- Published: 30th Apr, 2022

“No matter what political reasons are given for war, the underlying reason is always economic” - A J P Taylor

The ongoing conflict between Russia and Ukraine has a multifaceted impact on the global economy. Broadly, the global economy may be impacted via three main channels: financial sanctions, commodities prices and supply-chain disruptions. According to The Independent UK, increasing financial sanctions, commodity prices and supply-chain disruption emanating from the war will cost global economies as high as 400 billion USD. Therefore, major economies are starting to brace themselves to mitigate the shocks emanating from the ongoing Russia-Ukraine conflict.

Following sanctions imposed on Russia, energy producers have been placed on high alert for a possible hike in energy prices. Russia is a major oil exporter producing 17% of the world’s natural gas and 12% of the world’s oil. Also, gas supplies from Russia accounts for 40% of Europe’s natural gas consumption with both Europe and the US depending on Russia’s oil.

In terms of food and other agricultural products, Russia and Ukraine are major producers of wheat (more than a quarter of global exports) and sunflower seed oil (Ukraine supplies half of world demand). According to the International Trade Centre, Ukraine produces 18% of the world’s sunflower seed, safflower and cotton-seed oil; 8% of the world’s wheat and meslin (a mixture of wheat and rye); 12% of barley; and 13% of the world’s corn.

How does this affect Africa?

According to The Cable News Network, Russia’s flourishing trade with Africa in recent years is valued at 14 billion USD annually and imports from Africa is valued at around 5 billion USD per year. As the Russia-Ukraine conflict persists, analysts worry these could erode and signal a severe disruption in Africa’s food conditions.

Nigeria, Egypt, South Africa, Algeria and Kenya are major importers of Russia’s agricultural products, and are at risk of spikes in food prices if the war continues and trade is disrupted.

Rising Oil Prices and the Nigerian Economy

Global oil prices are currently above the 100 USD price for the first time since 2014 and almost at par with prices in 2008; an indication of the impact of the Russia-Ukraine tussle with an underlying pent-up global oil demand.

How can oil-producing and exporting countries like Nigeria leverage on rising oil prices?

Currently, Nigeria’s allocated budget for government spending in 2022 is a whooping N17.126 trillion despite having a fiscal deficit of N20.64 trillion. Does this mean Nigeria will be able to generate more revenue and enrich its reserves? Well, it may not seem as straightforward as it appears.

