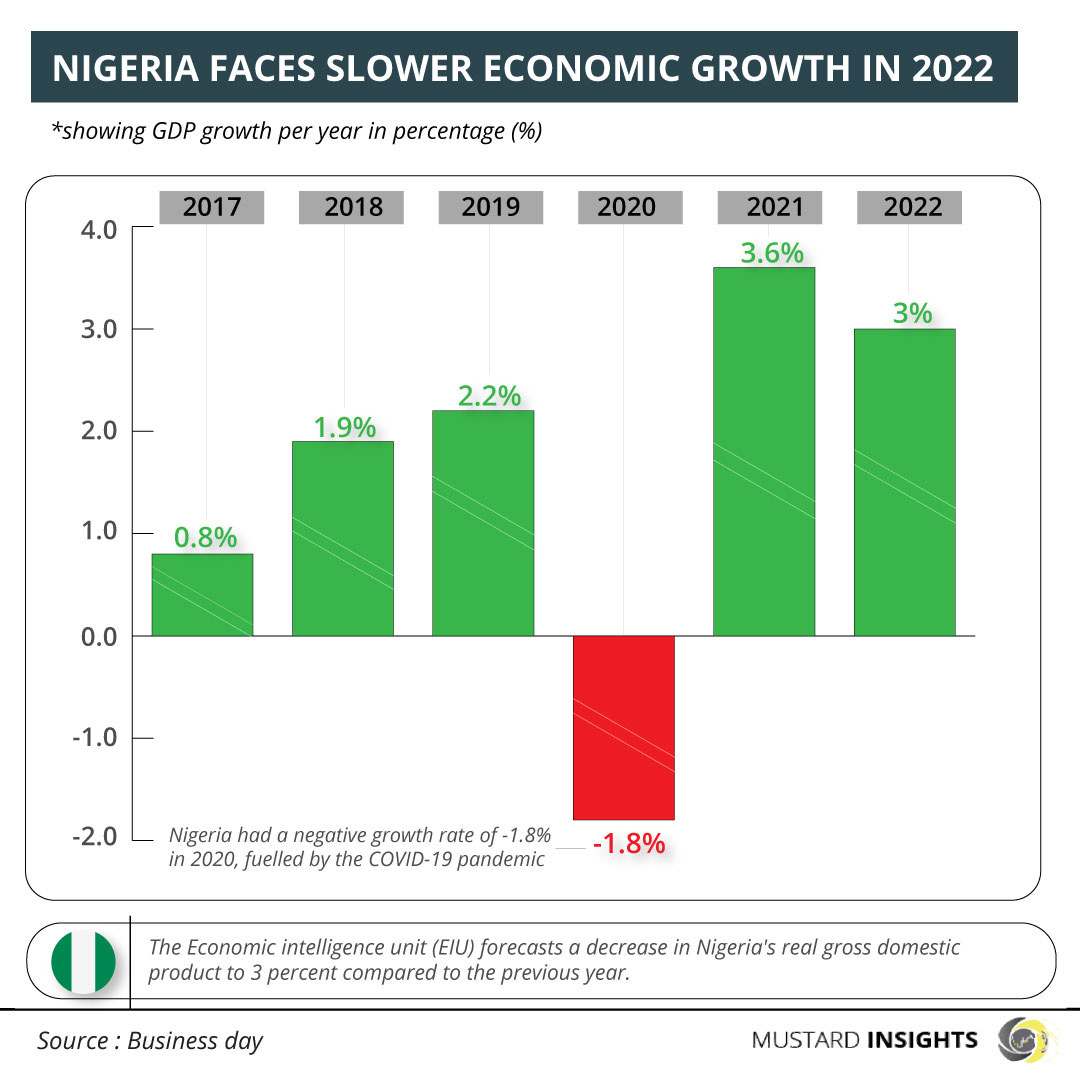

Nigeria’s real Gross Domestic Product (GDP) is forecast to decrease to 3% in 2022 compared to 3.6% in 2021, according to the Economic Intelligence Unit.

Nigeria’s economic woes have gone from bad to worse with rising diesel prices, lingering petrol scarcity in major parts of the country and worsening power supply. Diesel prices have more than doubled amid the Russia-Ukraine crisis, raising energy costs for businesses that must generate their own power to make up for the shortfall from an unreliable national grid.

Manufacturers are threatening shutdown, job cuts and price increases because of the higher energy costs while several other businesses are bracing for lower profits.

These undesirable factors put together make for a daunting outlook for Nigeria’s economic and GDP growth in 2022.

Breakdown and Key Metrics

According to the Economist Intelligence Unit (EIU), Nigeria is likely to record GDP growth of 3% in 2022. From an initial forecast of 3.3% in February, the EIU now expects real GDP growth to decline to 3% in 2022 from 3.6% in 2021.

The EIU’s projection, though at par with the average estimate from a Business Day survey in March, appears optimistic. The International Monetary Fund (IMF) and the World Bank expect Nigeria’s economy to grow by 2.7% and 2.5% respectively in 2022.

However, a faster growth is possible in 2023 and 2024, based on higher real exports and reduced imports. Growth rate will slow down in 2025 and 2026 as global oil prices decline and fundamentals deteriorate.

In 2021, Nigeria’s economy expanded by 3.6%, the fastest growth rate ever in seven years. This is largely because of the low base effect from the COVID-19- induced recession the previous year. Nigeria had a negative growth rate of -1.8% in 2020, fueled by the COVID-19 pandemic.

Other Insight

Forecasts expect Nigeria's economy to grow by 4.2% in 2022, but the country’s GDP growth will suffer a 0.6% decline from 2021’s high of 3.6%. This will bring about a slower economic growth in Nigeria in 2022.

The slowdown will stem from continued erosion of household purchasing power by inflation, monetary tightening by the Central Bank of Nigeria (CBN) and power-supply issues, with low water levels and inadequate gas supply constraining production.

According to the CBN, available data on key macroeconomic indicators suggest a likely subdued output growth for the economy for most of 2022. The expected slowed growth hinges on the dampening impact of rising energy prices in the domestic economy, tightening external financial conditions and the persistence of legacy security and infrastructural problems on growth.

Although interest rates remain unchanged, pressure continues to mount on Nigeria to hike rates in line with rising global interest rates. Hence, the EIU expects the CBN to increase rates by 100 basis points over 2022, taking it to 12.5%.

Nigeria’s economic growth is, however, expected to pick up to 3.9% in 2023 amid changing economic fortunes. This will be a welcome development as a mega-refinery, the Dangote Refinery, should come on-stream in 2022 and ramp up in 2023, further boosting net oil exports. Some output from the refinery will be for regional markets with local production replacing fuel imports from 2023 onward.

Takeaway

With a shrinking GDP size, relative to 2014, Nigeria’s economic struggles will be clear and the pain of its over 200 million people who are growing poorer and will have to contend with the world’s second highest unemployment rate and Africa’s sixth-highest inflation rate.

Nigeria’s Real GDP Growth Trend as at Q3 2024

Thoughts?

We won't share your email address. All fields are required.