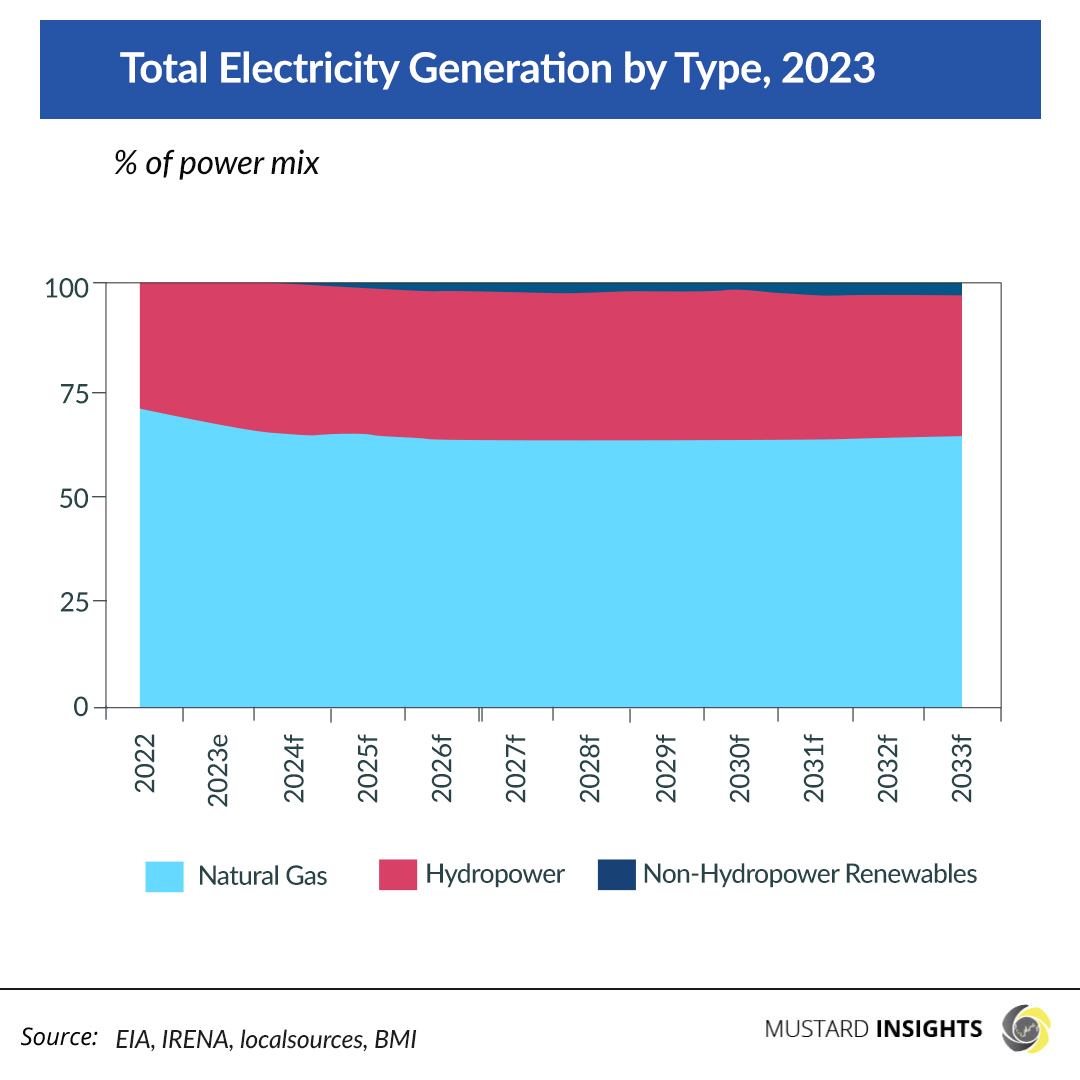

On the grid, Nigeria is on its way to aligning with global energy trends while comfortably leveraging some of its most available resources. Total Electricity Generation Data by BMI – A Fitch Solutions Company for 2023 show that Natural Gas contributes 65.9% of total electricity generation, Hydropower contributes 33.7%, and Non-Hydropower Renewables, a sparse 0.3%. This mix is fair, considering that Nigeria has no desire for the use of the more dangerous sources of electricity like coal or nuclear power. Gas is great for its low carbon emissions, its availability, low sulfur content, and high energy density, while Hydropower is quite simply a renewable source. The challenge of off-grid power generation in the country being reliant on Fossil Fuels (Petrol/Diesel) will be discussed in a later section.

