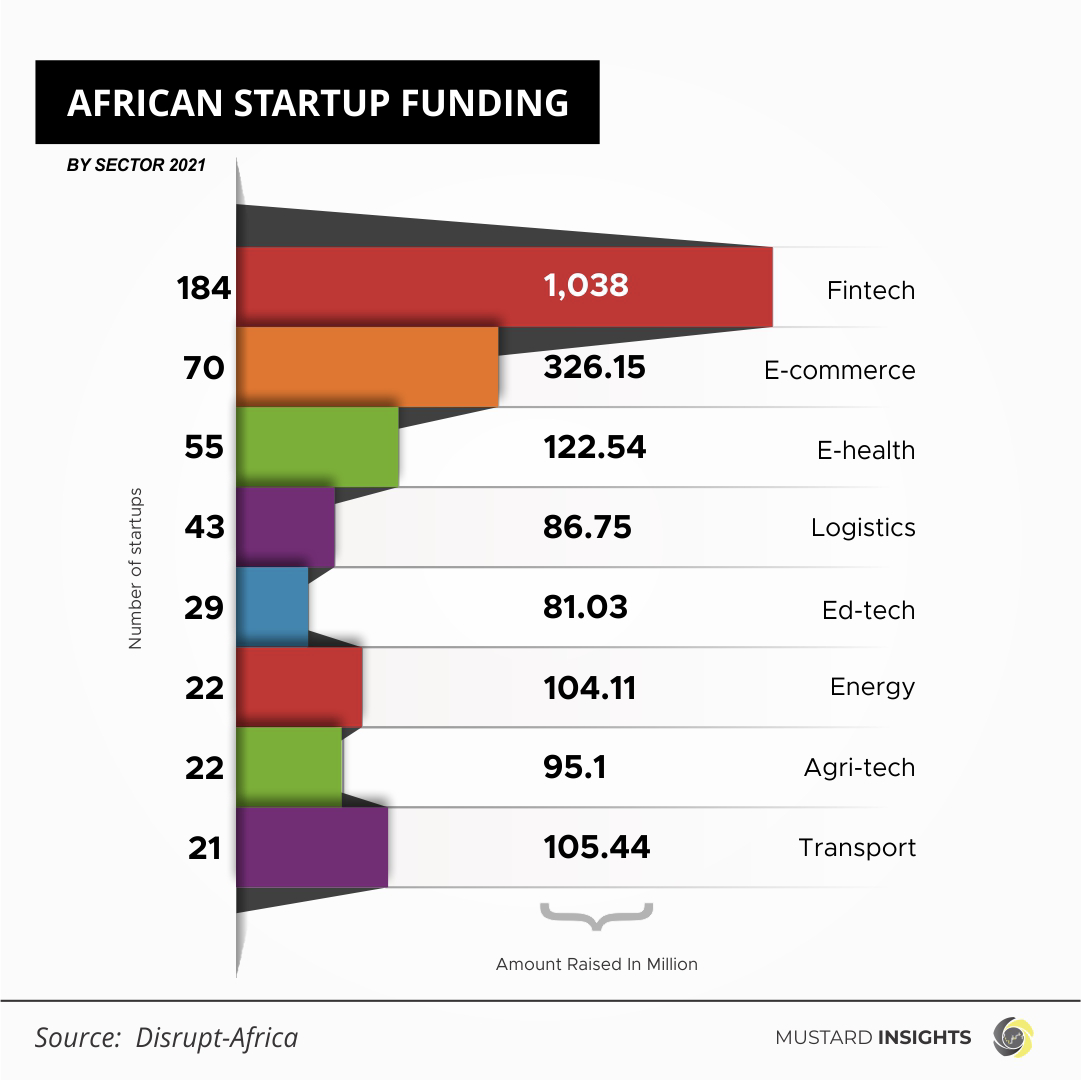

The relentless growth of Africa’s fintech space should not, however, detract from positive developments elsewhere. According to analysis provided by Disrupt-Africa, non-fintech startups still raised over 1 billion USD between them in 2021. Notably, many sectors more than doubled the amount of funding from the previous year.