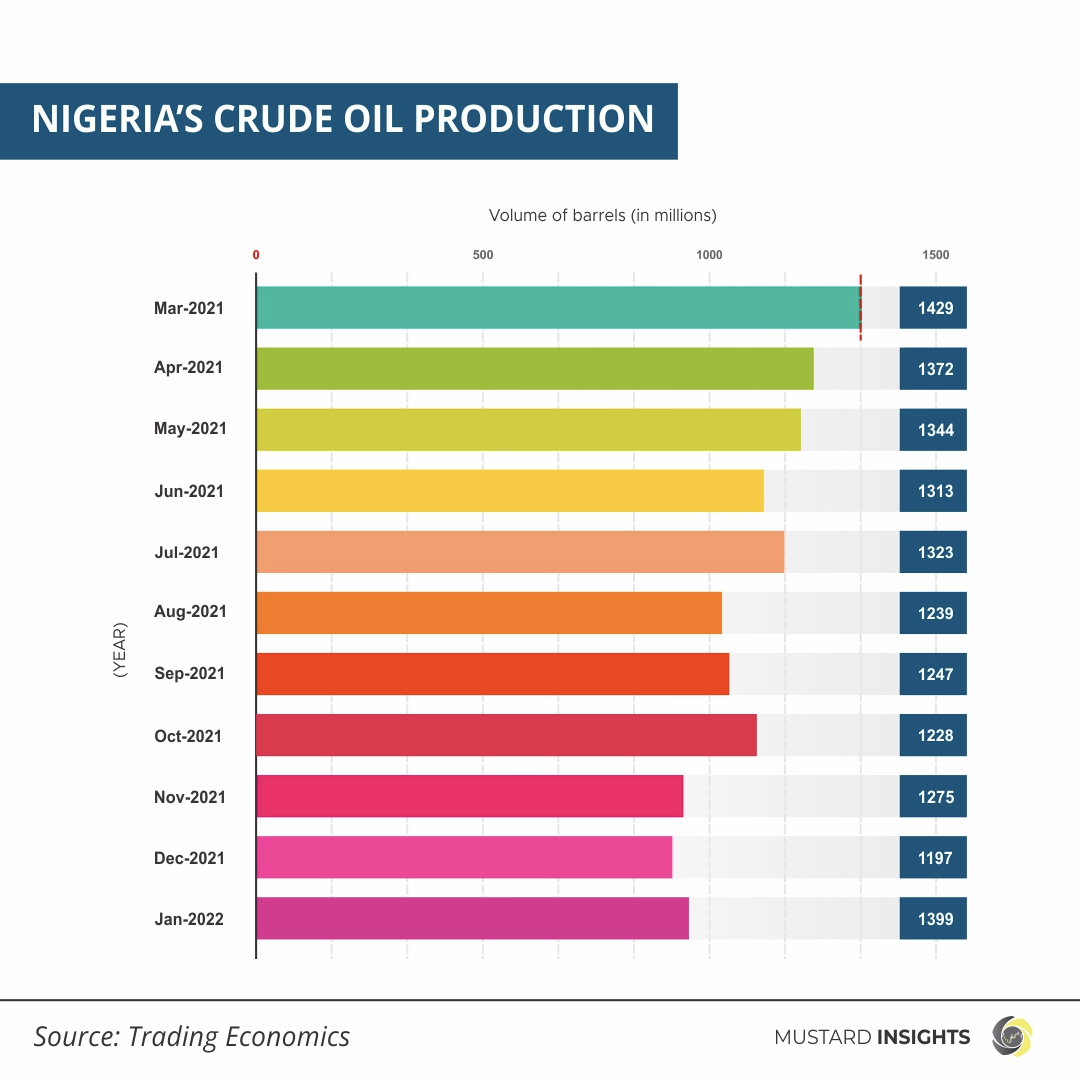

Low Crude Oil Production

Nigeria’s crude oil production output, currently at about half capacity (1.398 million barrels per day) have been hampered by persistent outages such as theft, pipeline sabotage unplanned maintenance including insecurity in the Niger Delta. These factors continue to threaten the growth and increased output of oil from the region. Oil production in the country declined from an average of 2.055 million barrels per day in the first four months of 2020 to as low as 1.200 million barrels per day in March of 2021 - a 41.6% decrease in production output.

As at January, 2022, oil production levels rose sharply to a nine-month high of 1.68 million barrels per day before being plagued by numerous operational and technical problems. These occurrences would see production levels drop below 1.5 million barrels per day and below the OPEC+ quota.

With the Nigerian oil sector in a fragile state and suffering from major production setbacks, it faces an uphill task of attracting investments from international oil companies to boost production levels to take advantage of rising oil prices.

