While physical materials and mining will always provide a path to wealth, financial services and the Banking/Finance sectors are the leading drivers of private wealth in modern times. Although the sector hit a brief snag during the pandemic, real estate remains the most prized physical asset, as seen especially in South Africa. 30% of that nation’s HNWIs’ private wealth are assets in equities. Real estate follows with 23%.

In one of our charts, Mustard Insights produced a summary of the 2022 Africa Wealth Report compiled by the investment migration consultancy, Henley & Partners. The report had some remarkable insights (pun may be intended) on the present state of private wealth in Africa. Some things become clear quickly: South Africa is far and away ahead in terms of private wealth accumulation, and Mauritius’s private wealth is growing rapidly.

The report focuses on South Africa and shows that the country possesses private wealth which is more than double that of the next highest country, Egypt. So, the question becomes inevitable: what has allowed South Africa’s private wealth to grow to such an extent? An easy reply will be to point to the country’s glut of natural resources. According to the World Mining Congress’ World Mining Data report from 2021, South Africa ranked 11th on the list of mineral-producing countries in the world. Rich in gold, diamonds, manganese, iron, and chromium, it’s easy to assume that minerals are the drivers of private wealth. This, however, isn’t the case.

Major wealth drivers in South Africa

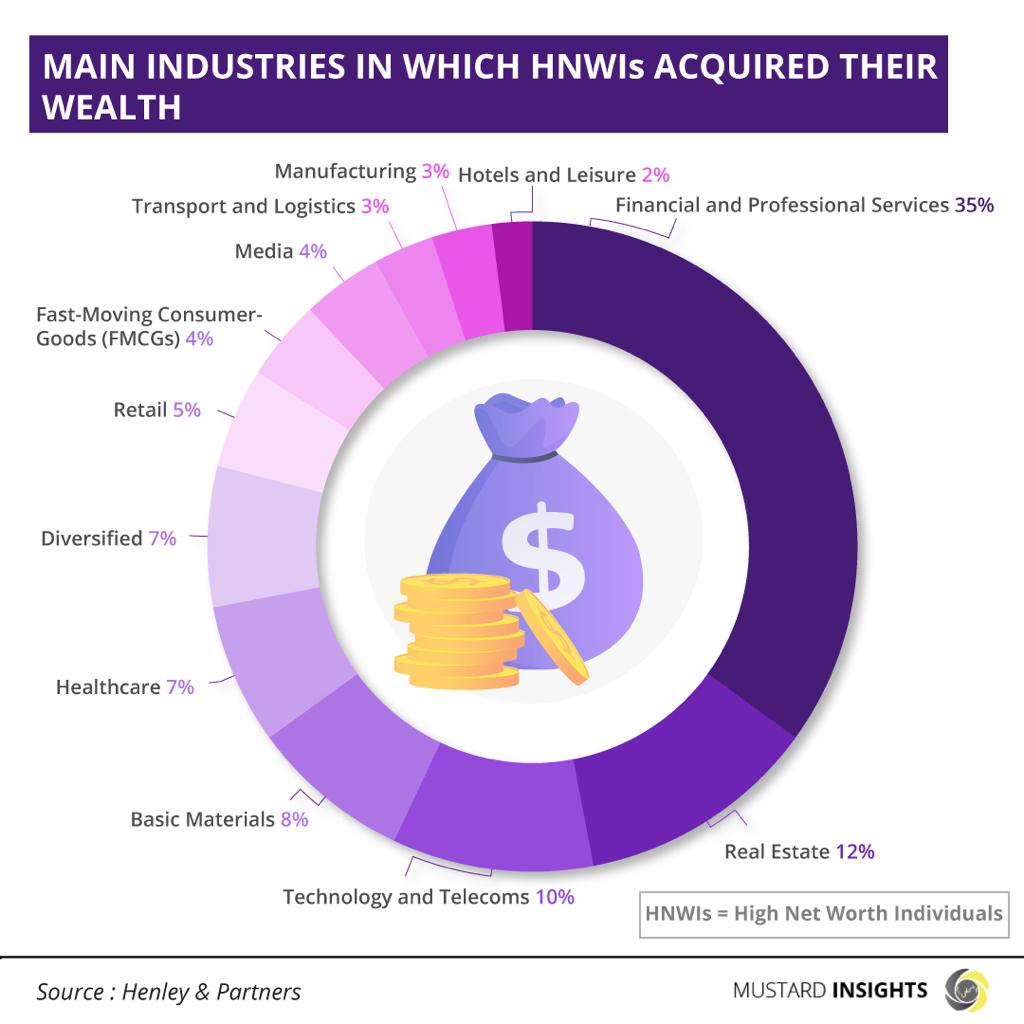

The leading sector driving South Africa’s private wealth is the Financial and Professional Services sector. This is no doubt buoyed by the country’s Africa-leading exchange, the Johannesburg Stock Exchange (JSE). Per data from the JSE and Statista, as of August 2022, the JSE ranks as the 19th largest stock exchange in the world, with a combined market capitalization of US$1.04 trillion. A lot of this finance-based wealth been fueled by the growth of the MSCI World Equity Index. This is a metric that is representative of the large and mid-capital equity performance of the leading 23% developed market countries. This index has climbed 173% between 2011 to 2021. While this index does not include emerging economies, the MSCI ACWI – ACWI meaning All-Country World Index does. The MSCI ACWI has climbed 166% in the same time period. The MSCI South Africa Index has climbed slightly more than 80%. It was a hugely profitable decade for investing, and it shows in private wealth growth.

