Foreign direct investment (FDI) is a category of cross-border investment where an investor resident in one country establishes a lasting interest in and a significant influence over an enterprise resident in another economy.Investors do this to earn higher returns because of the risk premium of the country they are investing in. Countries where default risk is higher would usually have a higher risk premium. Through FDI, foreign investors are involved in the activities of the other country, which results in transferring money, knowledge, skills, and technology.

Foreign direct investment (FDI) is a category of cross-border investment where an investor resident in one country establishes a lasting interest in and a significant influence over an enterprise resident in another economy.

Investors do this to earn higher returns because of the risk premium of the country they are investing in. Countries where default risk is higher would usually have a higher risk premium. Through FDI, foreign investors are involved in the activities of the other country, which results in transferring money, knowledge, skills, and technology..

The United States is the second-largest investor in Africa, behind China and has as one of its goal the aim to further promote the transformation of African countries. The U.S government, through one of its policies, African Growth and Opportunity Act (AGOA), provides African countries with the ability to take part in business transactions with the U.S.

International Business Machines (IBM), a U.S. company, supports its investments in Africa because of its mass urbanization, growing middle-class and demand for upgraded services in several sectors.

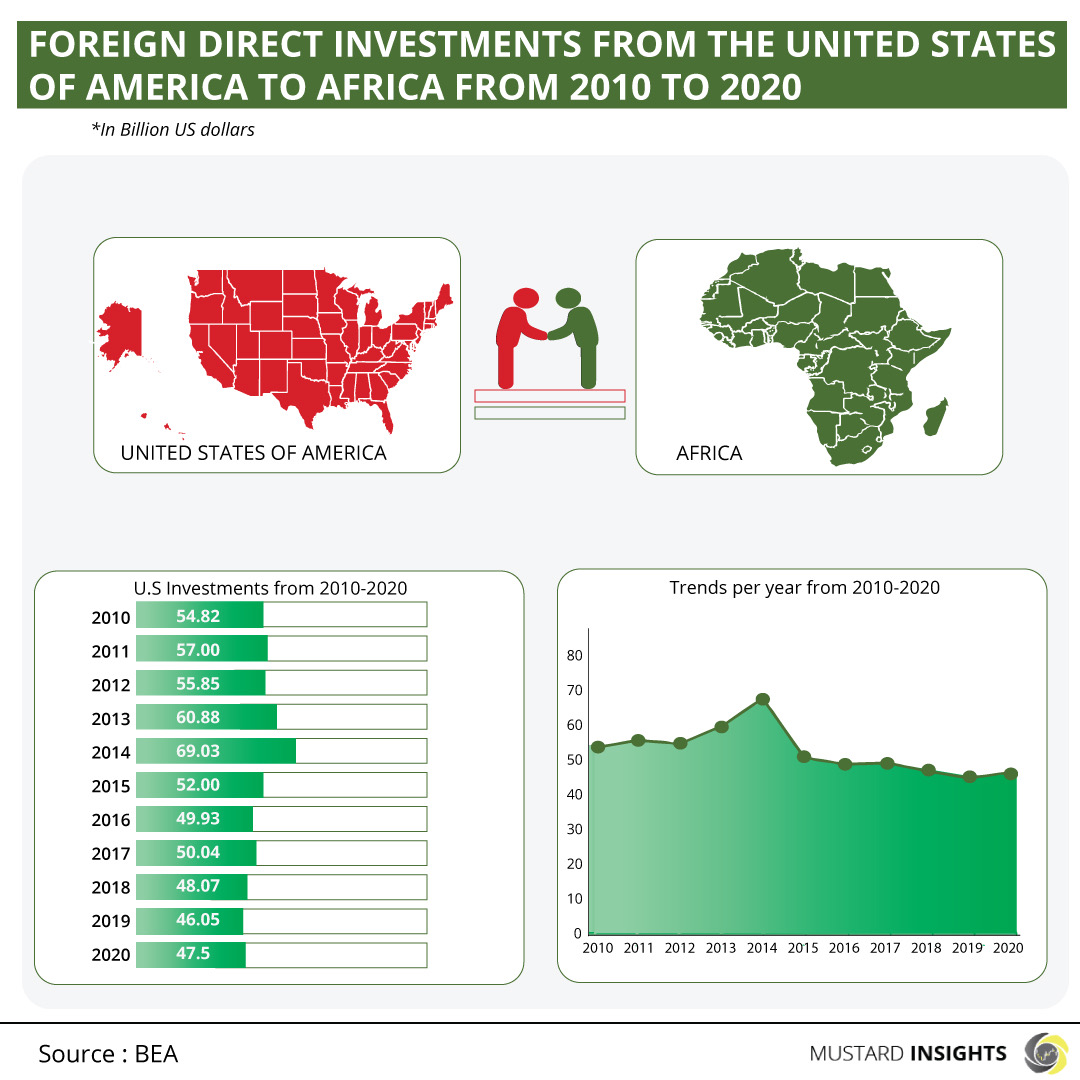

FDIs from the United States to the African continent sunk significantly to about $47.5 billion in 2020, following the peak of $69 billion reached in 2014. Africa receives the lowest FDI inflows than any other region, while the United States has higher FDI outflows than any other country.

The higher FDI inflow may be because the United States has a large economy. Also, the higher FDI outflows may be because investors are seeking higher returns on their investments and will foster international relationships. Sometimes, the investors may be interested in expanding their consumer base outside their domestic domain, shoring up supply chains or possibly for humanitarian or cultural reasons.

In 2010, Foreign Direct Investments inflow to Africa from the United States was 54.82 billion USD and increased to 57 million USD in 2011. By 2012, the FDI inflow dipped slightly to 55.85 billion USD before rising again to 60.88 billion USD.

FDI inflow from the United States reached its peak in 2014 with a valued of 69.03 million USD. Subsequent FDI inflow dropped by over 17 million USD the following year to 52 million USD and dropped an additional 2.07 million USD to close at 49.93 million USD. Africa recorded a FDI inflow of 50.04 million USD in 2017, 48.07 million USD in 2018, 46.05 million USD in 2019 and 47.5 million USD in 2020 from the United States.

Thoughts?

We won't share your email address. All fields are required.