In 2021, Africa was responsible for 762 million tons of global seaborne trade. This number accounted for a mere 6.9% of all global seaborne trade, according to data from the United Nations Conference on Trade and Development. This is a paltry sum, especially as the continent is technically an island.

In 2021, Africa was responsible for 762 million tons of global seaborne trade. This number accounted for a mere 6.9% of all global seaborne trade, according to data from the United Nations Conference on Trade and Development. This is a paltry sum, especially as the continent is technically an island.

Africa is bordered on the east by the Indian Ocean; the west by the Atlantic; the south by the South Atlantic; the north by the Mediterranean Sea, and in a small pocket in the north-east by the large Red Sea. All of these are thriving waterways in the global sea trade. It is clear that the continent is underperforming and not particularly pulling its weight.

A major cause for this is the absence, or inadequacy, of appropriate seaports. This is by no means the only reason. Insecurity is a major factor, as the eastern coast of the continent has had numerous issues with piracy affect trade in ports from Mogadishu in Somalia to Mombasa in Kenya. Countries such as Nigeria, Benin Republic, Togo, and Ghana on the western coast often experience delays, with slow docking and loading times.

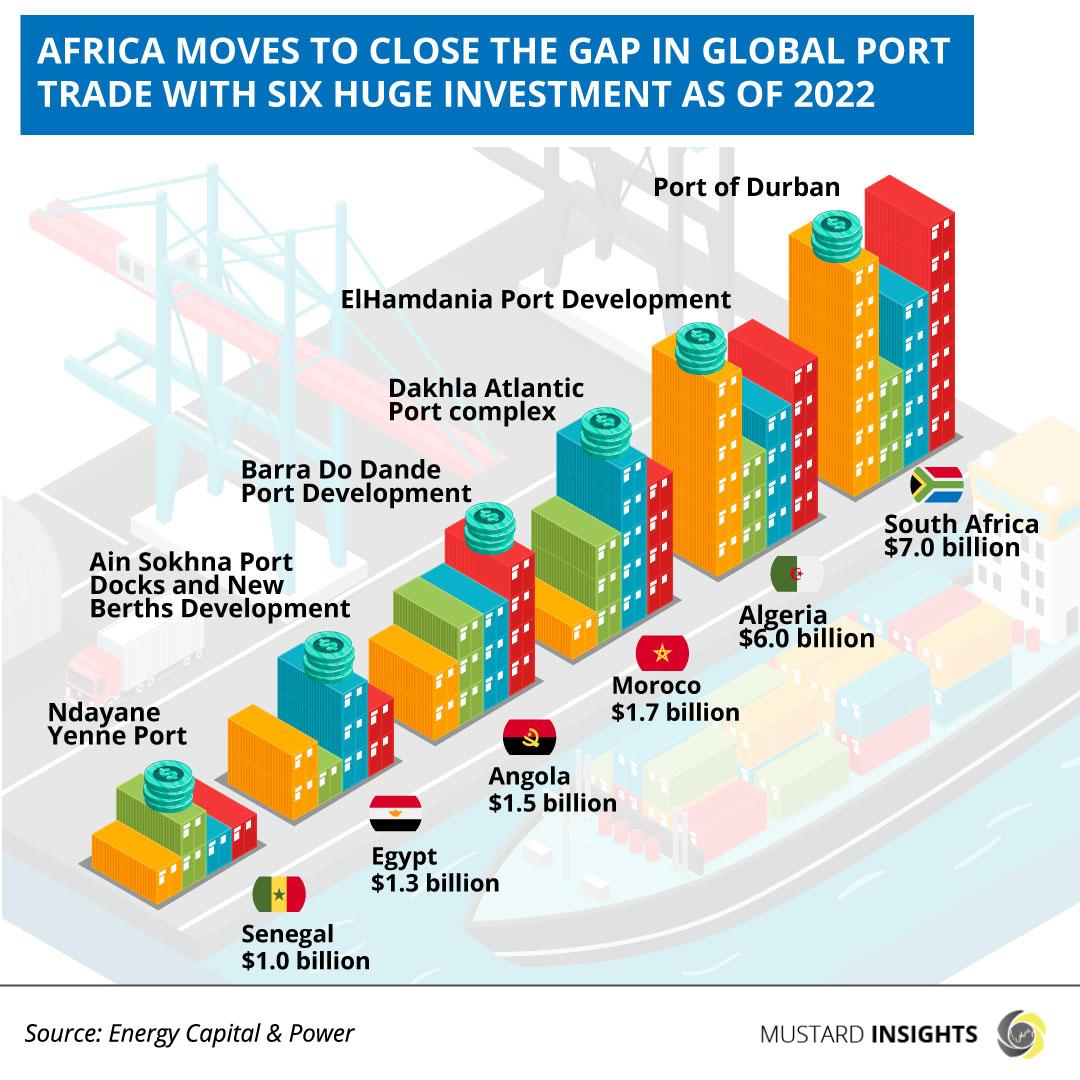

Therefore, one can still argue that the existence of appropriate ports can go a long way to boosting sea trade in the continent. Thankfully, a few countries on the continent have decided that this is an issue worth addressing and have begun to make strides in this direction. Let us identify some major port projects being carried out.

The Port of Durban – South Africa

This is already the largest and busiest seaport in Sub-Saharan Africa, handling over 31.4 million tons of cargo each year. However, South Africa’s Ministry of Public Enterprises, through the national bulk freight company Transnet, has announced plans to commit US$7 billion between 2021 and 2021 to expand the port. This will be from the present capacity of 2.9 million twenty-foot equivalent units (TEUs, the size of the average shipping container) to 11 million TEUs. Upgrades will include a deepening of the main wharf to handle large ships such as Neopanamax and Chinamax vessels, and building a new container terminal.

El Hamdania Port – Algeria

