A Review of Nigeria’s 2023 National Budget, and the Debt/Development Tug-of-War

The budget assumes an average real GDP growth rate of 3.75% in 2023. The last five years have seen Nigeria post real GDP growth rates of 1.90%, 2.26%, -1.94%, 3.38%, and 2.97% respectively. With these figures, it is difficult to see how the government has arrived at their assumed figure.

The 2023 budget has been eagerly anticipated by many for various reasons. Firstly, it is the last to be passed by the Buhari administration and will be inherited by the incoming government. This creates a certain expectance of sensitivity; Nigeria is not a country where incoming administration and cabinets like to continue the policies of the outgoing, often opting for a fresh start. Hence, a budget which must be inherited must be intricately tailored.

Secondly, the budget has been prepared based on fiscal assumptions such as oil price and the naira-to-dollar exchange rate, both of which are highly volatile. Other assumptions include the growth rate of the gross domestic product (GDP) and the rate of inflation, the first of which can be termed optimistic at best. It is here that we will begin our examination of the budget.

Budget assumptions

The budget assumes an average real GDP growth rate of 3.75% in 2023. The last five years have seen Nigeria post real GDP growth rates of 1.90%, 2.26%, -1.94%, 3.38%, and 2.97%[1] respectively. With these figures, it is difficult to see how the government has arrived at their assumed figure. There is also the issue of the 17.16% inflation rate average expected in 2023. Considering that December and the last quarter of 2022 saw a slight contraction in the nationwide inflation rate, it could be understood that the government expects inflation to fall further.

The oil price benchmark is set at US$75 per barrel of Brent crude, a cautious figure which accounts for the volatility that often characterizes the oil market. However, the benchmark naira-to-dollar exchange rate, set at NGN435.57/US$1, might serve as contentious. After all, different administrations tend to have different approaches to fiscal policy. Also, there still exists a large disparity between the official NAFEX rate, and the parallel rate. This difference has often led to the forex shortages, and higher production costs for local businessmen. This phenomenon inevitably leads to higher prices of goods, a trigger for inflation.

How much does the government aim to spend?

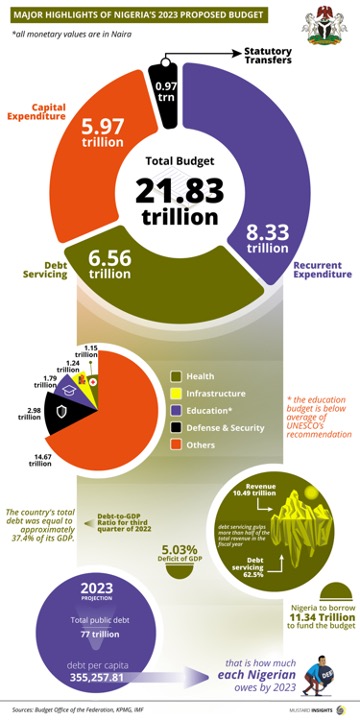

The total budget expenditure is NGN21.83 trillion, 20% higher than that of 2022. The bulk of this, up to 38%, has been devoted to recurrent expenditure. This is expenditure derived wholly from revenue and includes payments for anything other than capital assets, from salary payments to interests and transfers.

The major beneficiary of recurrent expenditure is the personnel costs of Ministries, Departments, and Agencies (MDAs), along with the personnel costs of Government-Owned Enterprises (GOEs). This is unsurprising: Nigeria is similar to most countries in that the government remains the largest employer of labor.

Capital expenditure, which involves government spending on acquisition or development of fixed capital assets, land, stock, or intangible assets, make up 30% of the budget. The bulk of this will go into four major areas:

- Capital supplementation, which involves the section of the budget appropriated by the government for activities which are carried over from the previous fiscal year where the budget proved to be insufficient;

- MDA capital expenditure, this, which is the highest expenditure allocation, is the part of the government expenditure which is to be allocated to ministries, departments, and agencies;

- GOE expenditure, which is the budget expenditure set aside for Government-Owned Enterprises (GOEs), expenditure which may likely go towards expansion of the GOEs or asset acquisition, and;

- Multilateral/Bilateral project-tied loans, through which the government may make funds available for loans while building a credit profile.

Debt servicing will take up 29% of the 2023 budget, a major 71% upgrade from 2022’s allocation, including a N1.2 trillion payment to “Ways and Means”. That term may be unfamiliar to most readers, so we will attempt to explain it as briefly as possible. When the government finds itself in a situation of an unplanned budget deficit, it is not unusual for it to turn to its central bank, which is essentially an independent entity. Hence, the Central Bank of Nigeria provides financing for the government through its Ways and Means in form of loans.

The government also possesses both external debts, in form of multilateral and bilateral loans, as well as commercial loans and promissory notes, and domestic debts. The latter are often accrued through the issuing of debt instruments to the public such as government and savings bonds, both treasury bills and bonds, and domestic promissory notes. The government services these debts through both capital and interest payments, in accordance to the loan agreements.

Can the government’s revenues fund the budget?

The short answer here is “no”.

