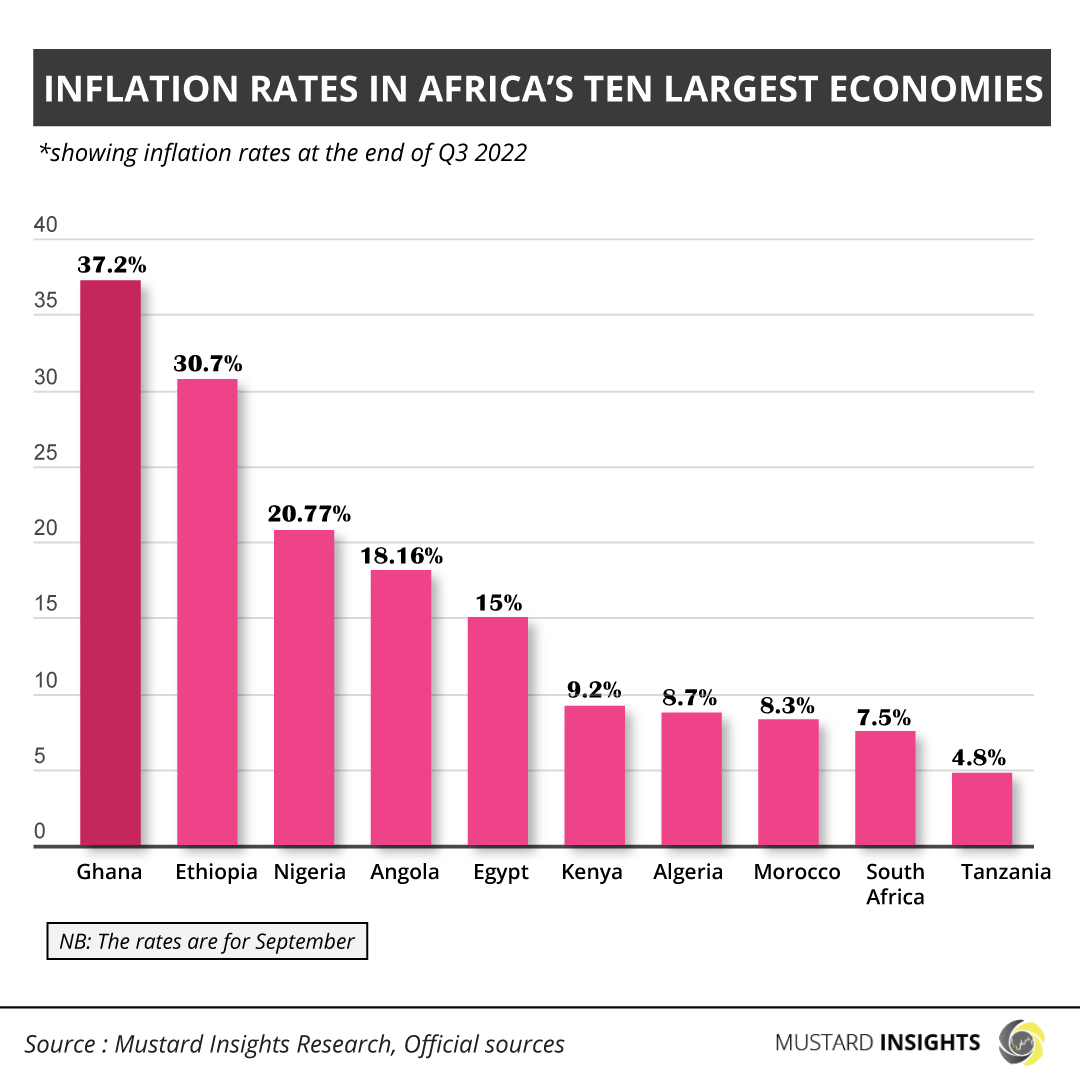

The third quarter of the year saw some of Africa’s largest economies continue to battle with crippling inflation. Countries like Nigeria, Ethiopia, Ghana, Angola, and Egypt are seemingly stuck in an endless inflationary cycle, with some yet to peak. Pretty much every top economy on the continent has seen its inflation rate grow this year in response to global inflation.

The third quarter of the year saw some of Africa’s largest economies continue to battle with crippling inflation. Countries like Nigeria, Ethiopia, Ghana, Angola, and Egypt are seemingly stuck in an endless inflationary cycle, with some yet to peak. Pretty much every top economy on the continent has seen its inflation rate grow this year in response to global inflation. However, some countries have experienced steeper spikes that others.

Inflation can simply by defined as the how rise in prices affects the purchasing power of money. It can often be seen as a fairly decent barometer of a country’s economic health. The inflation rate is seen as the year-on-year increase in the price of goods. Of the ten most prominent African economies, only one – Tanzania – has an inflation rate lower than five percent. Some countries have inflation rates as high 30%.

Worst affected countries

Ghana has experienced crippling inflation in 2022. From a figure of 12.6% at the end of 2021, the country's inflation rate stood at 37.2% at the end of September. The Bank of Ghana has responded by raising the interest rate from slightly above 14% at the start of the year to the present figure of 24.5%, as a way of reducing money supply. Despite this, food and fuel prices have continued to ascend dangerously, causing households to tighten their purse strings, small businesses to close, and demonstrators to pack the streets.

Ethiopia has battled high inflation for a long time, as the country’s inflation rate last dropped below 20% around April 2021. According to the United States Department of Agriculture report, the country’s high inflation is mostly caused by a steady devaluation of the local currency and agricultural production constraints leading to low domestic food supply and high importation. However, citizens can take solace in the fact the inflation seems to be on a downswing, with four consecutive months of decline from May’s 37.7% to September’s 30.7%.

Like Ghana, Nigeria’s inflation rate has steadily risen all year. September’s figure of 20.77% is about five percentage points from 2021’s year-end figure. The country’s food inflation rate is higher at 23.34%, with imports from the Russia-Ukraine region accounting for much of the country’s grain and fish supply. Heavy floods which affected much of the country’s agricultural regions this year have affected harvests and food inflation is expected to rise.

Quite often we wonder why the price of one commodity today changes tomorrow, and the answer is simple – its Inflation. Inflation measures the rate at which prices rise in an economy, and this may occur for a number of reasons like, demand, cost of products and services, increased money supply, devaluation, government policies and regulations amongst other factors. All this can affect the buying power of any individual of state significantly.

The positives

Despite climbing to a five-year high, Tanzania sustains the lowest inflation rate among the top economies at 4.8%. While food inflation is high at 8.30%, the country has insulated against volatility in the energy markets by instituting a temporary subsidy. This dropped fuel inflation by nearly two percentage points between August and September. Food prices have been affected by the Russia/Ukraine conflict as the country imports grain from the region, and a rainfall shortage leading to low agricultural production. Core inflation however, which excludes volatile items such as unprocessed food and energy, remains remarkably low at 3.3%.

Comments

Michael

3 years ago

Very insightful!

Thoughts?

We won't share your email address. All fields are required.

Michael Isah

3 years agoVery insightful