Data compiled by Disrupt-Africa shows that e-commerce and retail-tech sector saw total funding rise by 271.5% to over 326 million USD, investment in the transportation sector rose by 102.4% to 105.4 million USD. Other sectors like logistics secured 86.7 million USD, an increase of 134%, and ed-tech investment raised 81 million USD, a massive jump of 516.3%.

While foreign investment inflows into the fintech space partly underscore growing momentum in the Africa’s investment landscape, the continent certainly needs more investments to stimulate improved growth across sectors. Foreign Direct Investment (FDI) is beneficial to the host countries because it helps to enhance firm productivity and integrate domestic firms into global markets. Unfortunately, low foreign investment has held back Africa’s participation in global value chains.

According to the World Investment Report (2021), FDI flows to Africa declined by 16 per cent in 2020 to $40 billion – a level last seen 15 years ago. Egypt remained the largest recipient in the region.

In 2000, Africa only attracted 1% of global FDI inflows, and raised it to 4% by 2020. In contrast, developing countries in the Asia region increased their global FDI share from 10 to 54%. Hence, compared to other regions, Africa’s FDI is abysmally low.

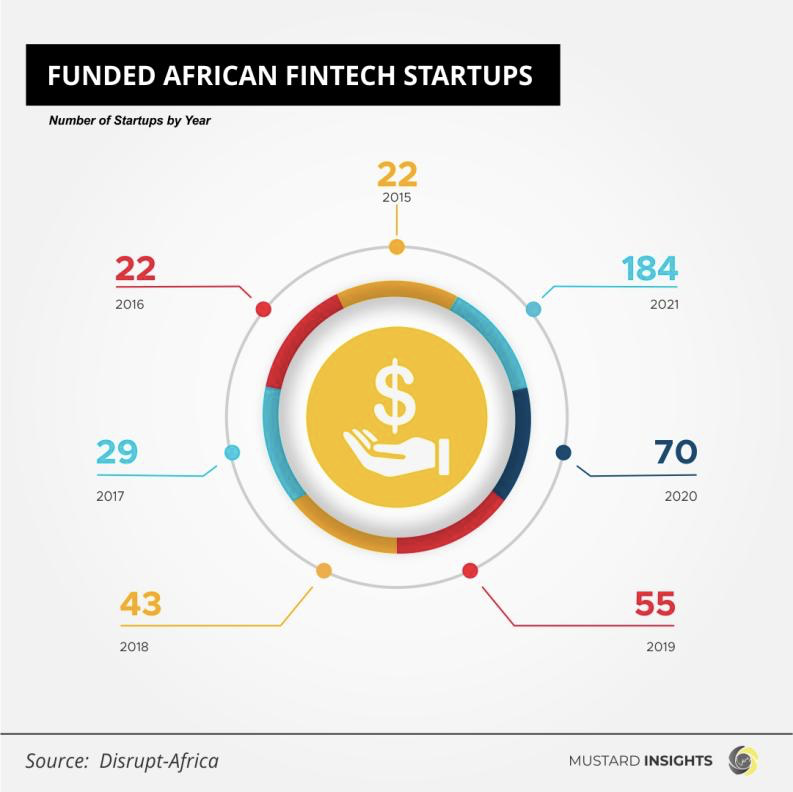

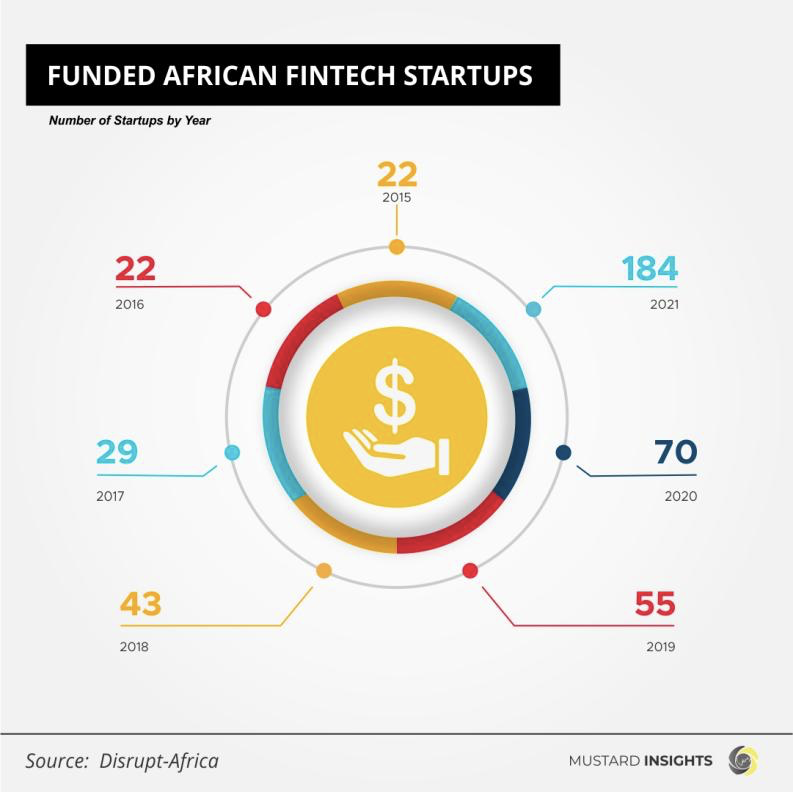

Year after year, the number of fintechs in the continent have risen astronomically and continues to influence foreign investors and their investments. Although it does appear that startups are major channel for foreign investment inflows into Africa with foreign investors willingly ignoring other sectors of the African economy, the reality tells another story.

How can Africa unlock more access to Foreign Investment?

Africa is a goldmine seeking to be tapped with its vast business opportunities and resources available to investors looking to increase and/or diversify their portfolio. With increasing FDI inflow into Africa for business growth, the economic growth and development of Africa can be assured, both in the short-term and long-term. Hence, key strategies that can be implemented to ensure more FDI inflow to Africa include:

Adequate infrastructure

The creation of adequate infrastructure within the African terrain can attract quality investors to the continent. These include transport facilities such as airports and ports, adequate and reliable supply of energy, skilled workforce as well as facilities that encourage vocational training of specialised workers. These provisions should be provided and made suitable to the investors that are being attracted.

