The African housing market is experiencing significant growth, driven by new trends and innovations that are creating a wealth of investment opportunities. Over the next decade, Africa is expected to be one of the fastest-growing regions in the world, with real estate markets across the continent attracting both local and international investors.

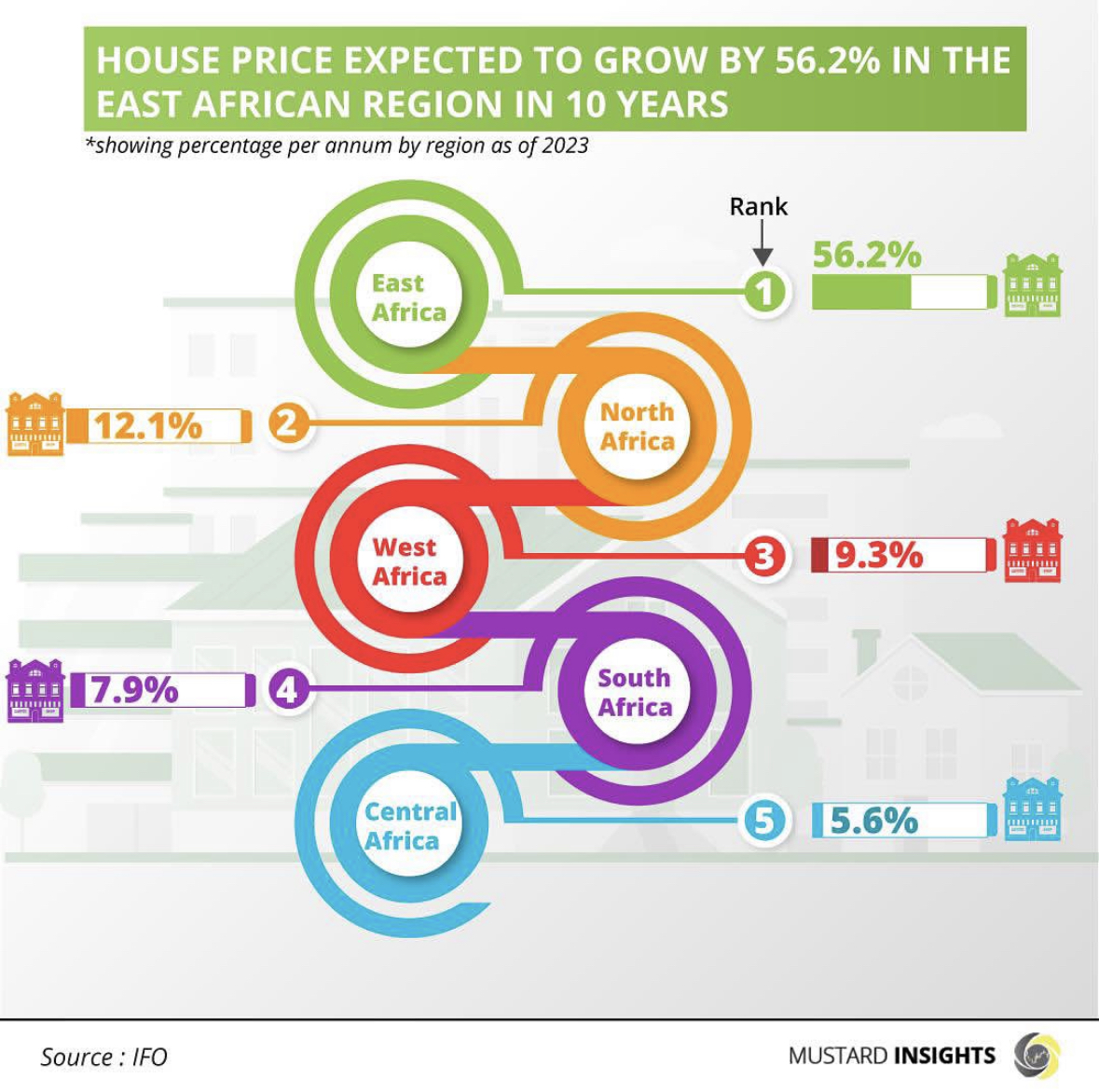

Among the various regions on the continent, Eastern Africa stands out as the leader in terms of growth potential. It is forecasted to see a remarkable 52.6% increase in house prices over the next ten years, outpacing all other regions. This surge in demand is driven by rapid urbanization, economic development, and a growing middle class.

Northern Africa, while not growing at the same pace as the east, still holds strong potential, with a projected 12.1% growth in real estate prices. Western Africa is also showing promise, with expected growth of 9.3%. Meanwhile, Southern Africa and Central Africa are projected to see more modest growth rates, at 7.9% and 5.6%, respectively.

Despite the positive growth projections, the African real estate market faces significant challenges. Economic conditions, including inflation, currency volatility, and high construction costs, continue to put pressure on both developers and investors. In addition, rental prices have been impacted by these factors, and local real estate markets are under strain to meet growing demand while balancing affordability and sustainability.

The African housing market is poised for significant growth, offering lucrative opportunities for investors. While regional variations in growth potential exist, the overall trend points to a thriving sector, particularly in Eastern and Northern Africa. However, stakeholders must navigate the complexities of the economic climate to capitalize on these opportunities. With the right strategies, the continent’s real estate market can continue to evolve, fostering both economic growth and improved housing access for its rapidly expanding population.

Thoughts?

We won't share your email address. All fields are required.