Starting from the smallest contributor to the mix – Non- Hydropower Renewables, it is clear that the global transition to cleaner sources of energy has made opportunities for renewable investments greatly desired. This is without surprise too; if the world has been forced to set projections to “go green,” the size and relevance of the market is only poised to increase. However, as a power generation source to curb supply deficits, it may be too little to move the needle on a commercial scale unless when used as stand-alone alternatives. Solar-(or any other available renewable)-powered communities/estates play their own part with mini-grid renewables having the capacity to meet high demand. They improve electricity access for the areas they cover, create room for Public-Private Partnerships (PPPs), encourage FDIs, and give their leaders an opportunity to be part of one of the biggest global conversations of the future.

BMI Energy forecast as of May 2024, however, reveals that Nigeria's power generation would grow annually by an average of 3% over the next decade. Their predictions provide that gas-fired power will maintain its lead as Nigeria's predominant power source at 63.5% of the market's average annual electricity output while most of the remaining power would be from hydropower sources.

Hydropower

Hydropower will account for an annual average of 34.4% of Nigeria’s total power generation over BMI’s 10-year forecast period. At the moment, hydropower capacity forecasts are based on Kainji Hydroelectric Power Plant with a capacity of 760MW – currently the largest hydroelectricity power station, and the 700MW-capacity Zungeru project that was connected to the national grid in June 2023. The operationalisation of the Zungeru project alone increased hydropower share in the power mix from 19.9% in Q3 2023 to up 22.2% in Q4 2023.

The Federal Government has also approved the construction of a 1.7GW hydroelectric power plant in Benue State, estimated to cost USD3.0bn and funded via PPP. While there are plans to complete the 3.1 GW Mambilla hydropower plant, the project has stalled for decades and seems to be going nowhere fast. However, if completed, Mambilla will become the largest hydropower project in Nigeria with its proposed creation of four dams and 700km of transmission lines.

Nigeria’s Minister of Power, Adebayo Adelabu, in May 2024 noted that while the country’s hydropower capacity is estimated at 14 GW, only around 15% of its potential has been harnessed.

Natural Gas

Nigeria is a resourceful nation that keeps on giving, and gas might as well be the new oil. The country currently ranks as having the ninth largest proven gas reserve in the world. In 2021, the Minister of State for Petroleum Timipre Sylva said 206 trillion cubic feet reserve of gas was accidentally discovered while in search for crude oil. He had also noted that if the country really sought out to find gas, as much as 600 trillion cubic meters could be found.

Compared to other fossil fuels, natural gas emits the lowest amount of carbon dioxide when combusted. Gas is not just a cleaner alternative in the use of fossil fuels but is also available in the capacity required for attempting to close the energy demand gap. BMI also predicts that Nigeria's thermal power generation will remain majorly gas-based over the next 10 years.

“Our 10-year forecast anticipates a steady growth in gas-fired power generation, averaging 2.7% y-o-y, with thermal capacity expected to increase from 10,412MW to 13,034MW.”

To bolster the opportunity, several plans are underway. Worthy of note is the 350MW Phase One of the 1.35GW Gwagwalada combined-cycle gas-fired power plant in Abuja, which is expected to generate 10.3TWh of electricity per annum.

