Despite the changes in macroeconomic conditions, and the Ukraine - Russia war which triggered commodity prices, commodity markets are still expected to perform excellently in 2022.

Commodities have been traded for as long as man can remember. They are essentially raw materials or agricultural products that are collected, produced, and traded in volume. These products come in various forms like gold, copper, sugar, and wheat. And are generally categorized into four, agricultural products, livestock, energy products and metals. These commodities are traded through two major means - exchanges and derivatives.

Despite the changes in macroeconomic conditions, and the Ukraine - Russia war which triggered commodity prices, commodity markets are still expected to perform excellently in 2022. The Head of Commodities Strategy in one of Americas leading banks stated that “the commodity markets exceeded our expectations in 2021, and 2022 looks to be another great year. While we see some prices edging lower from their current elevated levels, we expect most to remain above their long-term averages”.

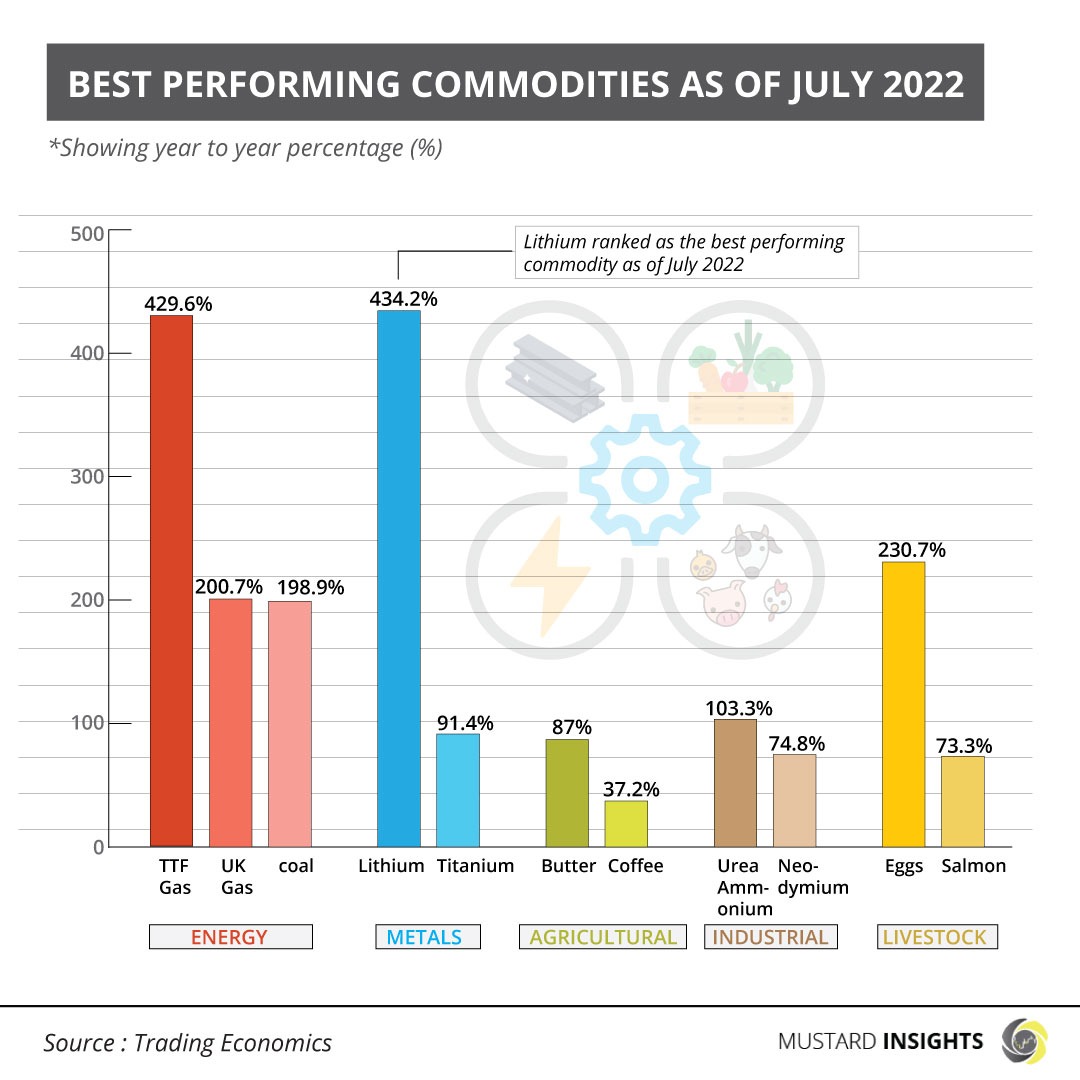

Dutch TTF Gas and Lithium Outperform the Fold

Lithium is one of the most sought-after commodities in the world today. It is required by numerous manufacturing companies, as it is a key element used in the making of rechargeable batteries for mobile phones, laptops, cameras require this very soft and silvery metal. Additionally, the increased demand for electric vehicles means that there will be an increased demand in lithium also, as these electric vehicles require large amounts of lithium for production. According to Canalys, in 2020, global sales of Electric Vehicles increased by a robust 39% year on year to 3.1 million units, where the total passenger car market declined 14 per cent. Australia, Chile, China, Argentina, Brazil, Zimbabwe, and Portugal are the major producers of lithium worldwide with Australia leading the bunch in production with about 55,000 metric tons produced in 2021 alone. While Chile and China produced 26,000 and 14,000 metric tons respectively. As at the time this was collated, lithium was performing at 434.2% as of the month of July.

Dutch TTF Gas was ranked as the second-best performing commodity by 429.6%. The Netherlands has been the center of international trade in Europe for decades now, with its vast connection over land, water, and air, which has benefited the Dutch in their gas trade. TTF means Title Transfer Facility and is an establishment set in the Netherlands specifically for virtual trading of futures, physical and exchange trades of gas. It is also the primary gas pricing hub for the European gas market.

