Various African countries over the past few years have had to grapple with rising costs of transportation, foreign exchange challenges, inflationary pressures and the high interest rates in an attempt to curb said inflation. All of these amongst other global economic downturns such as the Russia-Ukraine war and a pandemic Africa is yet to fully recover from, have expectedly caused the price of housing to rise.

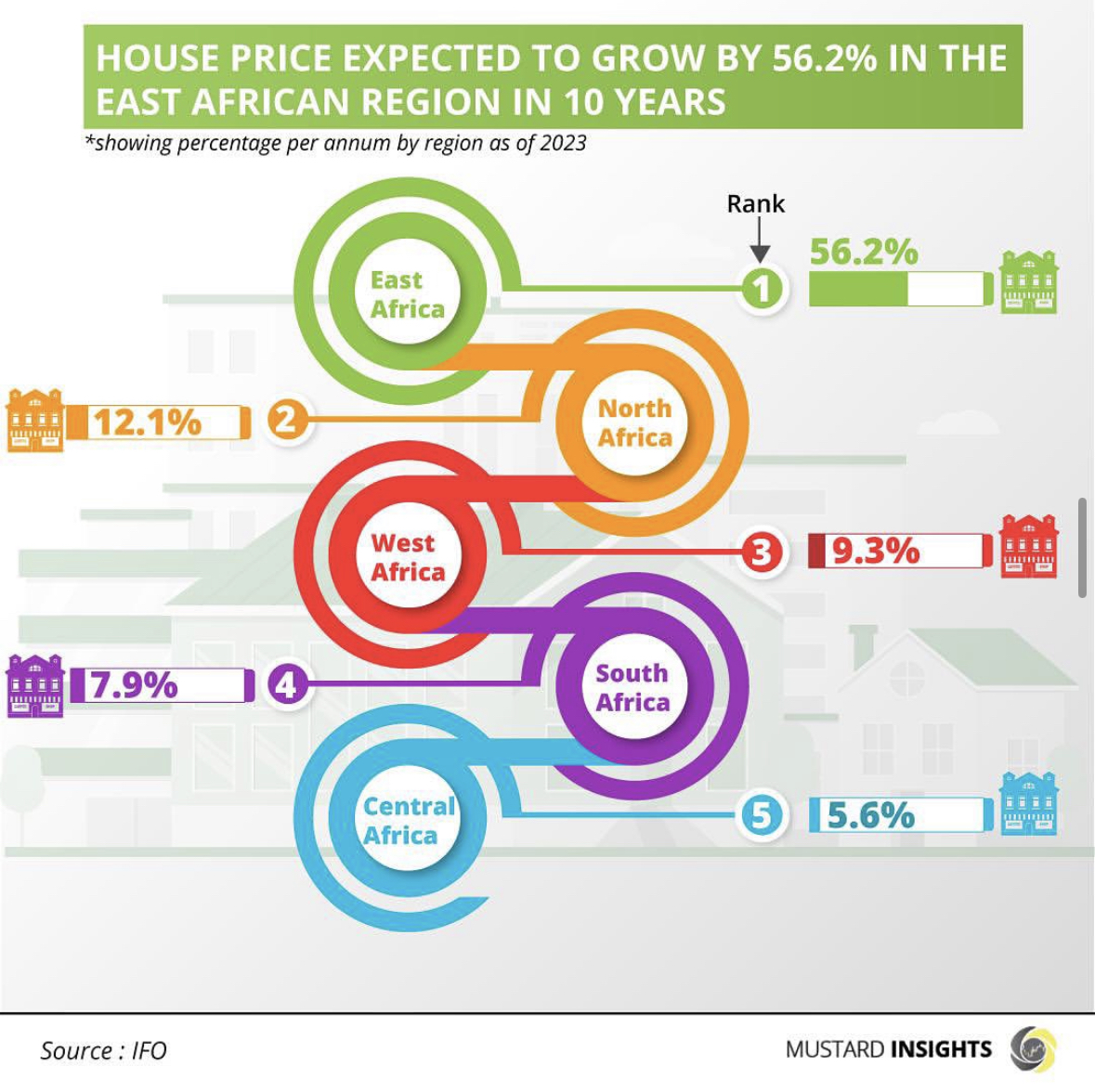

A Q2 2023 Economic Experts Survey (EES), conducted by the Munich-based Ifo Institute and the Swiss Economic Policy Institute, shed light on future house price growth across major world markets. While the EES predicts that house prices will increase at an average nominal rate of 9% per annum globally, East Africa is expected to see the largest growth at a whopping 52.6%! South Asia follows with 25.1%, while Central America and the Caribbean come third highest with 24.4% respectively.

There is no gainsaying the fact that this presents both a challenge and an opportunity for real estate players in East Africa. A cursory look at the reason for this substantial rise reveals that rapid urbanization and population growth have led to increased demand for housing. Additionally, inflationary pressures specifically around the rise in price of construction materials like cement, steel, and paint has increased upward pressures on housing prices leading to low construction activities. Rising energy prices too have exacerbated things.

In Kenya alone, data from HassConsult reveals that the price of an average house within Kenya by grew 10.5% in H1 compared to a reduction of 1.7% in the same time a year earlier. This has been regarded as the fastest growth seen in the property market since 2011.

East Africa's residential real estate market is expected to make a significant upswing, driven by several key factors. They include:

Economic Growth: The East African Community (EAC), a regional bloc encompassing Burundi, Kenya, Rwanda, South Sudan, Tanzania, and Uganda, has enjoyed robust economic growth in recent years. Countries like Rwanda, Tanzania, and Kenya have been particularly impressive, with their economic strength directly impacting the housing market and pushing up property values.

Urbanization: Rapid urbanization is another force shaping the region's housing landscape. An estimated 22% of East Africans now call urban areas home. This influx fuels the demand for housing, pushing prices upward as supply struggles to keep pace.

Access to Finance: Despite challenges in accessing formal financial services in some EAC countries, initiatives are underway to improve homebuyer access to financing. In Tanzania and Kenya, mortgage refinancing companies are emerging, while Rwanda boasts affordable housing projects. Uganda's banks, like Housing Finance Bank and Bank of Africa, have even introduced 100% financing for residential mortgages.

Housing Deficit: Rapid urbanization, coupled with inadequate urban planning, has created a significant housing deficit across the EAC. This makes homeownership a distant dream for many, due to factors like unaffordable mortgages, high land costs, insecure land tenure, and expensive construction.

The anticipated rise in East African house prices reflects a complex interplay of economic growth, urbanization, improved financial access, and the persistent housing deficit.

While this growth presents exciting investment opportunities, it also raises concerns about affordability. To ensure the housing market's future is sustainable and benefits everyone, stakeholders must implement strategies that address the affordability challenge and encourage responsible development.

Nigeria Leads Countries With The Most Homeless People

Thoughts?

We won't share your email address. All fields are required.