Off-grid Madness: The real problem

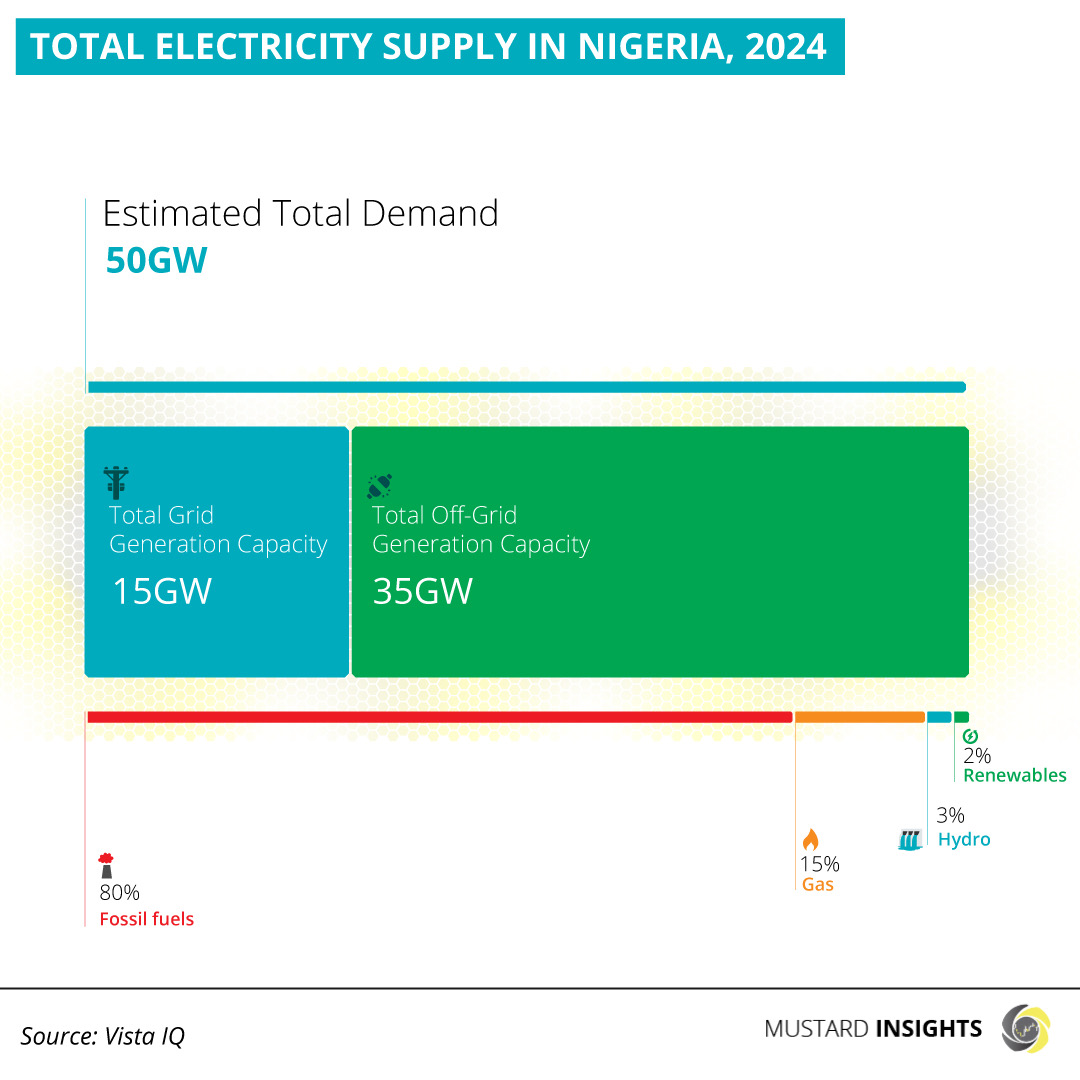

Off the grid, however, the story is different with fossil fuels and gas playing a predominant role while hydro and renewable sources contribute marginally. Akinlabi Ajelabi, Senior Consultant, Data & analytics of Vista Advisory, notes that while electricity demand is estimated at 50GW, Nigeria’s generation capabilities are limited to a paltry 15GW on-grid and 35GW off-grid! Around 55% of the population have access to electricity and this increases to 86% in urban areas. In other words, on average, just 30% of the electricity that the average Nigerian (with supposed access to power) utilizes comes from the grid. Insufficient power supply is, rather, managed with power from petrol and diesel-run generator sets.

While on-grid supply is in line with global trends, Vista IQ notes that electricity supply in Nigeria is 80% from fossil fuels, 15% from Gas, 3% from Hydro, and 2% from Renewables.

Not only is this terrible for the environment and for individuals, but they are also costly and contribute to overall inflationary pressures as higher costs of power generation make their way to prices of manufactured goods and so on. The difference between Nigeria’s ability to provide electricity or even contribute to a low carbon world is the availability of the relevant infrastructure to generate more on-grid electricity through safer channels.

Natural Gas also faces the challenges of infrastructural deficits and supply chain disruptions. It requires more investment in gas transport infrastructure and the limitations of pipeline vandalism or theft all limit the potential of gas as a dependable source of electricity. The Nigerian power grid is fragile, reporting up to 200 collapses in nine years before 2022 and seven collapses 2022 alone. BMI also reveals that Pumped Hydropower Storage (PHS) in Nigeria has a huge potential to bolster energy storage and grid stability, yet PHS technology within the country's energy infrastructure strategy is nascent and not expected to take form even in a decade.

Beyond inadequate infrastructure funding, both GenCos (Generation companies) and Discos (Distribution Companies) face their own financial distress. On one hand, GenCos are struggling to pay gas suppliers because of repeated cycles of indebtedness, and Discos are in financial distress, grappling with rising debts, gas shortages and poor bill collection rates.

While the goal of the electricity bill is to facilitate policies to promote the development of new grid infrastructure and ultimately improve the quality of Nigeria’s power network, no one knows how soon or if truly the updated policies will birth any kind of visible change. Needless to say, the sector has always been plagued by immense short-sightedness.

Today, Eko Electricity Distribution Company (EKEDC) is available to be purchased. West Power and Gas Ltd, the core investor in the company is exploring a potential equity sale of its stake in the power distribution company for $350 million. The Disco has over time been called out for its poor service delivery which can be attributed to limited financial and technical power. According to Nairametrics, the disco is a top performer in the power sector and had made N177.5 billion revenue in 2023. Could this be an attractive investment opportunity? Are we going to see more Discos up for sale? What is the future of electricity generation in Nigeria? Time will tell.

Thoughts?

We won't share your email address. All fields are required.