Elon Musk added another corporate feather to his bejeweled cap, after the shock announcement that Twitter’s board of directors accepted his offer. This is a huge story with a lot of fast-moving parts and will likely stretch out over the next few months, maybe even longer.

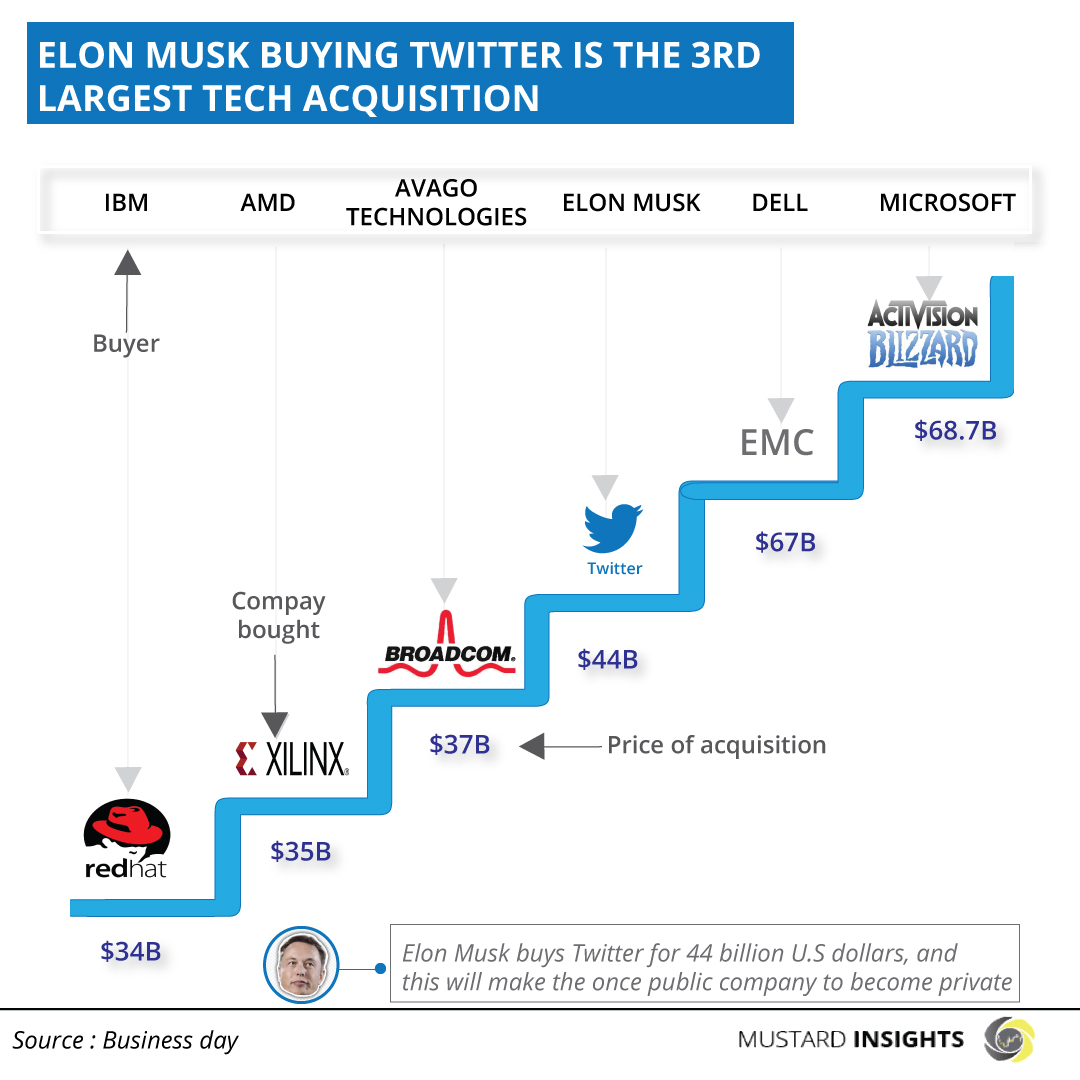

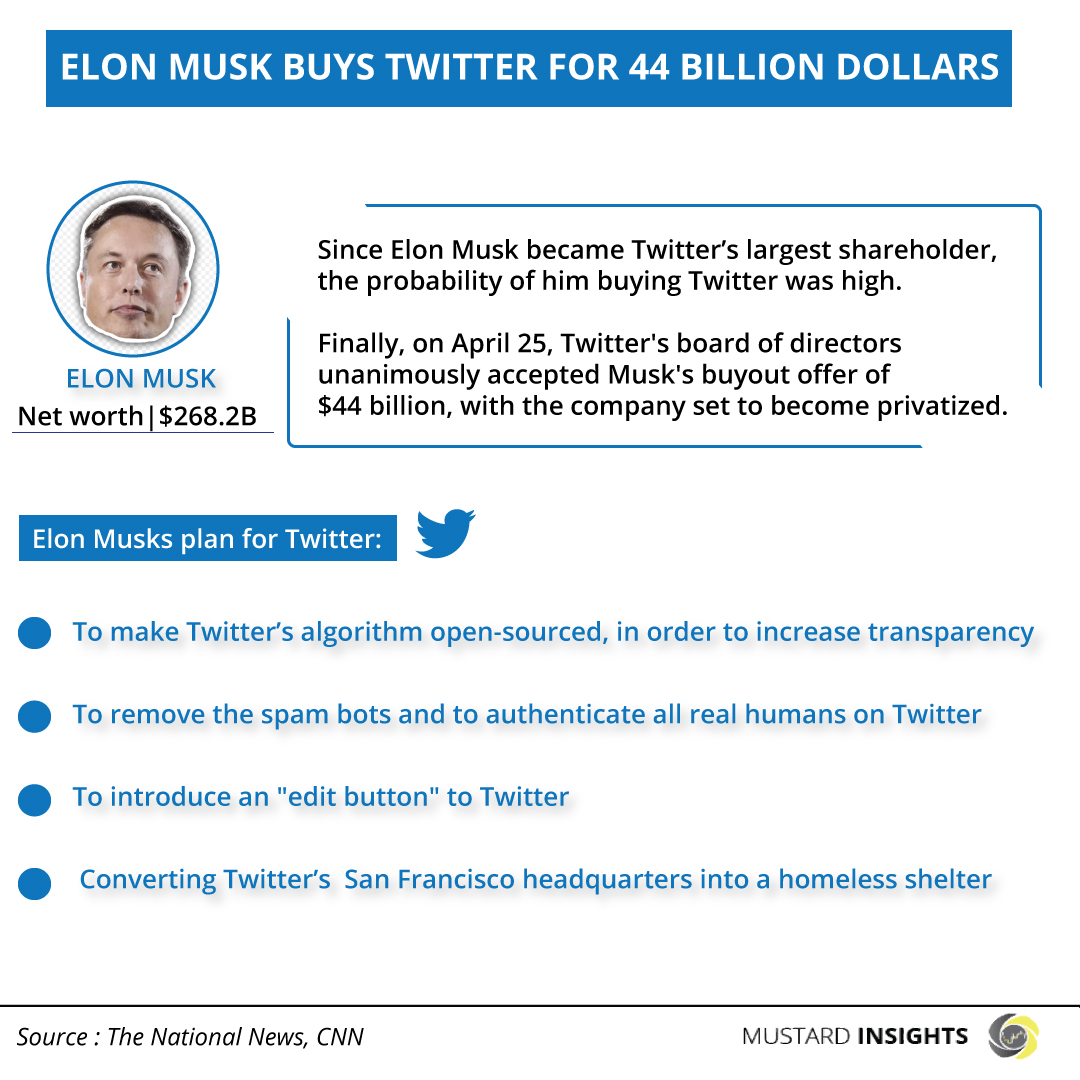

The CEO of Tesla, SpaceX, Neuralink, and the Boring Company, Elon Musk added another corporate feather to his bejeweled cap, after the shock announcement that Twitter’s board of directors accepted Musk’s offer of $54.20 per share, or $44 billion, for total control of the company.

This is a huge story with a lot of fast-moving parts and will likely stretch out over the next few months, maybe even longer.

Musk had started to purchase Twitter shares on January 31, 2022. On April 4, It was reported that he had obtained 9.1 percent of Twitter's stock for $2.64 billion, making him the company's biggest shareholder. Following the announcement that Musk bought Twitter, Twitter's stock posted its biggest intraday surge since the company's initial public offering (IPO) in 2013, rising by about 27%.

Twitter's board at first enacted an anti-takeover measure known as a poison pill. But when Elon Musk laid out the financial commitments he'd lined up to back his offer of $46.5 billion — and no other bidders came forth — the board opened negotiations with him.

More details on the poison pill:

Twitter enacted a poison pill, after Musk made his offer, to stop him from raising his more than 9% stake within the company over 15 per cent without arranging a bargain with its board. In reaction, Musk had debilitated to launch a tender offer that he might utilize to register Twitter shareholder back for his bid. Musk had started to purchase Twitter shares on January 31, 2022. On April 4, Elon Musk reported that he had obtained 9.1 percent of Twitter's stock for $2.64 billion on March 14.

