An underlying issue with port usage might be capacity and equipment: some ports are just not big enough for some vessels; neither do they possess the facilities. The port at Apapa possesses docking and storage equipment unlike any other in the country.

On 23 March 2021, one of the world’s largest container ships was making a routine crossing of the Suez Canal when it got caught in a sandstorm. The Ever Given ran aground and spun sideways, blocking the canal and bringing one of the world’s most important waterways to a halt. It will take until 29 March before the ship could be refloated, moved, and the canal opened for transit. Lloyd’s List, a maritime intelligence company, estimated that every day the canal was out of operation had cost $9 billion dollars in halted trade. More importantly, tankers delivering things like food, medicine, and fuel all ground to a halt. Prices of everything from oil to semiconductors were affected. One question stuck with this writer all through the ordeal: what if ships couldn’t get into Lagos for a week?

This shouldn’t be a problem, right? After all, the Nigerian Ports Authority lists the six ports it operates as thus: Lagos Port; Tin-Can Port; Delta Port; Rivers Port; Onne Port, and; Calabar Port. If the ships can’t dock in Lagos or Tin-Can, they could just be re-routed to any of the other ports. This is a theory; it is rarely found in actual practice.

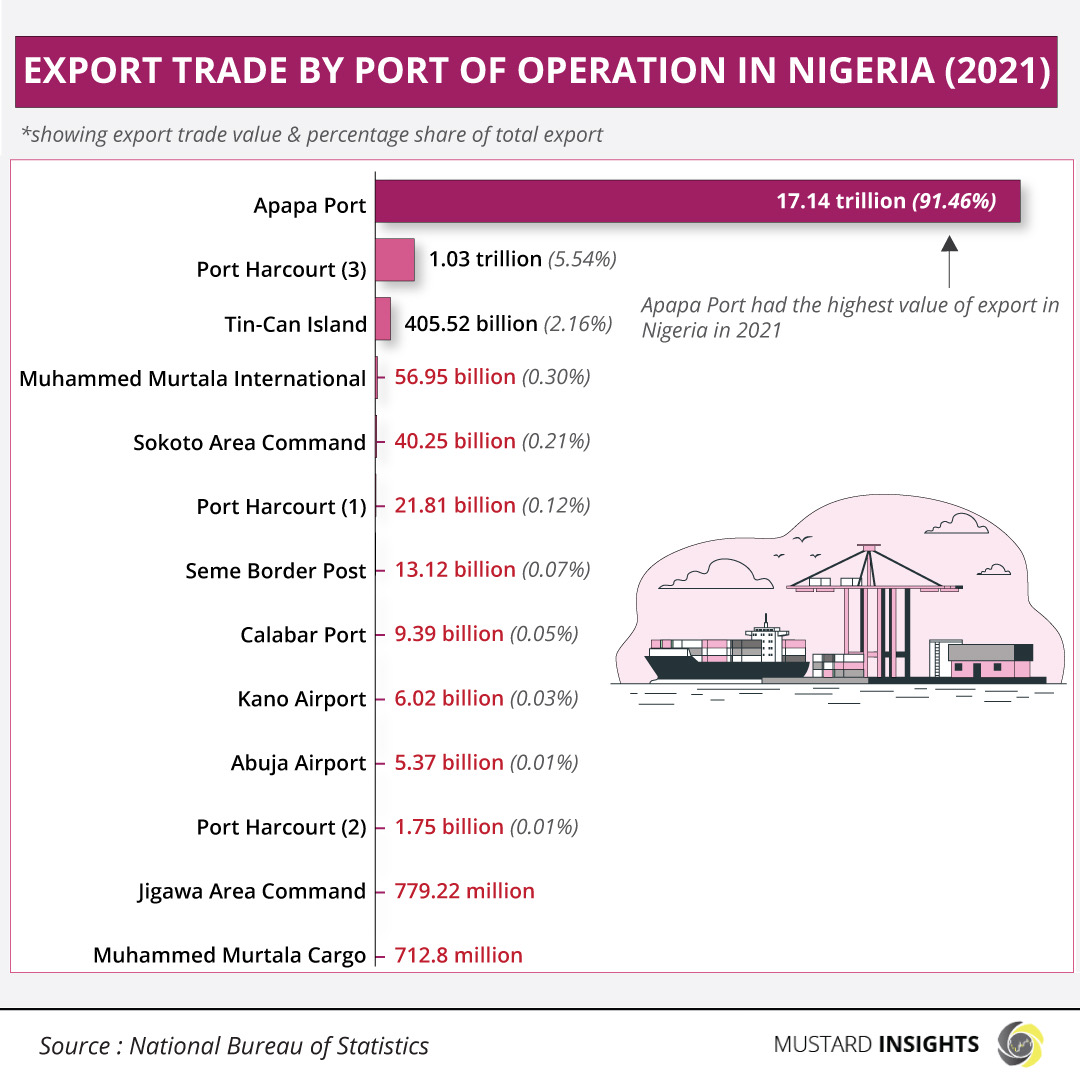

According to trade data from the National Bureau of Statistics and calculations carried out by Mustard Insights, 91.46% of all exports from Nigeria in 2021 went through the Apapa Port in Lagos. The next closest was the Onne Port in Port Harcourt accounting for 5.54%, with Tin-Can Port, also in Lagos, processing 2.16%.

Two ports which are right next to each other in the same city processing nearly 94% of all exports depict intense centralization. The Ever Given is not large enough to block the near-600 metre-wide Tarkwa Bay-Ikoyi inlet, thankfully. However, one must ask why a country with so much ocean coastline and four other ports in three different states runs all exports through what is essentially one location. The issue shows up again in import trade, albeit to a lesser extent.

Per the 2021 numbers, Apapa and Tin-Can accounted for 54.33% and 22.27% of all imports. That’s 76.6% of all imports coming into the country via a 600 meter-wide waterway. Looking past the seaports, another 4.82% comes in via the Murtala Muhammed Airport, along with 1.58% passing through the Kirikiri Lighter Terminal Command, both also in Lagos. Thus 83% of the nation’s imports come in through Lagos State.