Algeria’s major seaport is presently the Port of Alger, located in the West Mediterranean Sea and opened in 1998. While this is a busy port, it presently has a maximum draught of 10 metres, which is not enough to handle the world’s larger haulers. This is not ideal when considering the country’s favorable location in the busy Mediterranean. Hence, the country’s US$6 billion commitment to the development of the El Hamdania Port in the city of Cherchell. The port is designed to be the Africa’s second deep-water port after Lekki Sea Port in Lagos, Nigeria. Upon competion, it will handle 6.5 million TEUs at a full capacity, with an annual tonnage of 25-29 million tons. Developing the project will be the China Harbour Engineering Company, who have signed a memorandum of understanding with the Algerian Ministry of Public Works and Transport.

Dakhla Atlantic Port – Morocco

Morocco already boasts the largest port in the continent, with the Tangier Med Port boasting a capacity of 9 million TEUs, the 18th largest seaport in the world. The Tangier Med is located on the Mediterranean, so the country plans to construct a port on the city of Dakhla on its Atlantic coastline. The port is intended to accommodate 2.2 million tons annually and will cost US$1.7 billion, with operations due to commence in 2028. Construction will be carried out by the Moroccan companies, SOMAGEC and Societe Generale des Travaux du Maroc.

Barra do Dande Port – Angola

This is an oil and gas specialist port being built by the Angolan oil company, Sonangol, at a cost of US$1.5 billion. The port is to be built as part of an oil and gas zone, with an accompanying ocean terminal. This is part of the country’s plan to turn Barra do Dande into its main centre for petroleum trade. The terminal will contain tanks for storage of gasoline, diesel, and liquefied petroleum gas. The Brazilian company Odebrecht will be the main contractor, under supervision fomr DAR Angola.

Ain-Sokhna Port New Berths Development – Egypt

Egypt plans to convert its Sokhna industrial port in a global petrochemical hub. The Ain-Sokhna port is presently a part of the country’s Suez Canal Economic Zone, built to facilitate between the Gulf Cooperation Council (GCC), East Africa, and Asia. The present terminal handles both liquid and dry bulk cargo. However, a US$1.3 billion project is underway to increase terminal capacity to as much as 1.8 million TEUs per annum.

Zambia’s Top Export and Import Trading Partners in 2021

Thoughts?

We won't share your email address. All fields are required.