Eggs and UK Gas: The Next Best Performers

Meanwhile, the egg market performed at 230.7% as the demand for eggs continue to rise globally. The Netherlands, US, Poland, and Turkey are the world’s largest exporters of eggs. With the largest egg producing company being Cal-Maine which owns about 40 million layers. Proteina Animal (PROAN) from Mexico is second at 33 million hens. Mexico is also building up its egg industry and is expected to compete with the US in the Western Hemisphere.

The main price driver in the egg industry is feed costs – primarily corn. While egg prices are extremely volatile, seasonality is of great importance, with prices rising around international holidays such as Easter, Thanksgiving, and Christmas.

UK Gas is the second highest performer amongst energy commodities, performing at 200.7%. UK gas production peaked in 2000 and has since been declining, making the UK increasingly reliant on imports to meet demand. However, the 2021 UK Energy Brief stated that net imports fell in 2020 to 372 TWh as exports increased and imports were down from last year, with Norway accounting for 55% of UK gas imports in 2020. Imports were down due to lower demand, whilst exports increased largely because of increased trade with the Netherlands. Despite the increase, exports remain below the long-run average.

The Demand for Coal Resurges

The world is facing one of the worst energy crises ever. A shortage of oil, spike in prices of natural gas, lower wind, coupled with nuclear power imbalances has increased the demand for coal. In 2019, about 23% of all electricity in the United States was generated by coal-fired power plants, according to the U.S. Energy Information Administration. Eenergy commodity performed at 198.9% in July 2022.

In an Environmental Impact Assessment conducted recently, it was noted that coal-fired electricity generation was on track to increase for the first time since 2014, rising by 22% compared with 2020. Carbon dioxide emissions from the energy sector were estimated to increase 7% as a result. Additionally, the U.S. Global Investors, further stated that coal was also the least volatile commodity of 2021, meaning investors had a smooth ride as the fossil fuel surged in price. So, it may be a good commodity to add to your investment portfolio.

Other Performing Commodities

Titanium performed at 91.4%. Salmon, butter, and coffee also performed at 73.3%, 87% and 37.2% respectively. While industrial produces, Urea Ammonium and neodymium performed at 103.3% and 74.8% respectively.

Thoughts?

We won't share your email address. All fields are required.