Nigeria, a country with a rich tapestry of culture and resources, has faced challenges in nurturing a thriving Micro, Small, and Medium Enterprises (MSME) sector. As of 2022, the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) reported a staggering 39.7 million MSMEs, making up a significant portion of the business landscape. However, despite its numerical dominance, the sector grapples with numerous obstacles that hinder its growth and contribution to the economy.

Current Landscape:

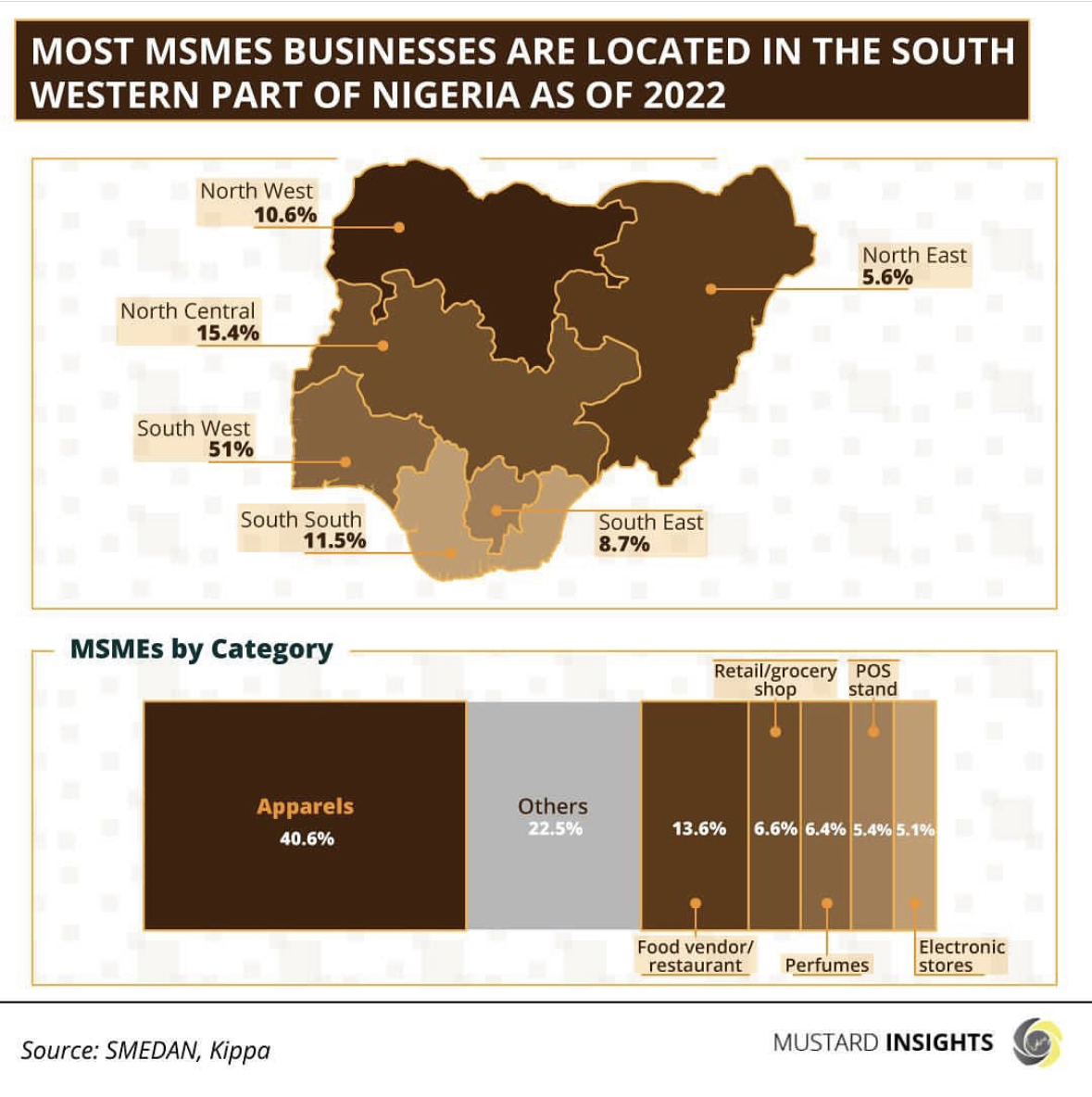

SMEDAN's data reveals a stark reality—38.4 million micro-enterprises and 1.2 million SMEs coexist, accounting for 96.7% of all businesses in the country. While the MSMEs contribute 46.31% to Nigeria's Gross Domestic Product (GDP), their role in gross exports is a modest 6.21%. The numbers underscore the untapped potential and underscore the need to address the challenges facing this critical segment.

Challenges Faced by MSMEs:

The PWC survey report of 2021 identifies several challenges faced by MSMEs, painting a vivid picture of the hurdles hindering their growth.

Accessibility to Affordable Financing:

Many MSMEs struggle to secure affordable financing, limiting their capacity for expansion and innovation.

Misalignment of Government Policies:

Economic policies exist, but the alignment of these policies with the needs of MSMEs remains a critical concern.

Poor Infrastructure:

Inadequate infrastructure not only increases the cost of doing business but also threatens the sustainability of MSMEs.

Multiplicity of Taxes:

MSMEs often face unexpected tax burdens, impacting their financial planning and hindering growth.

The informality of MSMEs:

The informal nature of MSMEs limits their ability to engage effectively with government regulations, impeding their voice in policymaking.

Addressing Challenges: Actionable Approaches:

Addressing these challenges requires a multi-faceted approach, and MSMEs can take proactive steps to navigate the hurdles:

Stay Informed:

MSMEs should stay informed about market trends, regulations, and government policies, adapting their business strategies accordingly.

Embrace Technology:

Leveraging technology can enhance efficiency, streamline operations, and open new avenues for growth.

Digitalization:

Adopting digital processes can improve transparency, reduce costs, and enhance overall business operations.

Business-Personal Separation:

MSMEs should implement a clear separation between business and personal finances to ensure financial stability.

Innovation from Feedback:

Listening to customer feedback can be a source of innovation, helping MSMEs refine their products and services.

AFDB's Role and Government Prioritization:

The African Development Bank (AFDB) President, Femi Adesina, expresses the institution's commitment to supporting the establishment of an entrepreneurship bank. While laudable, it is crucial to learn from past funding arrangements, ensuring transparency, accountability, and adherence to milestones to guarantee the desired impact.

As for government prioritization, all sectors are essential, and accurate data is key to informed decisions. However, experts highlight the importance of focusing on the service sector, given its youthful population that can contribute significantly to skilled labour. Agriculture and manufacturing also stand out due to the country's vast natural resources and potential for export.

Conclusion:

The MSME sector in Nigeria holds immense promise, but realizing this potential requires a concerted effort from both the government and entrepreneurs. By addressing challenges, embracing innovation, and ensuring transparent funding mechanisms, Nigeria can nurture a resilient and prosperous MSME sector that not only contributes significantly to the GDP but also fosters economic growth and job creation.

- Published: 8th January, 2024

Thoughts?

We won't share your email address. All fields are required.