The outbreak of covid-19 which disrupted the global economy is driving increase demand for technology solutions across industries.

The outbreak of covid-19 which disrupted the global economy is driving increase demand for technology solutions across industries. While the Nigerian economy is gravitating towards becoming a financial technology (FinTech) solution hub in Africa, the fundamentals in the economy indicate growth outlook in the industry.

Financial Technology also known as FinTech, is an industry that utilizes advanced technology to increase financial services’ efficiency and effectiveness. FinTech companies are businesses that provide financial services to the public using software systems.

Breakdown & key metrics

According to a report by Enhancing Financial Innovation & Access (EFInA) tagged ‘New data from EFInA’, 67.5 million of Nigeria’s 106 million adult population were financially included of which 47.6 million (45%) have a bank account. This shows that 55% of Nigeria’s adult population are financially excluded.

Currently, Nigeria has three FinTech unicorns competing with traditional banks and they are proving to be as valuable as the banks they compete with. These FinTech unicorns are OPAY, valued at 2 billion USD, and Interswitch and Flutterwave, both valued at 1 billion USD each and achieved the status within the last five years. With these additions, Nigeria now has the most unicorn businesses than any country in Africa.

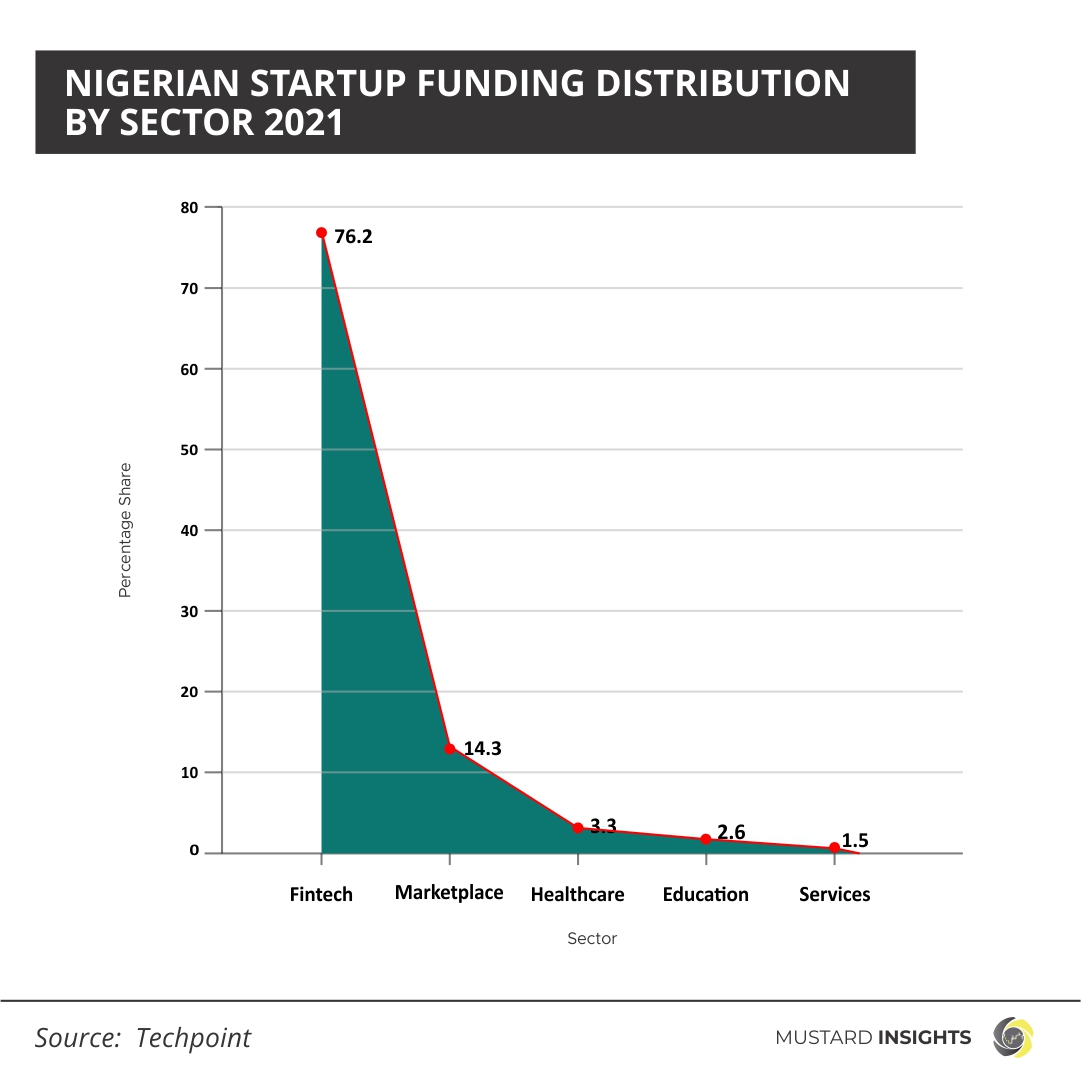

FinTech start-ups account for 76.2% of total start-up investment funding in Nigeria in 2021. Investors have predominantly poured cash into dozens of FinTech start-ups over the last five to ten years that offer services relating to cross-border payments, digital saving and agency banking. In 2019, three Nigerian FinTech start-ups reportedly raised 350 million USD in one week. In 2021, FinTech start-up raised almost 800 million USD.

With the advent of FinTech start-up platforms, investment in dollar-denominated assets and equities have risen from 541.7 million USD (223 billion NGN) in 2016 to 3.4 billion USD (1.4 trillion NGN) in 2020.

How FinTech Is Revolutionizing the Financial Services = Industry

Over the last decade, the Nigerian economy has consistently weakened and has seen its currency value depreciate against the US dollar. However, foreign investment inflow into the start-up space is helping to democratize product in the financial industry.

FinTech continues to rival traditional banking and disrupt their operations through digital service offerings and products. This has brought some success through diligent efforts to bank the unbanked population in the country. Also, they provide variety of platforms that enable investors vary their investments in foreign stocks and other opportunities.

Takeaway

FinTech in Nigeria is still on the rise and continue to harness the potentials of technological advancement to create opportunities in the finance service industry. With 55% adult population still unbanked, this presents more opportunities for growth in the industry.

Some Food Items With The Most Price Increase In One Year

Africa's Cocoa Industry 2022

Thoughts?

We won't share your email address. All fields are required.