PMS Importation & The Subsidy Quagmire

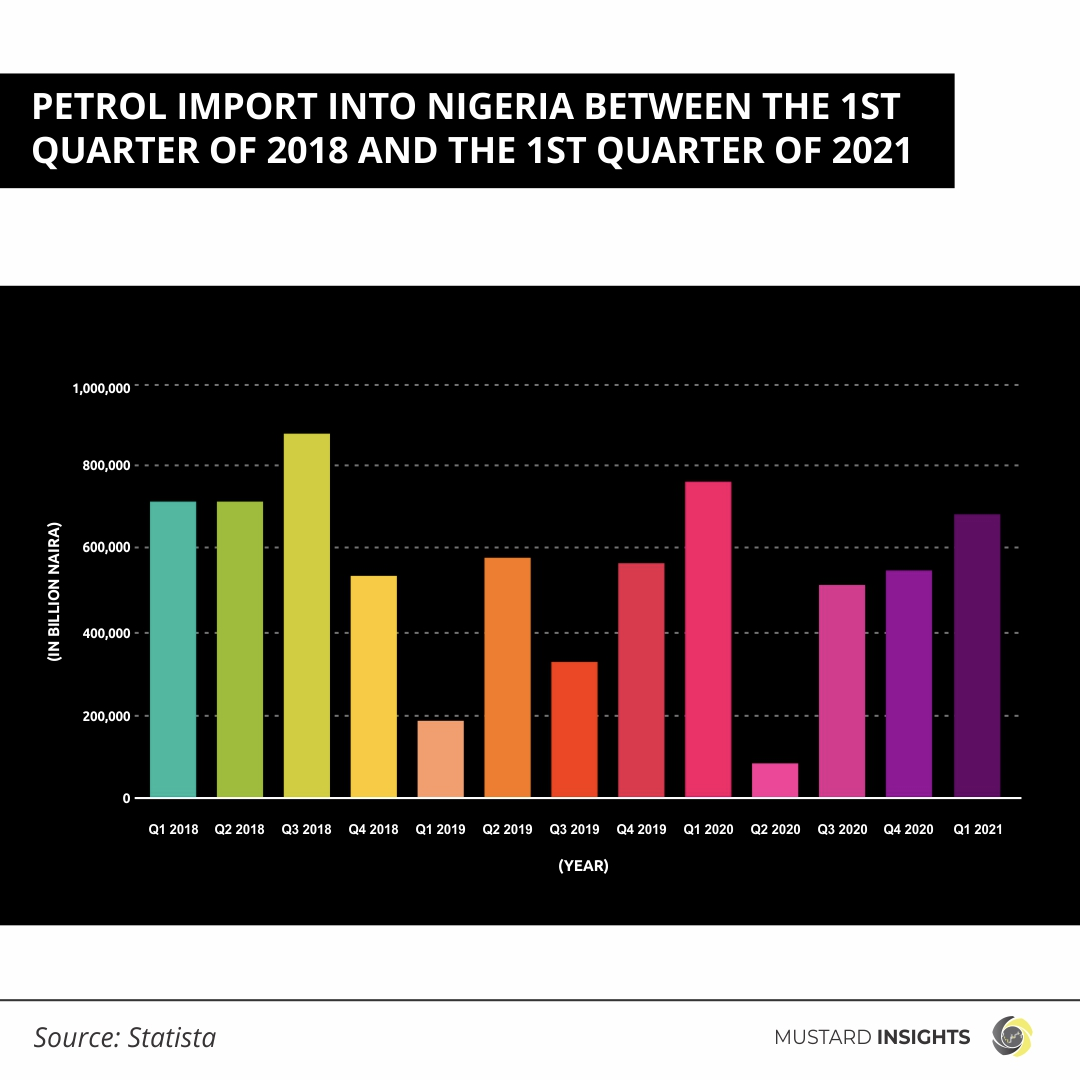

Oil is an essential commodity to the Nigerian economy, contributing about a third of the Nigeria’s gross domestic product. To a large extent, the direction of oil price impacts the national external reserves with rising cost of Nigeria’s importation of Premium Motor Spirit (PMS), or petrol.

According to a news report, the landing cost of petrol imported into Nigeria was N309.87 per litre and may rise to almost N500 per litre in recent weeks due to rising oil price. Without the fuel subsidy, cost of petrol may rise to about N333.099 per litre. With daily consumption of petrol in Nigeria pegged at about 60 million litres, the daily subsidy amounts to N10.1 billion and is projected to reach cumulatively highs of N6 trillion by the end of 2022.

A report by the Nigerian Economic Summit Group (NESG) disclosed that the federal government spent a total of N3.64 trillion on fuel subsidies between 2015 and 2021. The report also stated that the amount spent by the government on payment for petrol subsidy grew from N307 billion in 2015, to N1.77 trillion in 2021. This represents a 477% increase in seven years.

Based on these, the profits from higher crude oil prices are neutralised by the significant jump or spike in landing cost of PMS and low production capacity.

Food for Thought: How soon will Dangote refinery offer Nigeria a lifeline at reducing the cost of imports of PMS into the country?