A challenge that Twitter's board weighed was that except it sought to negotiate a deal with Musk, many shareholders could return him in a tender offer.

While the poison pill would have averted Twitter shareholders from tendering their shares, the organization, was initially concerned that its negotiating tactic would have weakened notably if it was shown to be going against the will of many of its investors. Hence, Twitter commenced negotiating with Musk to buy the company at the proposed $54.20 per share price.

How is Musk funding twitter acquisition?

Musk has personally committed $21 billion in equity financing, according to a filing with the Securities and Exchange Commission on April 21. Additionally, he has secured roughly $25.5 in debt financing via Morgan Stanley, Senior funding and other firms, which include Bank of America, Barclays, MUFG, Société Génerale, BNP Paribas, and Mizuho Bank.

More about Elon Musk’s Twitter acquisition:

Elon Musk, CEO of SpaceX and Tesla, could be required to pay Twitter a termination rate of 1 billion USD, under some circumstances, such as if Musk fails to secure sufficient debt funding to complete his $44 billion deal to purchase the company, according to a new SEC filing.

On the other hand, Twitter will owe Elon Musk a $1 billion break-up charge should it fall through because it found a competing offer or if shareholders reject the deal in accordance to the same filing.Twitter enacted a poison pill after Musk made his offer, to stop him from raising his more than 9 per

Elon Musk’s plan for Twitter:

Musk has stated that his first plan is to open-source the algorithm that ranks tweets in the content feed, in order to increase transparency.

He has also stated intention to remove the spam bots, and to authenticate all real humans. He also proposes an "edit button", and converting the San Francisco headquarters into a homeless shelter.

Thoughts?

We won't share your email address. All fields are required.