Create an Open market to encourage FDI inflows

Africa can attract significant FDI inflows through several avenues targeted at securing larger FDIs into the continent. These include reducing restrictions on FDIs, creating an open market that leverage transparency and favourable conditions to encourage ease of doing business, flexible labour markets and protection of intellectual property rights.

Set up an Innovative Investment Promotion Agency

Establishing an IPA can help Africa target suitable foreign investors and serve as an intermediary between them (foreign investors) and the African economy. The IPA set up will perform two distinct, yet interdependent roles; provide necessary requirements to investors keen on investing in Africa, and act as a catalyst for the provision of quality and adequate infrastructure, including readily available access to skilled workers, engineers and managers geared towards attracting such investors. In addition, it should engage in after-investment care and provide feedback on satisfied investors and the potentials for reinvestments in the continent.

Encourage first-time foreign direct investors

The African continent can open its doors to allow identified foreign firms which are not already part of an extensive network of subsidiaries but ready for linkages with domestic suppliers have access to them.

Addressing Insecurity

Addressing the issue of insecurity can attract more FDI inflow to Africa with foreign investors assured of their safe investments in Africa. This will increase the rate of reinvestments, expansion of the African economy and ease of doing business in the continent.

Leveraging the AfCFTA

Eliminating trade barriers will help to attract FDI inflow to Africa with the AfCFTA provisions making Africa attractive to foreign investors, thereby increasing effective market size. Investment provisions such as investment facilitation and protection can be additional incentives to investors.

Some Takeaways

Recent events globally have created an opportunity to reframe the minds of investors and their engagements in investing Africa. Admittedly, it is pertinent a conducive business climate is created to attract more FDI to the continent, building capacity on FDI promotion and facilitation will go a long way to achieve this considering more opportunities abound now more than ever for sustainable development through private investment while also yielding significant ROI to investors.