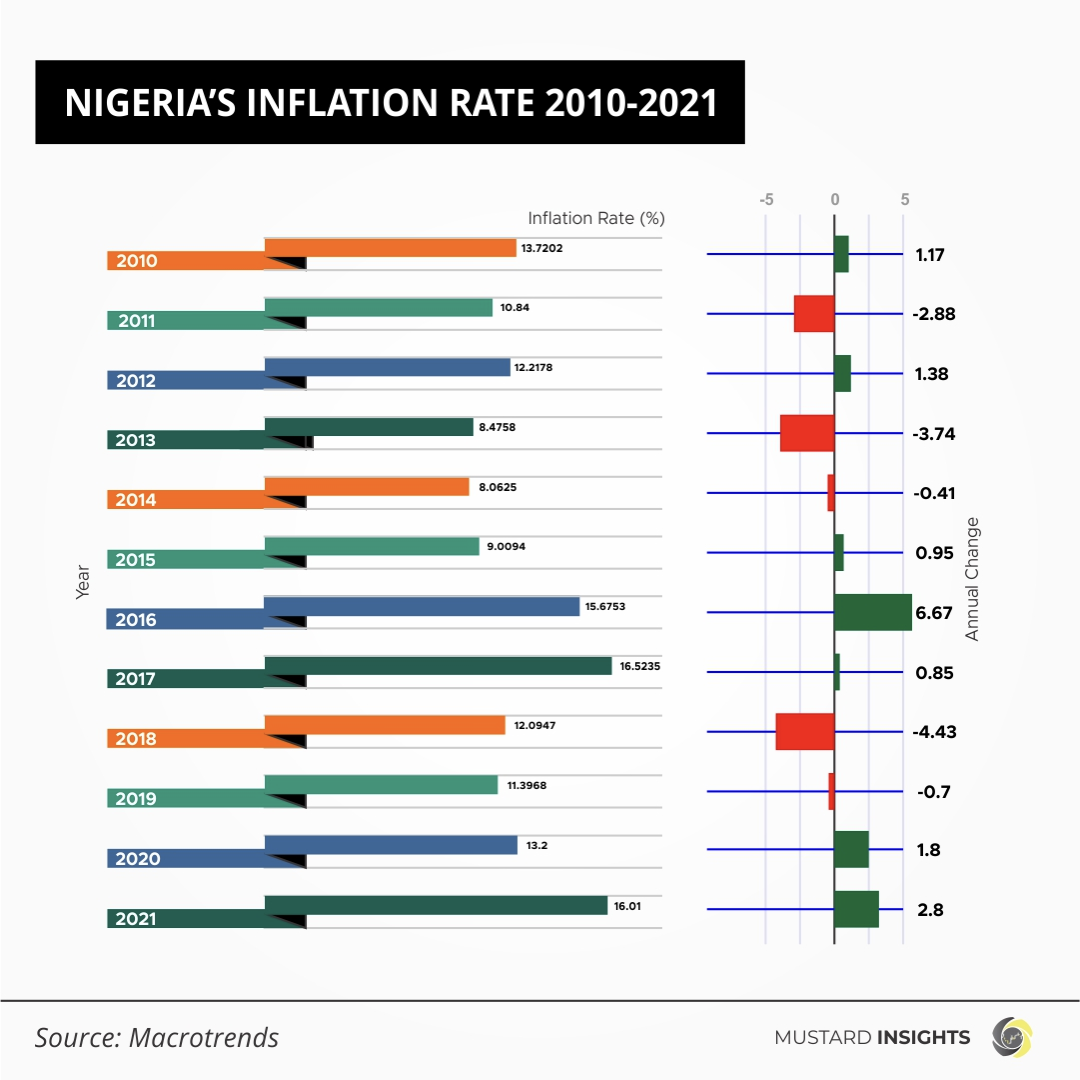

Inflation

The implications of the ongoing Russia-Ukraine war on Nigeria’s economy especially in areas of importation continue its threat to worsen an already fragile economy. The recent lack of Premium Motor Spirit fanned the embers of a looming crisis which saw cost of diesel, transportation and essential commodities rise.

The dependence on importation of agricultural produce such as wheat and sunflower seed oil from Russia and Ukraine will see prices continue its upward trend as the conflict between both countries rage on. This creates a dilemma where Nigeria has to decide whether to continue importing from the same source at a higher price (with known quality) or to seek an alternative supplier for import of commodities like cereals, mineral fuel, oil distillation products, fish, iron and steel, fertilizers among others which may not be of the same quality.

Food for Thought: How will Nigeria cope with the hike in price of major agricultural imports such as wheat?