The country also has a thriving wealth management scene, with US$80 billion in assets under management (AuM). Wealth management is an investment advisory service which seeks to offer financial services ranging from portfolio investment to tax services, mostly to affluent clients with a net worth of US$500,000 or more. Services like these consolidate and expand the assets of the wealthy. 57.14% of all Africa’s AuMs with wealth managers are in South Africa. It then comes as no surprise that the educational backgrounds of most of the country’s wealthy lies in Law (30%) and Finance and Accounting (28%).

Real Estate (12%), Technology and Telecoms (10%), Basic Materials (8%), and Healthcare (7%) are other areas through which South Africa’s high net-worth individuals (HNWIs) have acquired their wealth. This is also reflected in the academic pursuits of the country’s wealth. Apart from Law and Finance and Accounting, Medicine and Science (7%), Computing and Information Technology (7%), and Engineering (5%) are fields of study which have also led people to great wealth. As such, the role of education can’t be de-emphasized either.

Times Higher Education has four universities ranked among the world’s top 500: University of Cape Town, Stellenbosch University, University of the Witwatersrand, and University of KwaZulu-Natal. The QS University Rankings has the first three and the University of Johannesburg ranked as four of the five best universities in Africa, along with Egypt’s American University of Cairo. Thus, it is not unusual to see that 55% of all South Africa’s HNWIs are alumni of these four universities. Institutions such as the University of Pretoria, Rhodes University, and the University of South Africa also well ranked globally and produce an additional 24% of the country’s HNWIs. Apart from the high-level education provided, having nearly 80% of the nation’s privately wealthy concentrated in seven educational institutions creates space for connection and networking.

Since 2011, the country has been a member of BRICS, an economic alliance of Brazil, Russia, India, China, and the aforementioned South Africa, marking its acceptance as one of the world’s major emerging economies. The presence of a well-developed banking and finance sector has aided this growth, as well as low levels of government intervention and a relatively low corporate tax rate of 28%. Another African country has used low corporate taxation to drive wealth growth in the last decade.

The emergence of Mauritius

In the ten years from 2011 to 2021, the total private wealth in Mauritius has grown by 79%, the leading rate in Africa. The East African island nation has aimed to provide a conducive environment for investment and industry. As at the final Ease of doing business ranking released by the World Bank in 2021, Mauritius is the top-ranked African nation and 13th in the world. Taxation is one of the ways the country has attained this growth. Low levels of both corporate and income tax – both set at 15% – have made the country an attractive place to start a business and work. The country also doesn’t levy any inheritance or capital gains taxes.

The country has aimed to streamline the business environment. Per the World Bank 2020 report, along with taxation, the country has targeted four areas for growth:

- Simplifying the process of obtaining construction permits;

- Hastening the property registration process by publishing service standards and land administration data;

- Enforcing contracts by law and public reporting, and;

- Easing the resolution of insolvency.

As a result, the World Bank ranked the country 5th in Paying Taxes, 8th in Dealing with Construction Permits, 18th in Protecting Minority Investors, 21st in Enforcing Contracts, 23rd in Registering Property, and 28th in Getting Electricity. For context, the latter metric sees South Africa, Egypt, and Nigeria ranked 114th, 78th, and 169th respectively. The country is rated by New World Wealth as the safest in Africa, a status is shares with Namibia and Botswana. This, along with the low rates of taxation, might pull already-wealthy individuals along with possible investors to the country. In ten years, the number of HNWIs resident in Mauritius has grown 78% from 2,700 at the start of the decade. There is also a rapidly-growing financial services sector, and a now-stable stock market. While growth has stagnated recently, by December 2021 Mauritius’s stock exchange, SEMDEX, had grown 461% in twenty years.

Crucially, the country has combatted the inequality that might creep in by allowing minimum wages to be set by sectors and keeping income tax at a 15%. As a result, median wealth in the country is relatively high. Mauritius leads all African countries in wealth per capita by a large margin – it’s US$34,500 per capita is significantly ahead of second-place South Africa’s US$10,970. In July 2020, the World Bank classified the tiny nation as a high-income country. Henley & Partners project the country to experience another 80% wealth growth in the next decade, growing as fast as developed economies like Switzerland, Australia, and New Zealand.

Wealth trends

The case studies of both South Africa and the growth of Mauritius reveal some pathways to wealth growth. Education is key, especially in specific sectors like Law and STEM-related courses – Science, Technology, Engineering, and Mathematics. While physical materials and mining will always provide a path to wealth, financial services and the Banking/Finance sectors are the leading drivers of private wealth in modern times. Although the sector hit a brief snag during the pandemic, real estate remains the most prized physical asset, as seen especially in South Africa. 30% of that nation’s HNWIs’ private wealth are assets in equities. Real estate follows with 23%.

Growing wealth in a country demands a great environment for doing business and investing, while restricting inequality and poverty, hence ensuring safety. Mauritius has succeeded in all of these. Low tax rates, reasonable minimum wages, electricity access, and minimal bureaucracy has contributed to attract both wealth and investment to the country. The emergence of the small, climate change-threatened country as one of the world’s high-income countries is nothing short of economic miracle and should be recognized as such.

The State of Private Wealth in Africa

Comments

Thoughts?

We won't share your email address. All fields are required.

Sarah

2 years agoThis is good information. I wonder if it’s the same for other countries in Africa.