The centralization in Nigeria’s sea trade hurts the economy. It is not uncommon to hear of congestion at the Apapa and Tin-Can ports. Cargo ships can find themselves waiting to dock for as long as a month off the Lagos coast. For context, that is similar to the amount of time it takes ships to travel from China to Lagos. Per investigation from the Financial Times, congestion might force importers to patronize fleet operators, paying high sums, as much as $4,000 per 20ft container, to move cargo to the mainland. Together, all these cost the country as much as $55 million a day via lost economic activity. Lomé in Togo, notably capable of handling Panamax vessels, is now the busiest seaport in the region, and cargo headed for Nigeria is ever-increasingly offloaded there.

Nigeria cannot fully maximize its shipping potential if it continues to centralize its trade in such a singular and small location. Expanding trade to other states boosts economic development in those states, creating more jobs and growth hubs. It gives investors and companies’ options with ample availability of land and labor in other parts of the country. It does seem that the country doesn’t realize this, seeing as Lekki is getting an international airport to go with the new seaport. However you look at it, Lagos’s gain is Nigeria’s loss, and this shows up in various facets of the economy.

In the first half of 2022, 69.9% of all capital imported into Nigeria went to Lagos State, accounting for $2.17 billion of the $3.11 billion total foreign capital coming into the country. This is unsurprising: as trade goes, so will capital. When capital accumulates in a region, industry and human resources will too. This creates a spiral; industry comes to the state because of the labor availability, and labor from other parts of the country in turn flock to the state for the jobs industry provide.

This creates a scenario where one state receives nearly 70% of all foreign capital investment while 29 states combined receive nothing. Lagos’s growth is coming at the direct expense of other states. The inequality this creates cannot be healthy for the national economy, as large parts of the country are not performing economically. It’s not healthy for Lagos either.

The population of Lagos has exploded to the detriment of other parts of the country, which often lose their most capable workforce to the burgeoning city. Lagos itself can be rather nightmarish to live in, the effects of the country’s smallest state by land mass being its most populated. The Economist ranked the city as the second worst to live in across the world, only behind Syria’s Damascus. Unsurprising, given the population density, that the city’s residents spend hours in traffic every day and live in tiny, overpriced apartments. Public transport infrastructure is poor, and air quality is dismal in some areas.

It remains to be seen if the government sees this as an issue and what will be done about it. The country can’t hope to develop holistically when its growth and trade is so heavily concentrated in a single city.

Thoughts?

We won't share your email address. All fields are required.