The budget document presented by the Ministry of Finance is quite clear on this. The government estimates 2023 total revenues to sum up to N11.05 trillion. This will be majorly sourced from Oil Revenue (20.2%), revenue from GOEs (35.07%), non-oil taxes (22.03%), and independent government revenue such as sectoral taxes (28.69%). The issue here is that this figure falls far below the projected expenditure of N21.83 trillion, eventually creating a considerable budget deficit.

The government intends to make up for this budget deficit by borrowing, with the bulk of lending coming internally through the issuance of debt instruments such as bonds, promissory notes, and bills. There will also be external lending, through multilateral and bilateral lending from countries such as China, India, and Japan, as well as loan drawdowns from the IMF, World Bank Group, and the African Development Bank Group.

Education, Health and Infrastructure

8.2%, 5.3%, and 5,7% of the budget has been allocated to the Education, Health, and Infrastructure sectors respectively. The Education sector has been allocated the total sum of N1.79 trillion, spilt into:

- N973.83 billion for the Ministry of Education and its dependent agencies;

- N103.29 billion provisioned for Universal Basic Education Commission (UBEC);

- N248.27 billion to be transferred to the Tertiary Education Trust Fund, and;

- N470 billion of the Tertiary Education Revitalisation and Salary Enhancement.

While the 2023 allocation for Education is the highest share of the budget earmarked for the sector since 2019 and the second highest of this administration, it continues to fall short. The United Nations Educational Scientific and Cultural Organizations (UNESCO) has since 2015 recommended that its member states and especially developing countries spend 4 to 6% of GDP or 15 to 20% of budget expenditure on education.

Nigeria’s education budget has always failed to satisfy even the lower limits of this criteria. In August 2022, the United Nations’ Resident and Humanitarian Coordinator, Mathias Schmale, stated that Nigeria needed to raise its education spending up to 20% of the budget. He stated that this was necessary if Nigeria aimed to achieve universal, basic and equitable basic education for all children by 2030, compared to where the country presently stands.

The same can be said for Health, where Nigeria has not come close to meeting a 15% Health allocation agreed to by African Union countries in 2001. While the 5.3% of the budget allocated surpasses 4.7% allocated in 2022, it still falls well below the 12 to 15% allocated by countries such as Rwanda and South Africa. 2023, however, marks the first time the health budget has crossed the N1 trillion threshold, with a total of N1.15 trillion set aside for the sector. N1.02 trillion has been provisioned for the Ministry of Health and its agencies, N76.99 billion for Immunization funding, and N51.64 billion to be transferred to the Basic Healthcare Provision Fund (BHCPF), 1% of the Consolidated Revenue fund.

The fact is that the allocations to these sectors show the relatively paltry commitment of the country to these sectors. Unsurprisingly, the National Bureau of Statistics ranked Time to Healthcare as the nation’s leading cause of multidimensional poverty; school attendance was third. Other poverty indicators include availability of cooking fuel and housing materials, both a signifier of Nigeria’s infrastructure deficit.

The infrastructure sector has been allocated a 5.7% share of the budget, good for a sum of N1.24 trillion. While this may seem sufficient, it begins to pale when put in context. The World Bank has ranked Nigeria 132nd out of the 137 countries it surveyed with respect to infrastructure, stating that Nigeria needs to spend as much as 4% of its GDP if it intends to close its infrastructure gap.

Debt stifling development

This makes clear the manner in which Nigeria’s national budget serves as a descriptor of the major issues facing the country. Constant terrorist attacks and a stifling debt profile means that the country allocates 13.4% and 28.9% of its budget to Defense & Security and Debt Servicing respectively. This shows how badly the country is struggling to stay afloat; more funds are allocated to survival and preservation-based sectors such as security and debt servicing instead of national building sectors like health, education, and infrastructure.

In a way, the 2023 budget has an overarching theme of debt. Apart from the already-existing debt profile, which nearly 30% of the budget will go into servicing, only about 51% of the budget’s financing will come from expected revenue. This indicates that Nigeria will likely borrow more in 2023, deepening the debt trap the country finds itself in. Money is finite, and in some semblance of a zero-sum game, funds allocated to one sector are funds another sector is deprived of.

While some may say that it is prudent for the country to prioritize escaping debt, this has the effect of stalling development. The only solution one can see is that the country finds a way to raise its revenue. However, Nigeria presently lacks the infrastructure needed to achieve that, paired with an ailing education sector and increasing loss of human capital through a significant brain drain to the West.

The “development-or-debt" conundrum will for years remain one Nigeria’s budget will have to face. Debt Servicing allocation surpasses Education, Health, and Infrastructure’s put together. The latter three sectors are arguably the most important sectors needed for a nation’s growth and development. Hence, through its 2023 budget, it becomes clear what path the government has chosen.

[1] Average of Q1, Q2, and Q3 real GDP growth rates, with Q4 as yet unannounced.

Some Food Items With The Most Price Increase In One Year

Africa's Cocoa Industry 2022

Thoughts?

We won't share your email address. All fields are required.